Health Care triggers a new relative strength index buy signal

Key points:

- The Relative Strength Index (RSI) for the health care sector crossed above 70 on Friday

- A trading model that uses the RSI indicator triggered a new buy signal

- The health care sector has rallied 78% of the time after other signals

The Relative Strength Index (RSI) indicator

The relative strength index (RSI), developed by J. Welles Wilder Jr., measures price momentum for stocks, indexes, or other assets. However, one can apply the indicator to almost any type of time series. I like to use the RSI indicator on the ratio between two securities to identify relative strength trends. When the RSI ratio exceeds 70, the relative momentum trend is positive. Conversely, the relative momentum trend is negative when the RSI ratio falls below 30. I view an overbought signal as a positive development, which runs counter to conventional wisdom amongst most traders. i.e., positive momentum begets more positive momentum.

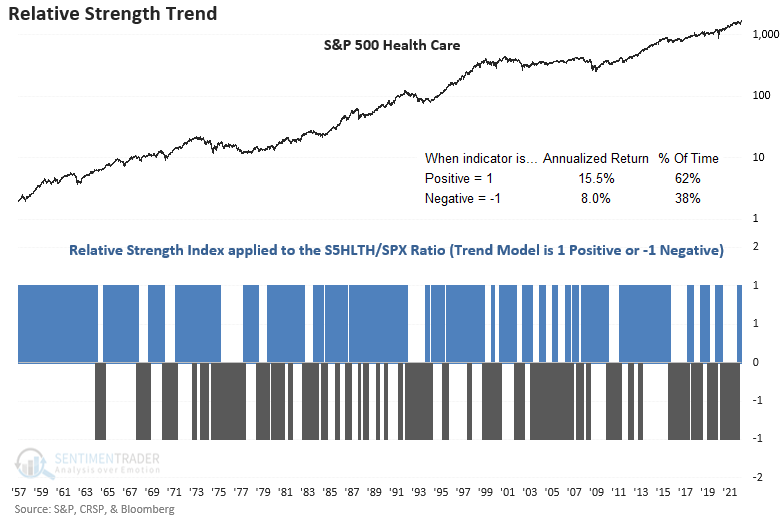

The Relative Strength Index (RSI) relative ratio trend for the health care sector

My RSI ratio trend model reversed from negative to positive on 12/20/21 when the RSI ratio crossed above 70. Favorable RSI ratio trend conditions show significantly higher annualized returns for the health care sector, with a return of 15.5%. In contrast, when the RSI ratio trend is negative, the sector annualizes at 8.0%.

How the trading model works

The RSI trading model is simple. When the RSI ratio trend is positive, the model generates a new buy signal when the RSI indicator for the underlying stock or ETF crosses above 70. At the same time, the 5-day rate of change must be positive. I use a reset to screen out duplicate signals by requiring the RSI to fall below a user-defined level before a new alert can trigger again. The RSI condition ensures that we buy solid absolute and relative trends. I want to avoid buying the best house in a lousy neighborhood. i.e., relative winners in protracted downtrends.

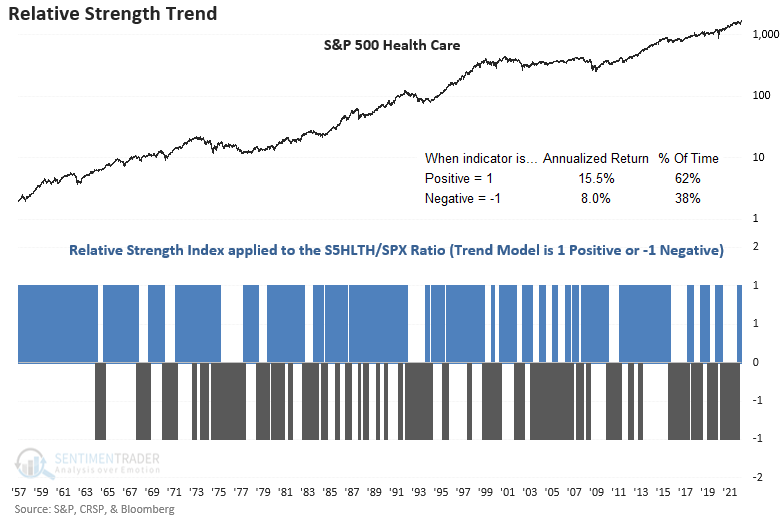

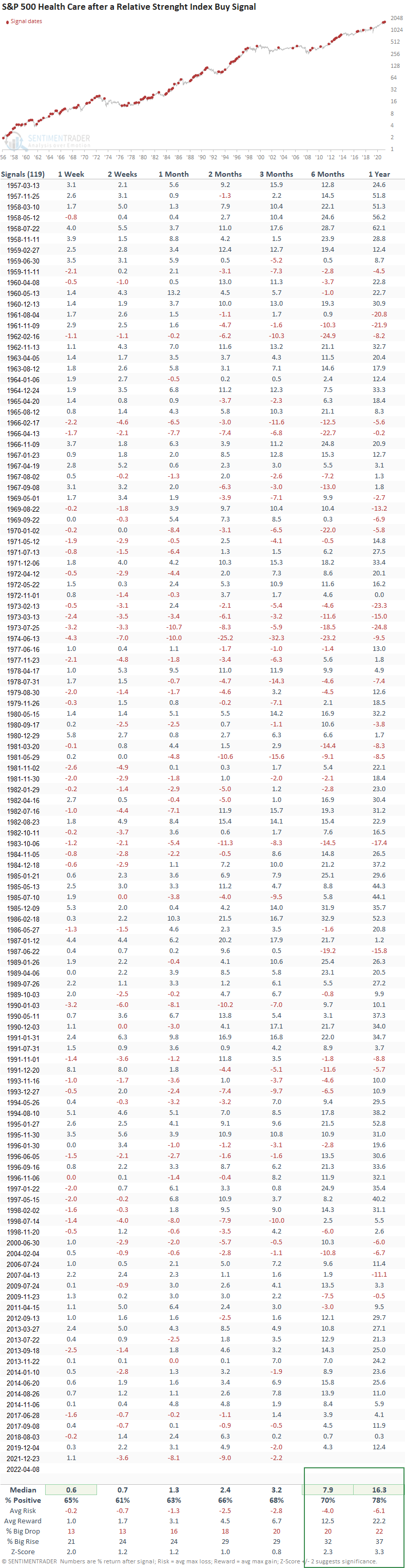

Similar relative strength signals have preceded gains 78% of the time

This model generated a signal 119 other times over the past 65 years. After the others, health care future returns, win rates, and risk/reward profiles were solid across all time frames, especially the 6 & 12-month windows.

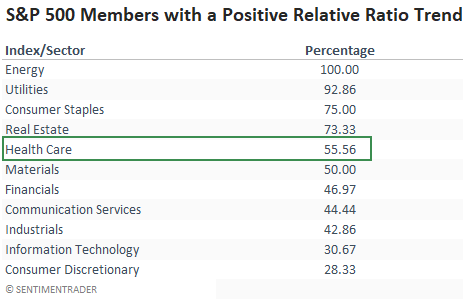

The health care sector shows above-average participation trends

When I count the number of members with a positive RSI relative ratio trend, the health care sector shows above-average relative participation, with 55% of the components in a favorable position.

If I drill down to the sub-industry level within health care, the following groups look the best.

- Biotech

- Health Care Distributors

- Managed Health Care

- Pharmaceutical

What the research tells us...

When my RSI ratio trend model is positive and the RSI indicator crosses above 70, absolute and relative price momentum begets more momentum. Similar setups to what we're seeing now have preceded rising prices for the health care sector, especially on a 6 & 12-month basis. With healthcare, consumer staples, and utilities on an RSI buy signal, we need to be mindful of the market message.