Hedging stocks with an options collar: The NVDA Edition

Key Points

- A collar is an options position that allows an investor the opportunity to hedge an existing stock position

- A collar involves selling a call option and using the proceeds to pay for all or part of buying a protective put position

- As with most option strategies, there is more than one way to use it

NVDA has upcoming earnings

First, note that this piece is not about ticker NVDA per se. Using options, we will use Nvidia as our underlying stock to highlight the collar position. As such, the example trades detailed below are not meant as recommendations (although they do serve the purpose of hedging).

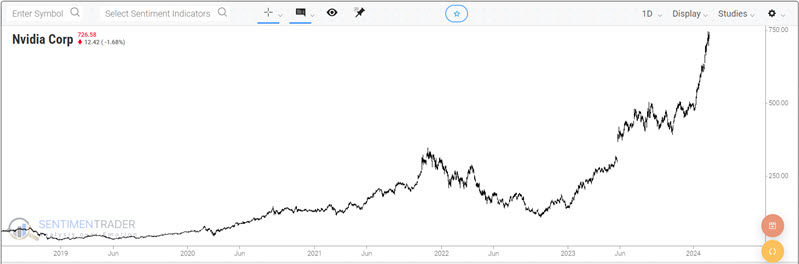

Few stocks have performed better than Nvidia (ticker NVDA). You can see its stratospheric rise in the chart below.

NVDA is scheduled to announce earnings on February 21st. While the announcement is expected to be well received, the reality is that few things can cause a massive and immediate downdraft in a high-flying stock than a disappointing earnings announcement. So, for our example, we will assume that:

- An investor owns 500 shares of NVDA (presumably with a nice open profit)

- They are concerned about the potential for earnings to knock the stock down

- They want to hedge against this possibility

The same scenario can apply to any stock. Let's look at two different ways to use the collar strategy.

Minimizing Risk in NVDA

The "classic" approach to a collar is to sell an out-of-the-money call option for every 100 shares held long and buy an equal number of put options. There are many choices regarding which option strike prices to buy and sell and which expiration to use.

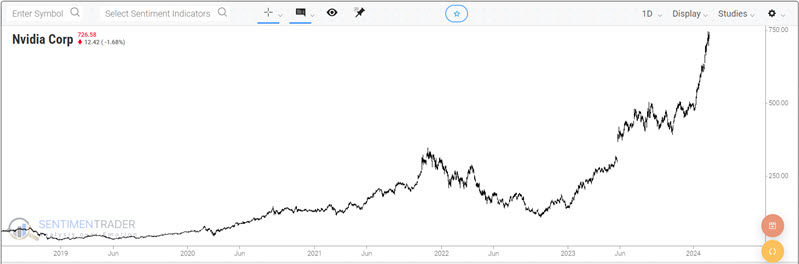

Since earnings come out on February 21, we will use options expiring on 2024-02-23 for this example. With NVDA shares trading at $731.56 a share, we will do the following:

- Hold 500 shares of NVDA trading at $731.56

- Sell 5 Feb 23, 2024 830 strike price calls @ $15.60 (Delta of 24)

- Buy 5 Feb 23, 2024 730 strike price puts @ $42.50 (Delta of 46)

The particulars for this position appear below (all screenshots below are courtesy of Optionsanalysis.com).

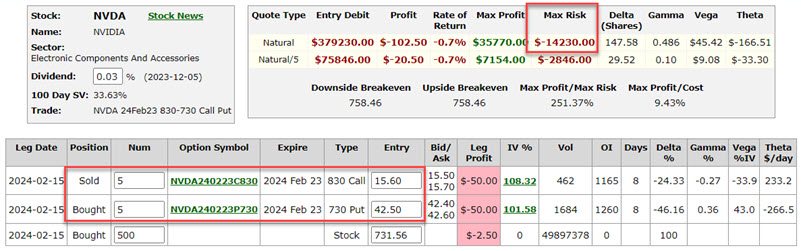

The risk curves (i.e., the expected dollar profit or loss at a given price for NVDA shares as of a given date) appear below (the black line represents option expiration day).

A few things to note:

- The current value of the 500-share stock position is $365,780

- Because the puts cost more than the calls, we must pay out $13,450 (42.50 - 15.60 x 500) to enter the collar

- Because we are selling 5 calls, our maximum profit potential during the life of the collar is $36,335 (if NVDA trades above the call strike price of $830)

- If NVDA does trade above the call strike price, the trader must be prepared to either buy back the call options or have their stock shares be called away

The good news is that if NVDA does sell off, the maximum loss we can experience during the life of the collar is -$13,666 if the shares drop below the put strike price of $730 a share

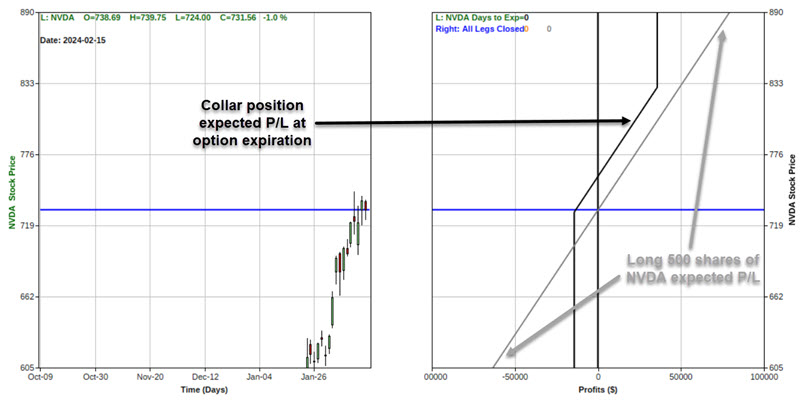

The chart below displays the equity curve for the collar position at expiration versus the equity curve for the long 500 shares of stock position alone (which is a straight line - for each $1 rise or fall in the price of NVDA shares, the stock position gains or losses $500).

The cons to this position are that the trader must pay out money to enter the collar and that the stock could be called away if the stock rises above the call strike price and the trader does not buy back the call options. The pro to this position is the limited downside risk should a worst-case scenario unfold.

Now, let's look at an alternative collar.

Using calls to pay for puts

This iteration of a collar is something I refer to as the "open collar." With this approach, we sell fewer call options (to retain some unlimited profit potential) and use the proceeds to pay for most or all of the cost of the put options.

This strategy may be preferable in any or all of the following situations:

- The investor is unwilling to cap the upside potential completely

- The investor does not want to pay out cash to enter a hedge

- The investor is only interested in hedging against a significant decline in the stock

Once again, we will use options expiring on 2024-02-23. With NVDA shares trading at $731.56 a share, we will do the following:

- Hold 500 shares of NVDA trading at $731.56

- Sell 4 Feb 23, 2024 840 strike price calls @ $13.97 (Delta of 22)

- Buy 5 Feb 23, 2024 650 strike price puts @ $10.90 (Delta of 18)

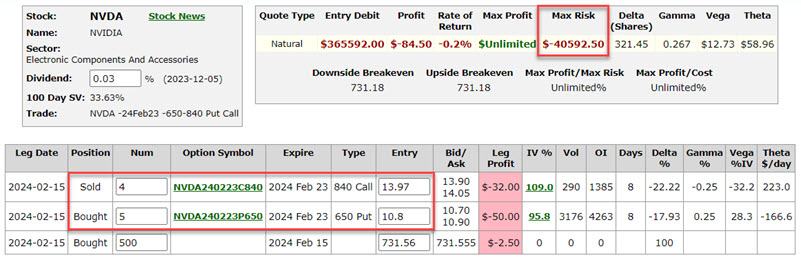

The particulars for this position appear below.

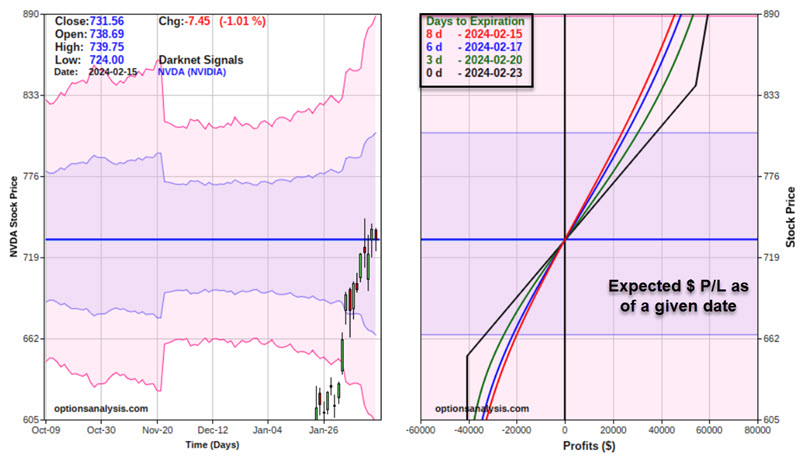

The risk curves (i.e., the expected dollar profit or loss at a given price for NVDA shares as of a given date) appear below (the black line represents option expiration day).

A few things to note:

- The current value of the stock position is $365,780

- We receive $5,584 for selling the calls ($13.97 x 400)

- It costs $5,450 to buy the protective puts ($10.90 x 500)

- In this scenario, the calls pay entirely for the puts, and we receive a credit of $134

- Because we are selling 4 calls, if NVDA trades above the call strike price of $840, we could have 400 shares called - however, we would still hold 100 shares of stock (i.e., we retain some unlimited profit potential if the stock shares soar)

The good news for this position is:

- We actually get paid $134 to enter the hedge

- We retain unlimited profit potential on 100 shares if the stock soars

- Our maximum potential loss is limited if the stock collapses

The tradeoff from the position above is that the maximum loss is -$40,952 if NVDA falls below the put strike price of $650 (versus a maximum loss of -$13,666 below $730 with the earlier position).

The chart below displays the equity curve for the collar position at expiration versus the equity curve for the long 500 shares of stock position alone (which is a straight line - for each $1 rise or fall in the price of NVDA shares, the stock position gains or losses $500).

This position is essentially a no-cost way to hedge against a massive selloff in the stock price.

The bottom line:

- If the stock soars, the investor enjoys a reduced amount of unlimited profit potential

- If the stock plummets, the collar position limits the loss below $640 a share

- In between, the investor has $134 more profit potential (from receiving a credit on the option position)

Comparing the two positions

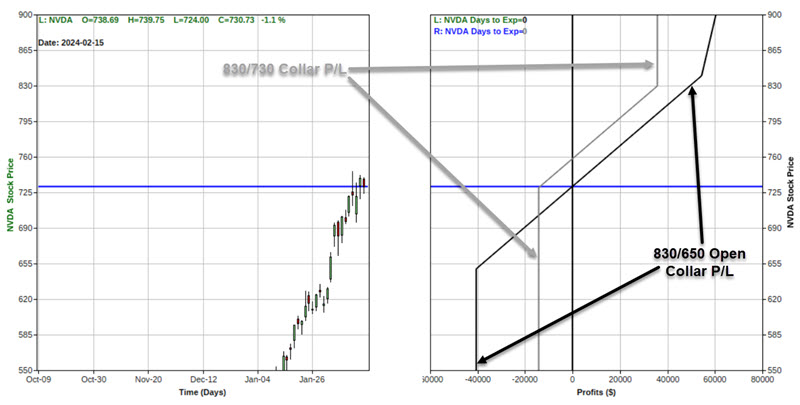

The chart below displays the expected P/L for the two positions and highlights the apparent tradeoffs in potential reward and risk.

What the research tells us...

Hedging an existing position can be achieved in any number of ways. The keys to selecting the proper position are first to decide if entering a hedge is even worth it in the first place. Remember that with a collar, you are giving up some profit potential to limit risk. If the answer is "Yes", then you must determine how much profit potential you are willing to give up, how much downside risk you want to eliminate, and how much you are willing to pay out to enter the hedge.

There are no "correct" answers to any of the above questions - only ones that meet your own objectives. Regardless of one's decisions, the collar is a quick and easy (and often low-cost) way to limit downside risk in a stock position.