Hedgers Are Hedging As Transports Lag Amid Momentum Ebb

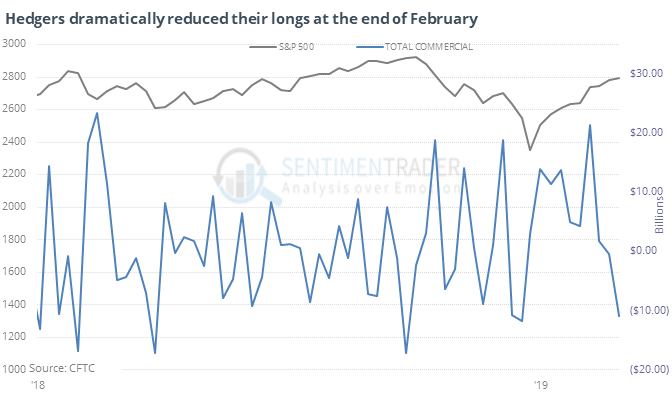

Hedgers actually hedging

Hedgers in the major index futures pared their positions by more than $10 billion at the end of February. That’s one of their larger one-week increases in hedging activity.

When they’ve made such big changes in the past, it has been a bit of a negative for stocks.

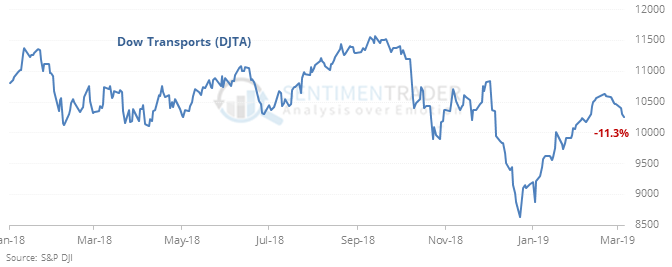

Dow doubts

The Dow Transports have lagged the Dow Industrials during this rally. While the Industrials got to within 3% of their 52-week high, Transports never got closer than 8% to their own high.

Going back to 1920, we saw that times when Transports lagged twice as much as Industrials, it was actually better for forward returns than when Transports led.

Ebbing momentum

The S&P 500 closed below its 10-day average for the first time in 40 sessions, ending one of its longest-ever streaks above average. Other times it lasted this long, buyers stepped in short-term but it tended to not last. This was also the first time in two months that NYSE Up Volume dropped below 15% after seeing a breadth thrust in January.

No liquidity premium

Over the past month, the SPY Liqudity Premium dropped to -35%, suggesting investors are no longer valuing the liquidity of ETFs versus individual stocks. Per the Backtest Engine, when the 20-day average dropped to this low of a level, the S&P 500 rallied during the next month only 38% of the time.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.