Good Growth During Earnings Season As Nasdaq Leads

This is an abridged version of our Daily Report.

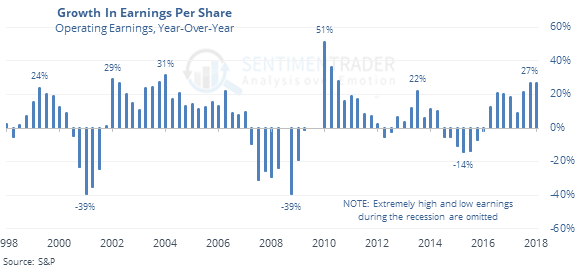

A great season of earnings

Earnings season is expected to bring another quarter of impressive growth.

When that growth is high, however, earnings season carries more risk than reward.

Tech is leading the charge

The Nasdaq Composite is leading the four major equity indexes to new highs. It gave a false signal in March and its short-term record as a leader is poor.

A non-contrary contrary indicator

The weekly AAII survey of individual investors showed the percentage of bullish investors jumped 15 percentage points this week, from 28% to 43%. Be careful with using this as an automatic contrary signal. Two weeks after jumps of 15% in bullish opinion, the S&P 500 was higher 74% of the time by an average of 1.1%.

Turkey burger

The Optimism Index on Turkey sticks out on the Geo-Map (or later in this report) as being one of the few countries showing pessimism. Most are in excessive optimism territory. With a reading of 6, its optimism is back to one of the lowest levels in the history of the TUR fund.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |