Good quarters tend to beget good quarters

Key points:

- The S&P 500 Index gained +10.6% during the 4th quarter of 2021

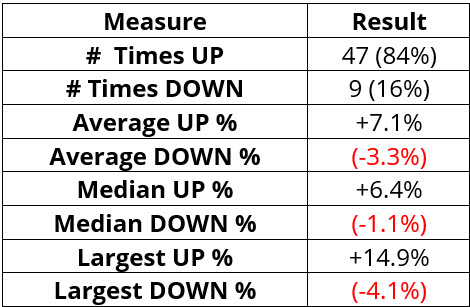

- Historically, a quarterly performance of +9% or more has been followed by another up quarter 84% of the time

Quarters up 9% or more

We define a quarter as any three months ending in March, June, September, or December.

There have been 56 quarters that have seen the S&P 500 Index gain +9% or more in price since 1933. Forty-seven of those quarters were followed by another up quarter. Only nine times did the S&P 500 decline over the next quarter.

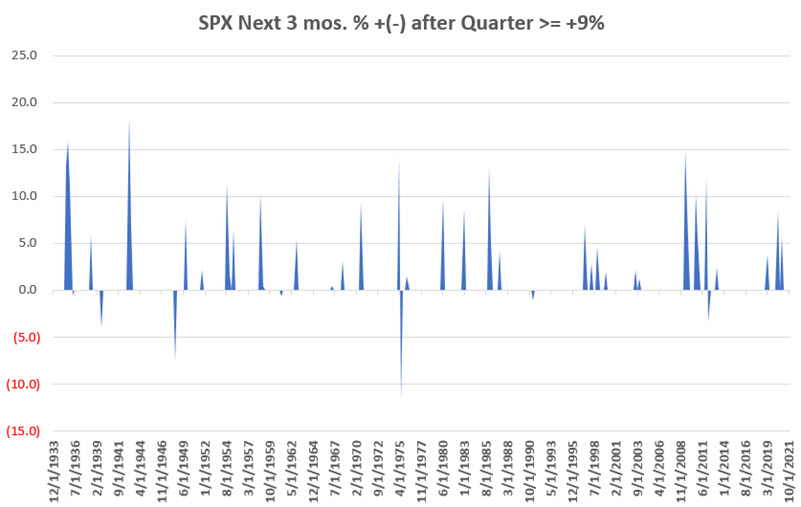

The chart below displays the quarterly performance for the S&P 500 following quarters of +9% or more.

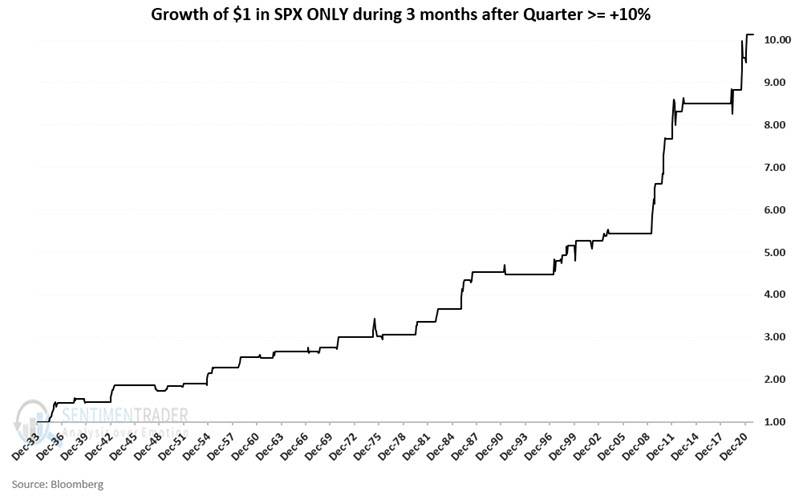

The chart below displays the cumulative growth of $1 invested in the S&P 500 for three months after a +9% quarter.

The table below displays a summary of performance results.

What the research tells us…

Traders should not assume that the first quarter of 2022 is sure to show a gain for the S&P 500 Index. An 84% success rate is a powerful indication, but it does not guarantee success. Still, the latest signal suggests that as long as price action holds up, investors should continue to give the bullish case the benefit of the doubt.