Good Times As S&P Shrugs Off Financials

This is an abridged version of our Daily Report.

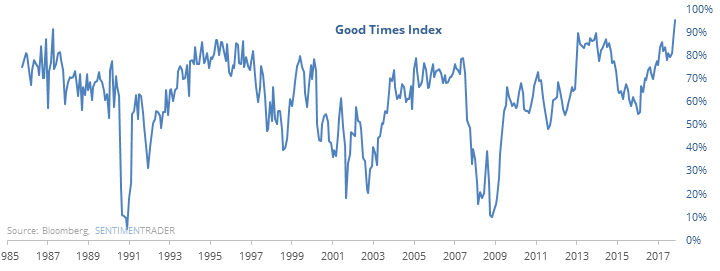

Good times

Low stress and easy financial conditions have led to high confidence, low savings and good economic surprises.

That combination of positive factors has never been seen to the degree we’re enjoying now. Prior “good times” led to mixed returns, with the last two peaks in stocks triggering after the good times started to ebb.

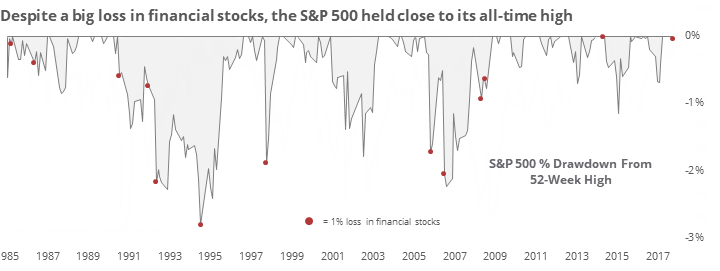

Shrugging off financials

Financial stocks lost more than 1% on Wednesday, but the S&P 500 closed just off its all-time high. This is odd - usually, when financial stocks take such a big hit, the S&P suffers a larger negative impact, knocking the S&P more than 1% off its 52-week high on average.

When the S&P shrugged it off, it led to consistently poor returns for stocks.

FOMC seasonality

The Dow Industrials Average ETF, DIA, managed to close at a multi-year high on a day the Federal Reserve announced its position on interest rates. Its most consistent performance going forward was over the next 7 days.

Coffee is the most hated commodity

The Optimism Index on the contract has slid below 15, nearing its all-time low. According to the Backtest Engine, of the 59 total days since 1991 when the Optix was below 15, coffee showed a positive return over the next month 75% of the time.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.