Growth Better Than Unemployment As Warnings Cluster

This is an abridged version of our Daily Report.

Growth > unemployment

The President’s triumphant gaffe about a 100-year high in economic success masked a relatively common signal. When GDP growth was higher than the unemployment rate, stock returns were in line with random, suggesting there was more use for politicians than investors.

Trigger warning

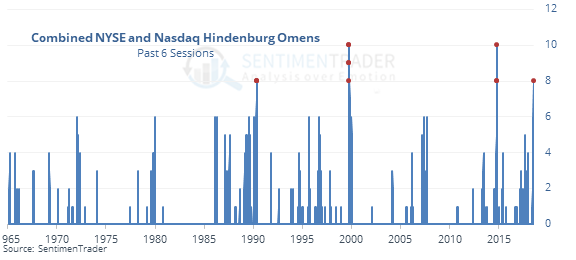

On both the NYSE and Nasdaq exchanges, technical warnings have triggered for over a week straight. This is the largest cluster of warnings since 2014, and 3rd-most in 50 years, leading to broadly negative returns, but less so in defensive sectors.

Semi recovery

The SMH semiconductor fund was down more than 3% intraday before recovering to close off just over 1%. Over the past 15 years, it has had similar reversed 29 times.

More outflows

The ICI reports that investors withdrew more than $5.5 billion from equity mutual funds and ETFs in early September. According to the Backtest Engine, such large outflows led to a rally in the S&P over the next month 69% of the time.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |