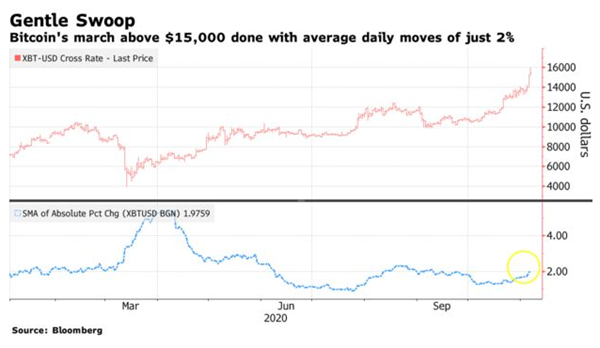

Health care stocks haven't done this since January

Health care stocks were some of the biggest beneficiaries of Wednesday's post-election relief rally. As a sector, they outperformed even highflying tech shares.

As a result, more than 30% of them broke out to fresh 52-week highs, among the biggest thrusts in years.

With some sectors, a surge in new highs tends to be a good sign of positive momentum, with consistently positive forward returns. Those tend to be higher-beta sectors. In more defensive sectors, we typically see weaker returns in the shorter-term after big thrusts. That was modestly the case for health care.

One of the relatively odd aspects of the surge in new highs is that there wasn't a concurrent surge in the percentage of them that also moved above their 200-day moving averages. Even after Wednesday's jump, fewer than 80% of them were in long-term uptrends. When that happens, the sector fared worse in the shorter-term.

What else is happening

These are topics we explored in our most recent research. For immediate access with no obligation, sign up for a 30-day free trial now.

- What happens when there is a surge in new highs among health care stocks

- And what happens when the surge is met by muted participation

- Seasonality and insider buying interest in health care stocks

- Value stocks have underperformed growth by nearly the widest spread in 30 years

| Stat Box The Dow Industrials rallied more than 1% for 4 consecutive sessions through Thursday. Going back to 1896, a total of 124 years, the index managed only 19 other streaks like this. Its most consistent performance was over the next 2 months, when it gained 15 times and lost ground 4 times. |

Sentiment from other perspectives

We don't necessarily agree with everything posted here - some of our work might directly contradict it - but it's often worth knowing what others are watching.

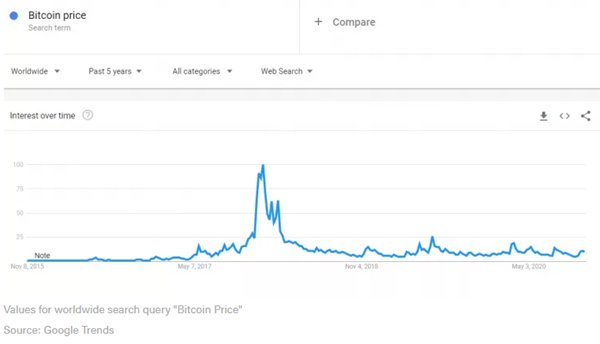

1. Not much sign of FOMO among bitcoin traders - Coinbase

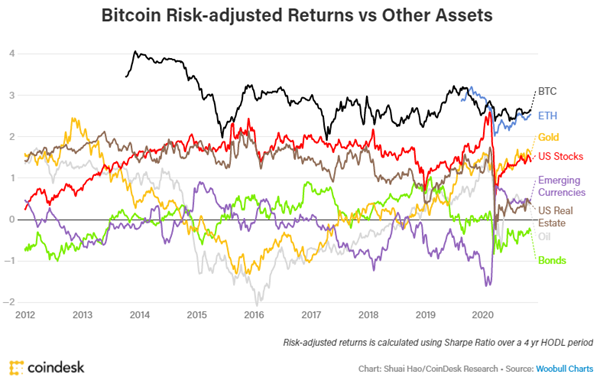

2. Even though it has the highest risk-adjusted return of any market - Coindesk

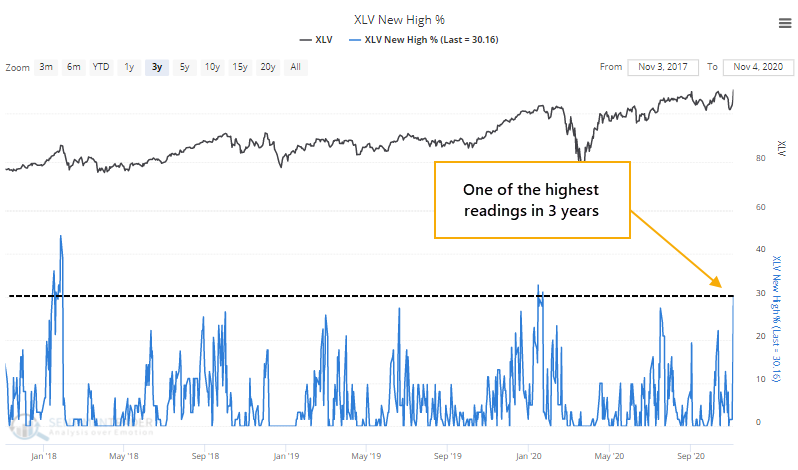

3. It's also rallying with smaller daily gains, not usually the sign of a euphoric market - Bloomberg