High-yield bond carnage

Key points:

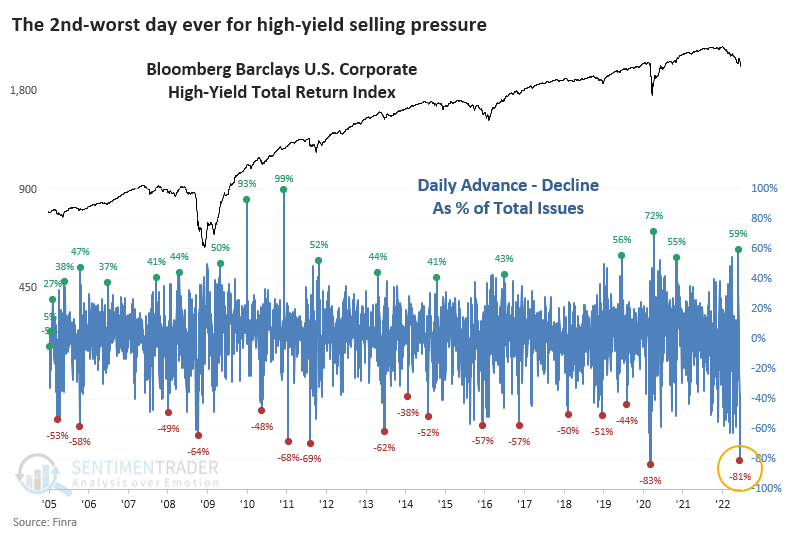

- On Monday, high-yield bonds suffered the 2nd-most lopsided selling pressure in 17 years

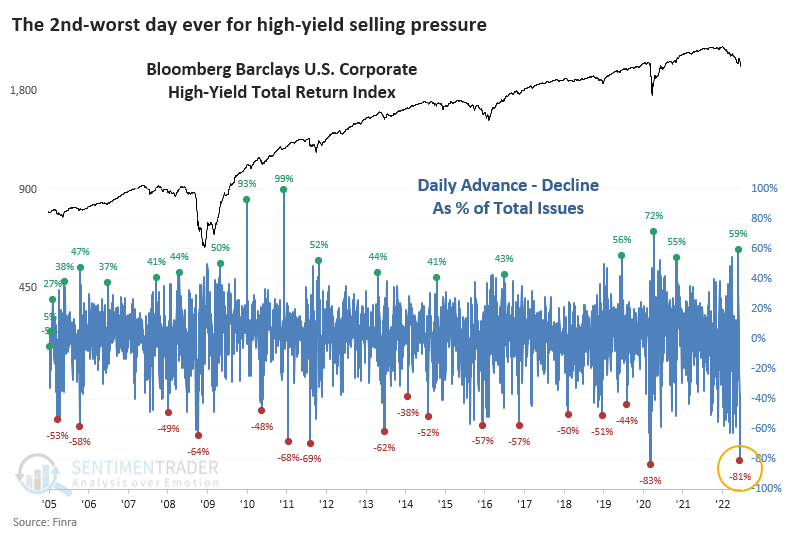

- It pushed the 3rd-most bonds to 52-week lows

- Similar bouts of overwhelming selling preceded short-term pain, but long-term gains

High-yield bond market suffers historic carnage

The market carnage over the past week hasn't been limited to stocks. Bonds have also been hammered, especially those most geared to economic performance.

Like we saw in stocks, investors dumped pretty much all bonds, particularly of the high-yield variety. In a remarkable fit of selling pressure, more than 80% of high-yield bonds declined on Monday. That's the most lopsided bout of selling in 17 years next to March 9, 2020.

The overwhelming selling pressure knocked even more of the bonds to a 52-week low. A net of more than 70% of high-yield issues fell to a new low, the 3rd-worst reading since 2005. The only dates with more panicked selling were October 2008 and March 2020.

A buying opportunity, but not right away

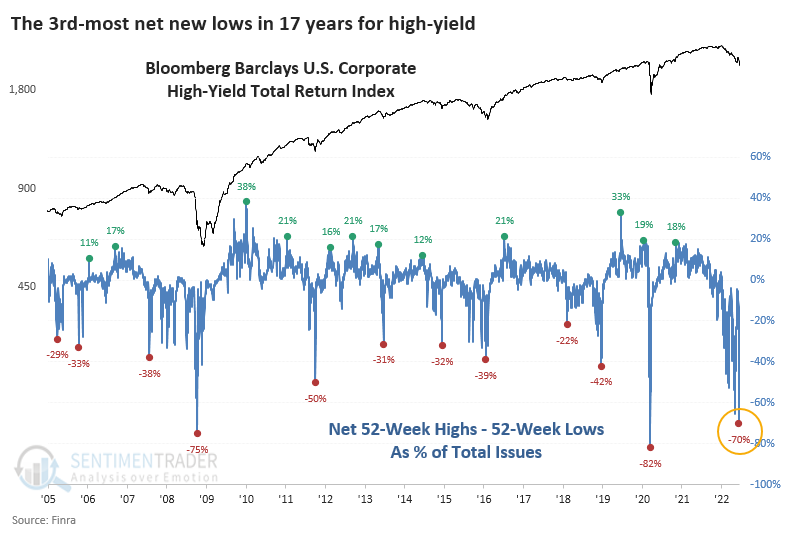

When we combine the two figures, it's clear that we're in rare territory in terms of how eager and how broadly investors are looking to reduce exposure to this part of the market.

It's also clear that neither bout of panic coincided with the exact low for high-yield.

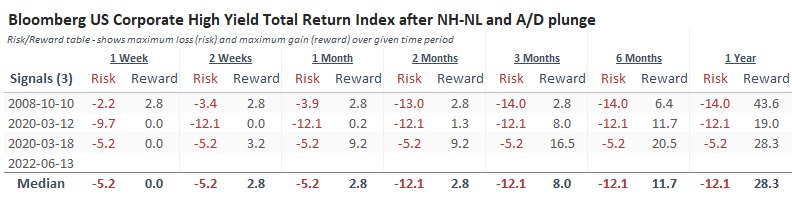

That's clearer when we look at the Risk/Reward Table for the signals. In 2008 and 2020, high-yield bonds declined at least 10% within the next two months, then roared ahead as the market recovered.

What the research tells us...

The past few days have triggered panic in several markets simultaneously. High-yield bonds were among the worst-hit relative to their historical behavior, and the only precedents we have for this level of selling were the two worst waves of panic in 17 years. Unfortunately, neither one marked a low for the bonds, as investors continue to sell in the weeks ahead. While this level of panic might be too early of a signal for buyers, it should serve as a heads-up that additional pressure in the next couple of weeks should present an excellent buying opportunity.