Gold's drop, commodities pop

Sentiment in financial market is sky-high. Traders and investors are no longer asking the question "should I be buying?" Instead, they're mostly asking the question "which asset should I buy to score the quickest and largest gains". Everything from tech stocks to small cap to value to ex-U.S. stocks to commodities to cryptocurrency is going up.

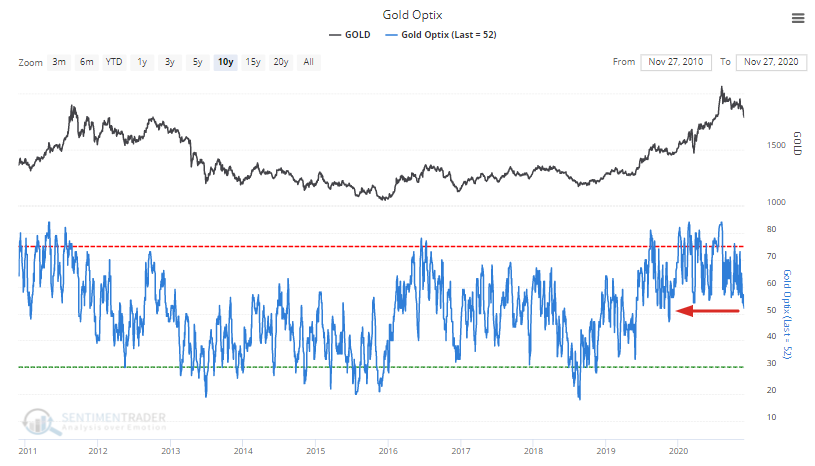

The one major exception? Gold and silver are sliding down. Gold's Optimism Index has fallen to a 1 year low:

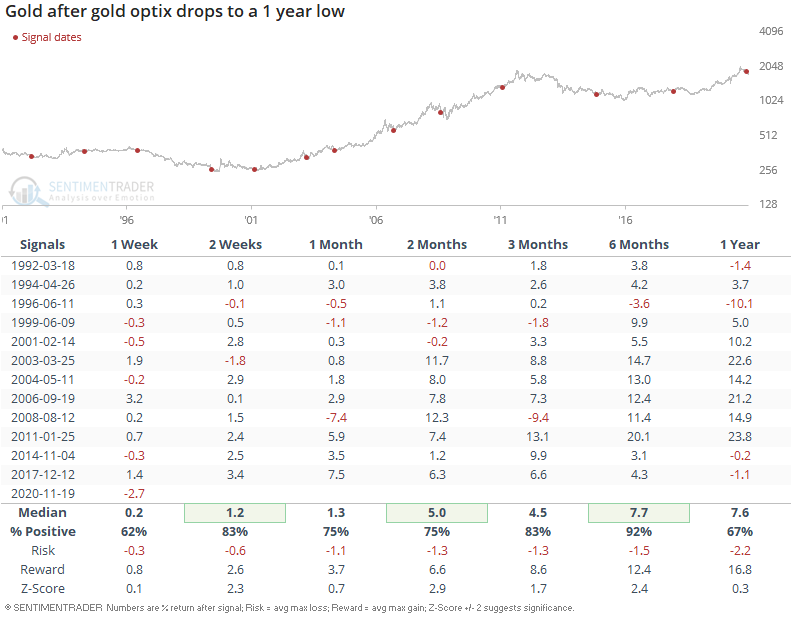

When this happened in the past, gold had a very strong tendency to rally in the months ahead:

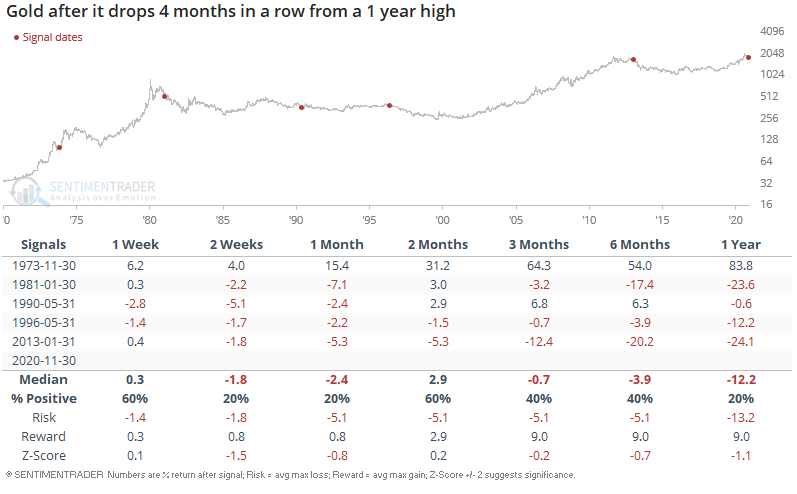

Looking at this from a different perspective, gold dropped 4 months in a row from a 1 year high. When this happened in the past, gold's forward returns were not consistently bullish (unlike in the previous stat):

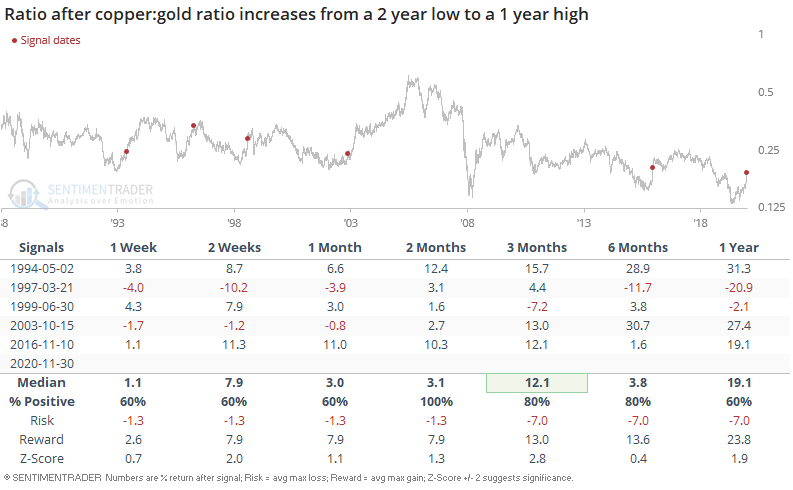

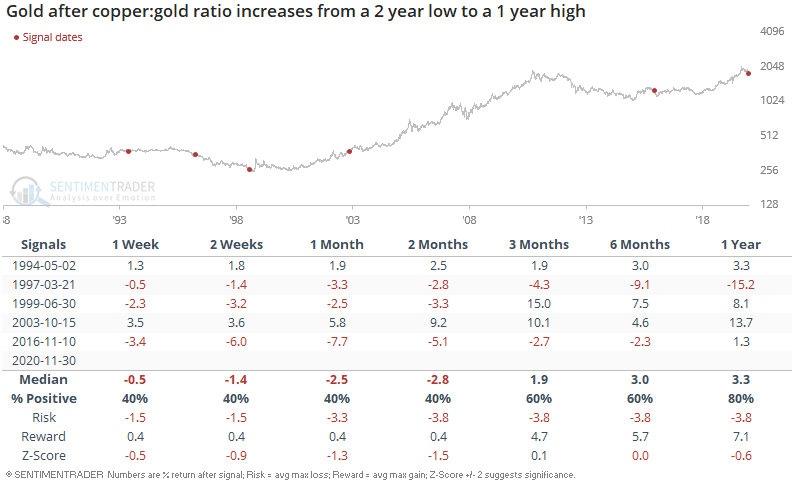

Commodities are rallying across on the board on hopes that a vaccine will help the economy recover back to normal. The copper:gold ratio has jumped to a 1 year high after being at an all-time low:

When this happened in the past, gold's forward returns were mostly mixed:

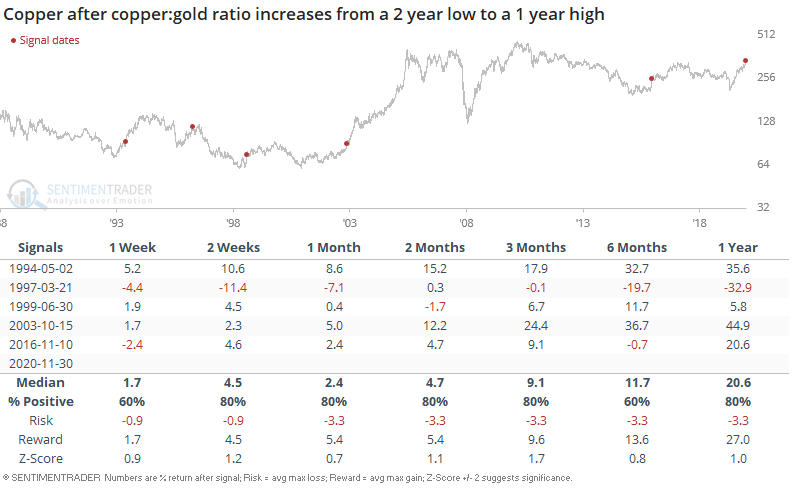

Copper's forward returns were more bullish than average:

And the copper:gold ratio usually continued to climb: