Growth Stocks Don't Like the Ends of Recessions

The recession is over, and we can all breathe easier now.

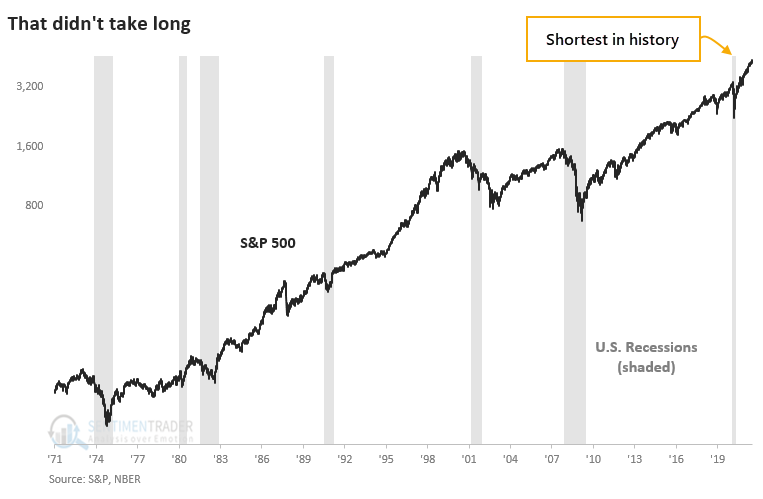

According to the National Bureau of Economic Research (NBER), the "official" arbiter of U.S. business cycles, the economy pulled out of recession last April, ending the shortest recession on record.

Great. The only problem is that it would have been nice to know this a year ago. Because of data lags and the requirements for determining business cycles, that's not possible, so we have to deal with things well after the fact.

ENDS OF RECESSIONS - OKAY FOR STOCKS, BAD FOR BONDS

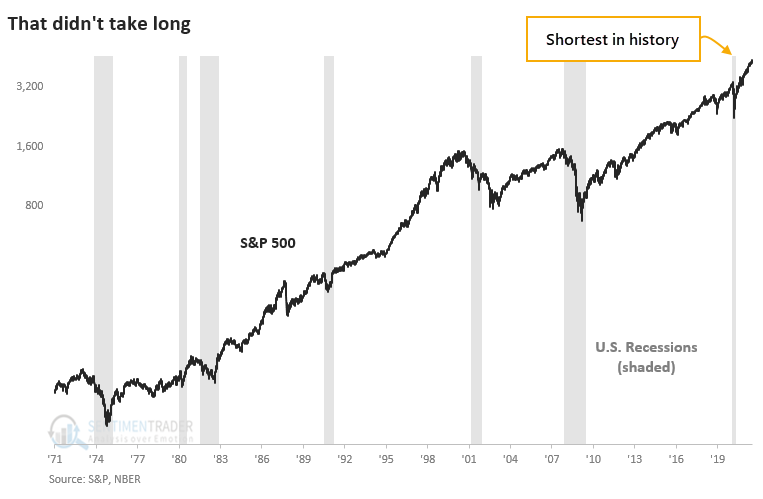

To see if there is any potential use in becoming more optimistic once a recession is officially declared to be over, the table below shows how the S&P 500 performed following a publicly declared end to a recession by the NBER.

In the very short-term of a couple of weeks (not shown), the S&P dropped after each of the last five declarations. The weakness didn't last long, though it still underperformed a random return up to a year later. Only over the next 2-3 years did it show above-average performance, with low risk and high reward. The last two signals, clearly, were very positive for stocks over almost all time frames beyond a few weeks.

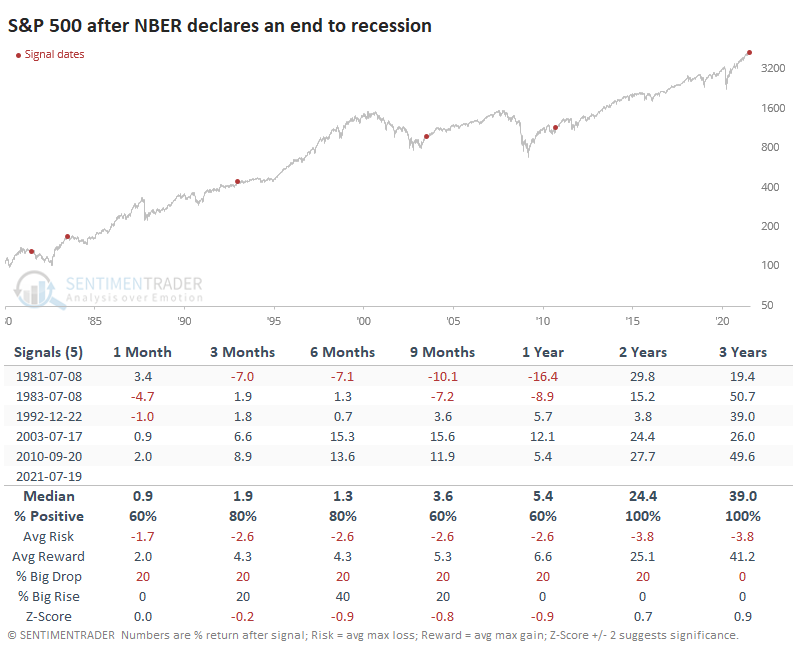

The U.S. dollar showed mixed returns.

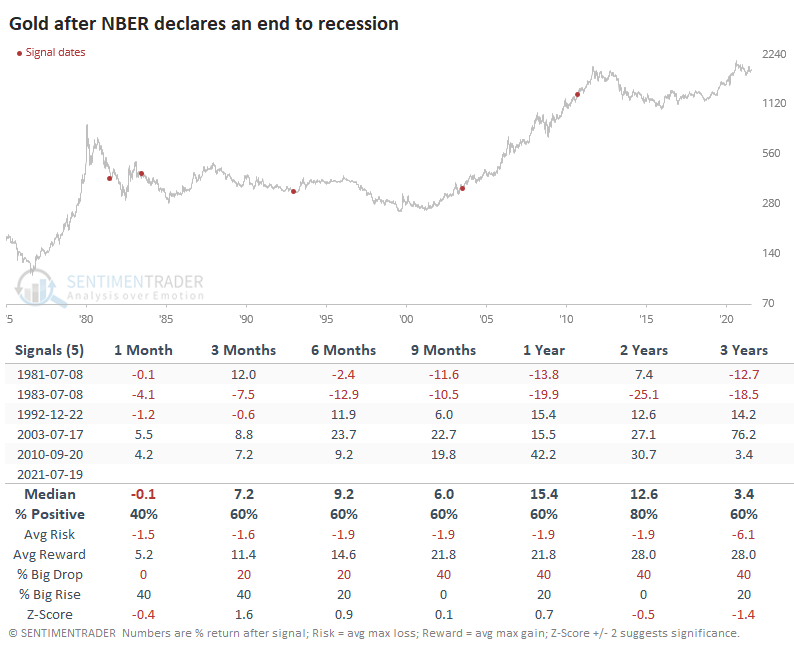

Gold was basically the inverse, with declines in the 1980s as the dollar rallied and gains after the last two as the dollar fell.

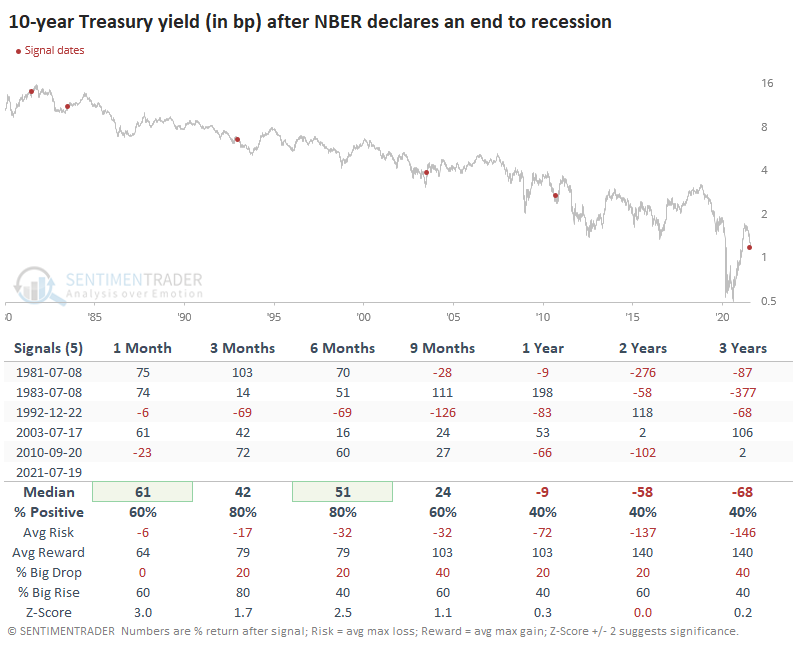

The yield on 10-year Treasuries rose four out of five times during the 3-6 months following an announcement that a recession had ended but had trouble holding those gains as the long-term trend of lower rates asserted itself.

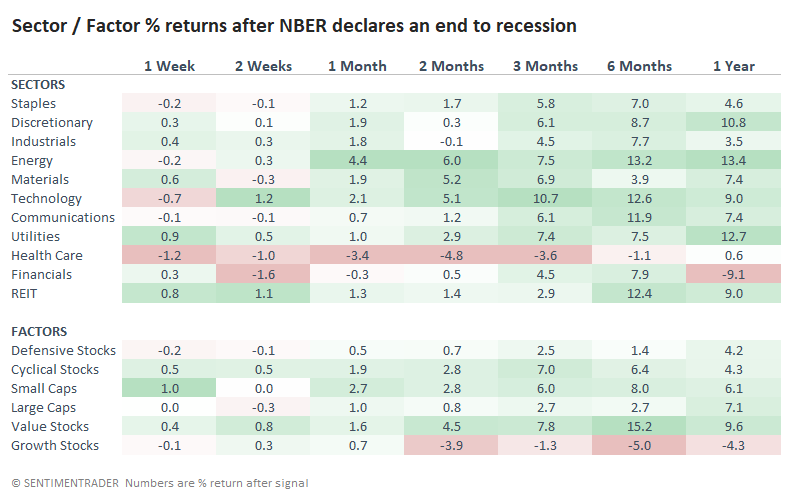

ENERGY AND VALUE SHINED, GROWTH STUMBLED

Returns in sectors and factors showed some large differences, though we must be careful with such a small sample size. Some of these returns go against other recent studies, though one consistency is that Energy and Value stocks showed some of the best returns. The average return on Growth stocks was atrocious.

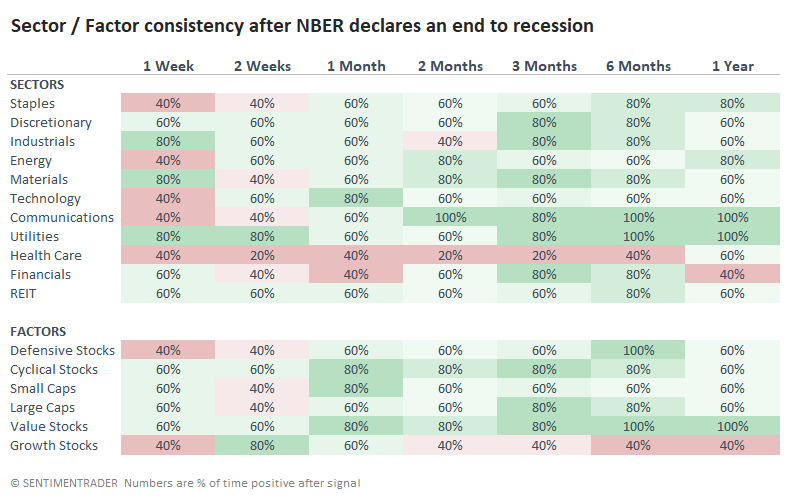

We can see that in their consistency as well. This is the percentage of time each sector and factor showed a positive return across the time frames. With a sample size of only five, though, this has less meaning.

Often, the best time to invest for the long-term is when the news is worst. The national news is chock full of reports about the economy falling into recession, jobs being lost, markets tanking. The inverse isn't as true, but we can still generally expect below-average returns when everything seems rosy. Now that headlines will be trumpeting an end to the shortest recession on record, we should be on guard that it doesn't necessarily mean clear sailing, especially for Growth.