High-yield bond market goes negative

High-yield bonds have started to crack, and it's worth watching.

Availability to credit has a big impact on sentiment in all markets and can be a leading indicator for stocks. Sophisticated investors tend to pay almost as much attention to machinations in bonds as in stocks, especially when debt levels are high.

Within the bond market, high-yield bonds can prove to be a good tell for stocks because the two are closely linked. When investors smell trouble, they tend to flee credit risk and sell high-yield bonds before other types.

Internal momentum is waning

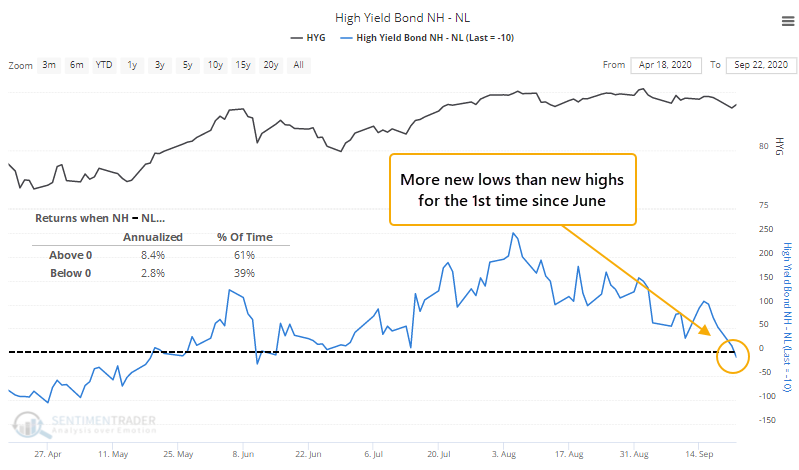

In recent days, the number of these junk bonds that have dropped to a 52-week low has outnumbered those rising to a 52-week high. This is the first time this has flipped negative in months.

When there are more 52-week highs than lows in this market, HYG has returned an annualized +8.4%. That drops to +2.8% when there are more lows than highs, so this is a concern.

One mitigating factor could be momentum - it's been months since this figure was negative.

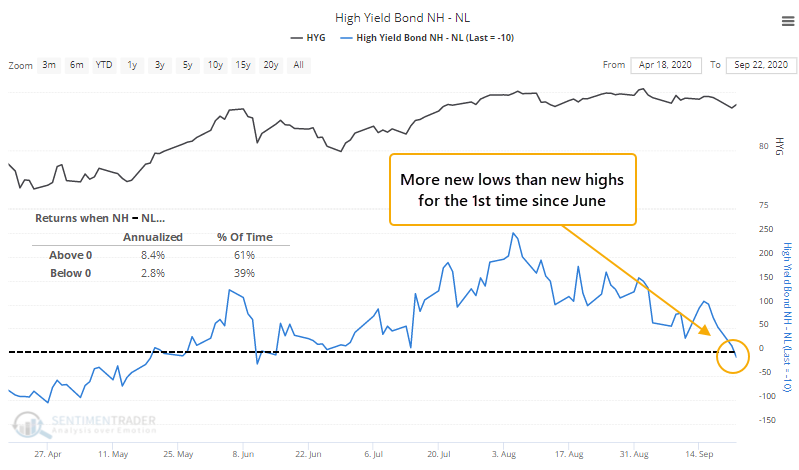

The table below shows every time the high-yield market had gone at least 3 months with more bonds hitting 52-week highs than lows, then that finally went negative.

This wasn't too much of a mitigating factor. It didn't prevent large losses in 2007 or the latest one earlier this year.

For the broader stock market, this loss of internal momentum in high-yield bonds preceded a poor risk/reward ratio in the months ahead, with an inconsistent probability of positive returns.

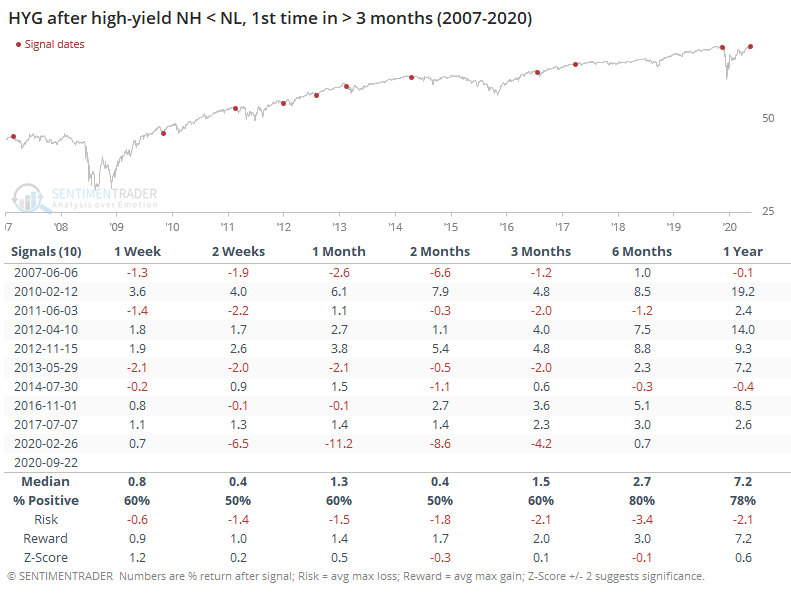

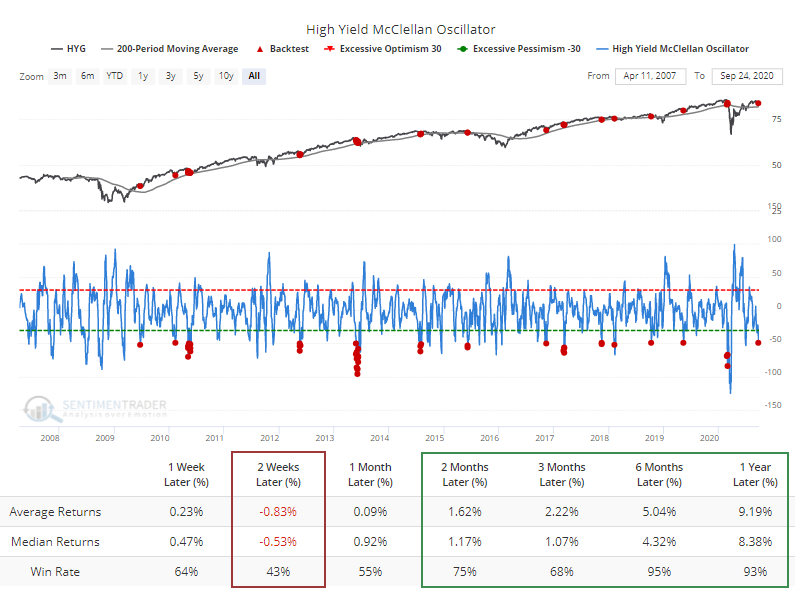

Other internal metrics for this market are already showing some shorter-term oversold signals. The McClellan Oscillator has neared -50 while HYG is still trading above its 200-day moving average. The Backtest Engine shows some short-term wobbles but good medium- to long-term returns (thanks in no small part to the study period being dominated by a long bull market).

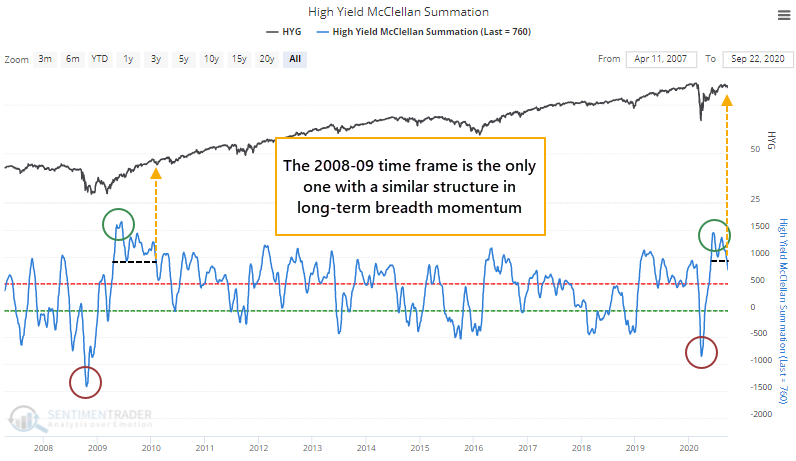

From a longer-term point of view, the McClellan Summation Index has rolled over from a very high level.

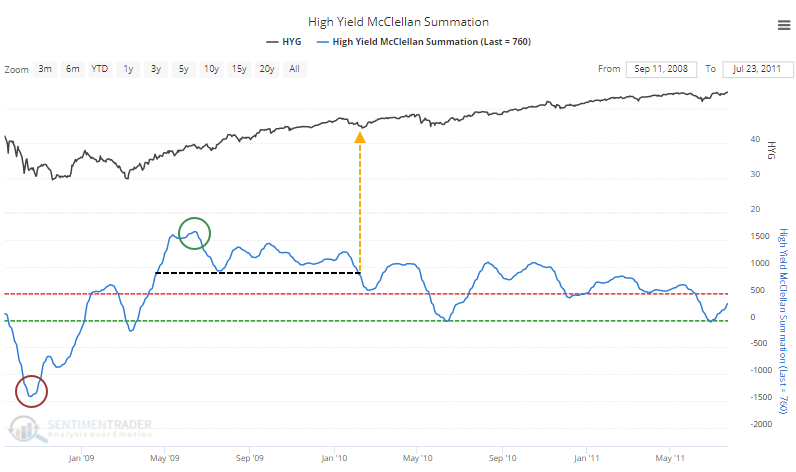

The only time frame that can compare is 2008-09 when the Summation Index hit a deeply oversold condition, then rebounded to an extremely overbought one. After that initial rebound, the Summation Index dipped, rallied again to a lower high, then fell to a lower low. That's where we are now. Below is a zoomed-in look at that window.

Despite the waning momentum, HYG rebounded in the months ahead though it didn't form a lasting bottom until months later after the Summation Index curled up after turning negative.

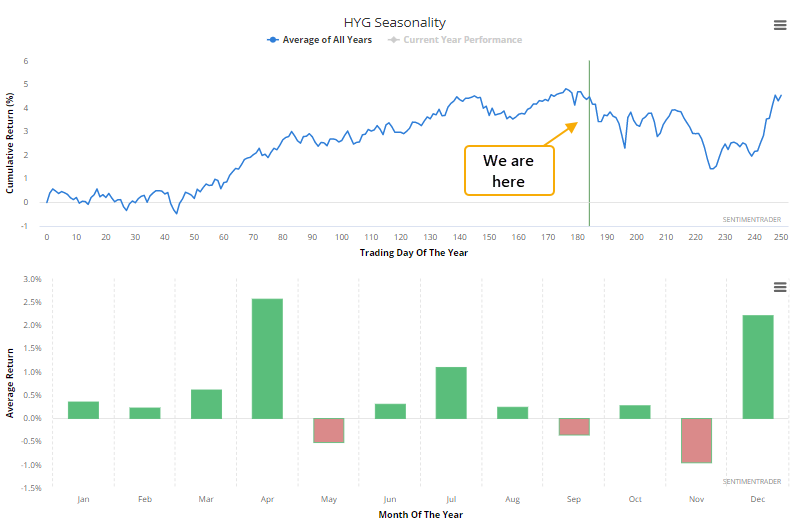

Seasonal window is mostly shut

While a minor consideration at best, high-yield bonds are now entering what has been a tough seasonal window.

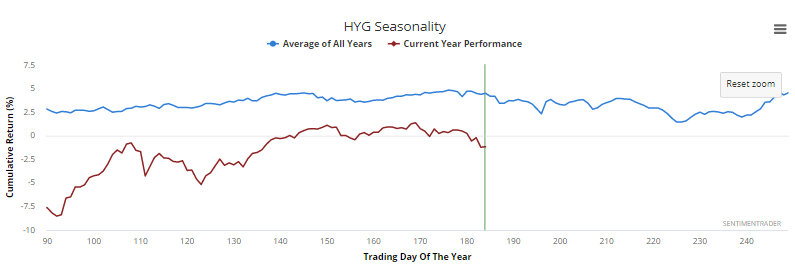

Once the initial plunge and recovery earlier this year passed, HYG's path in 2020 (red line) has followed its typical pattern (blue line) fairly well.

ETF traders flee and sentiment turns sour

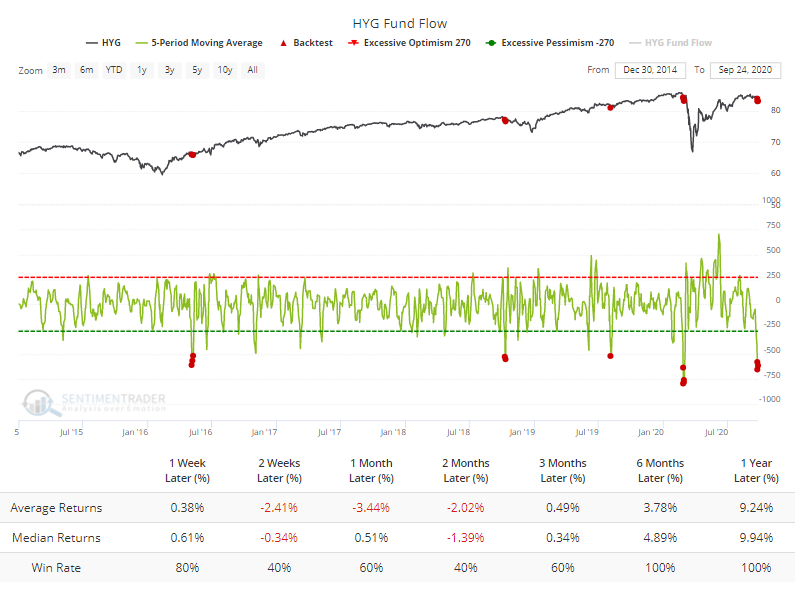

Traders seem to be anticipating more tough times ahead, as they've pulled an average of more than $500 million per day from HYG over the past week. The Backtest Engine shows this has been an unreliable contrary indicator over the shorter-term but since all signals have triggered during a relatively benign environment, longer-term returns were excellent.

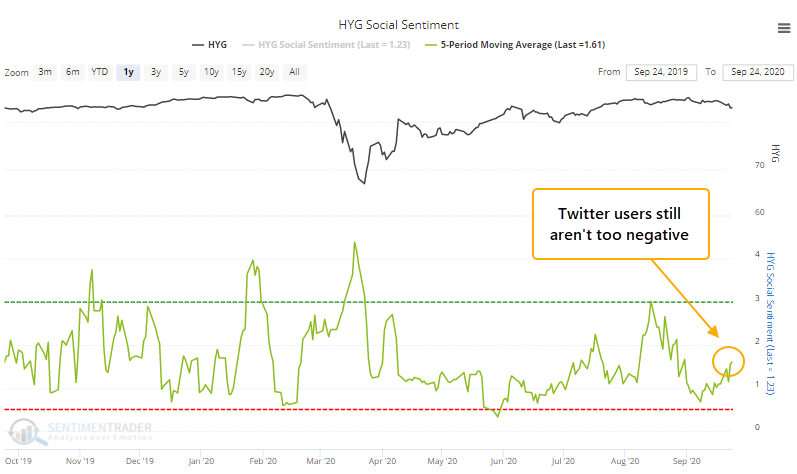

Twitter users had become quite enamored of funds like HYG earlier this month. The 5-day average of Social Sentiment dropped below 0.75 earlier this month. The indicator is derived by comparing the number of negative messages to positive ones, kind of like a put/call ratio that most of us are familiar with. You can watch Eric defend the dissertation for his Doctor of Science in Information Systems degree on these calculations on Vimeo.

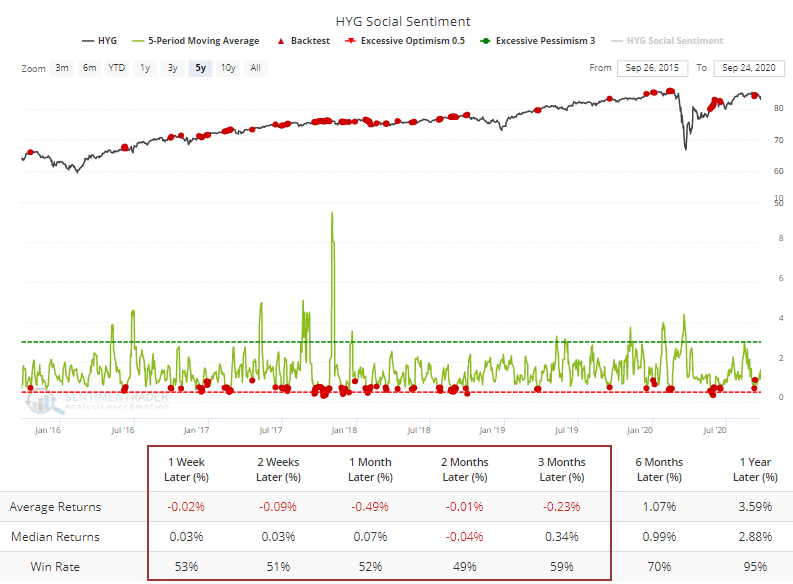

Over the past 5 years, when the 5-day average of Social Sentiment was below 0.75, results negative on average.

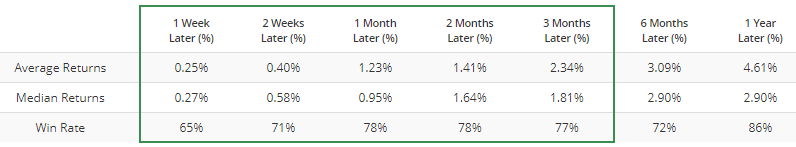

That's quite different from forward returns when Social Sentiment was above 2.5. Better bounces in HYG have come after these users were spreading more negative messages.

This kind of behavior has helped to push the 5-day average of HYG's Optimism Index below 25, while it's still hanging above its 200-day moving average. The Engine shows mostly very good longer-term returns, again thanks in large part to a mostly friendly environment.

When this works, it tends to really work and when it doesn't, it really doesn't. Meaning, periods of even short-term pessimism to this degree during uptrends tend to be just about "it" for the selling pressure with only minimal drawdowns. But if buying interest dried up and there was minimal upside with a continued pattern of lower lows in HYG, it led to some nasty, protracted declines and much deeper pessimism.

The overall suggestion here is that waning momentum and signs of short-term pessimism have not consistently led to good risk/reward setups on the long side just yet. It has typically taken more digestion, and even less optimism, before HYG formed a low more reliably. If it can't do so in the coming weeks and continues to see lower lows, then some very ugly precedents come to the fore.