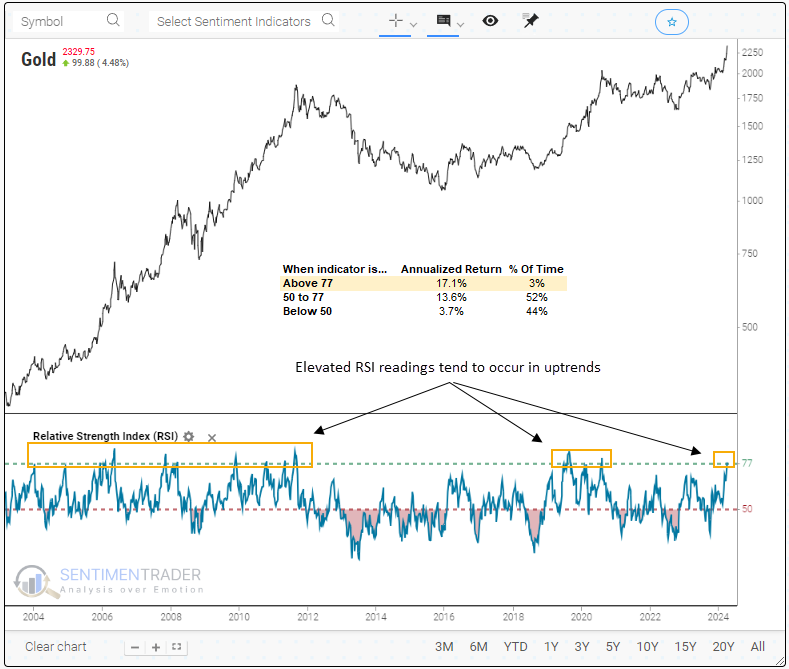

Gold surges to a historic overbought condition

Key points:

- Gold's Relative Strength Index using weekly data has risen to the highest level in more than four years

- Similar price momentum conditions occurred in uptrends, with Gold rising 86% of the time a year later

- While a Gold mining index rose 79% of the time over the subsequent year, it underperformed Gold futures

The bullish price momentum in Gold suggests a new long-term uptrend

In October 2023, I published a research note titled "Gold falls to a historic oversold condition." Using daily data, I showed that when Gold's Relative Strength Index fell below 20, price momentum was so bad that it was good. Gold did not disappoint, rallying 23.5% over the subsequent six months, the best return over that time frame since 1982.

This extraordinary surge in gold has driven the Relative Strength Index to the opposite extreme, surpassing a reading of 77 based on a 14-week setting, a scenario observed in just 3% of precedents since 1973. Instances above 77 have yielded a remarkable 17% annualized return for the precious metal.

The 14-week RSI for Gold previously cycled from less than 50 to above 77 in 2019, resulting in a 26% gain over the following year.

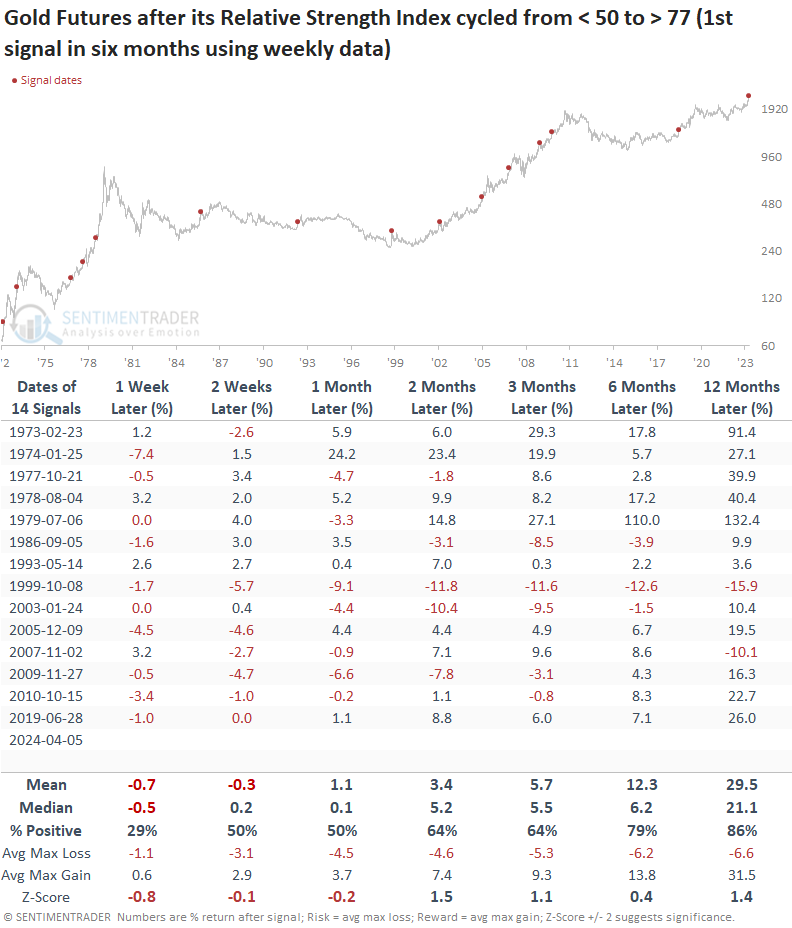

Similar price momentum signals bode well for a new uptrend

Whenever Gold's Relative Strength Index reversed from below 50 to above 77, the precious metal encountered short-term difficulties. However, investors who wisely entered the market during this consolidation or pullback phase enjoyed significant rewards in the ensuing year, as the commodity exhibited a median gain of 21%. Additionally, consistency was excellent, rising 86% of the time.

At some point over the ensuing year, Gold was higher every time except for 1999, which marked an immediate peak.

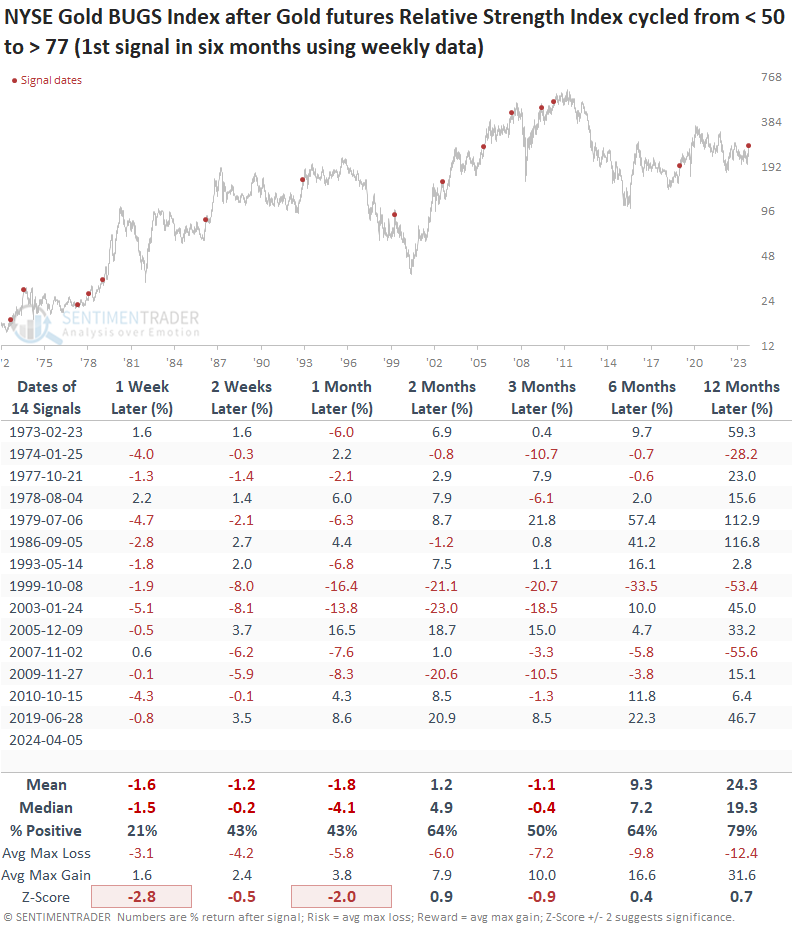

The NYSE Gold BUGS Index showed even more pronounced weakness over the near term after similar RSI conditions for Gold. While the median return and win rate exhibit excellent results a year later, both metrics underperformed an allocation to the precious metal.

So, Investors might find it more advantageous to allocate funds toward a vehicle like the Gold ETF (GLD) instead of opting for a Gold mining ETF.

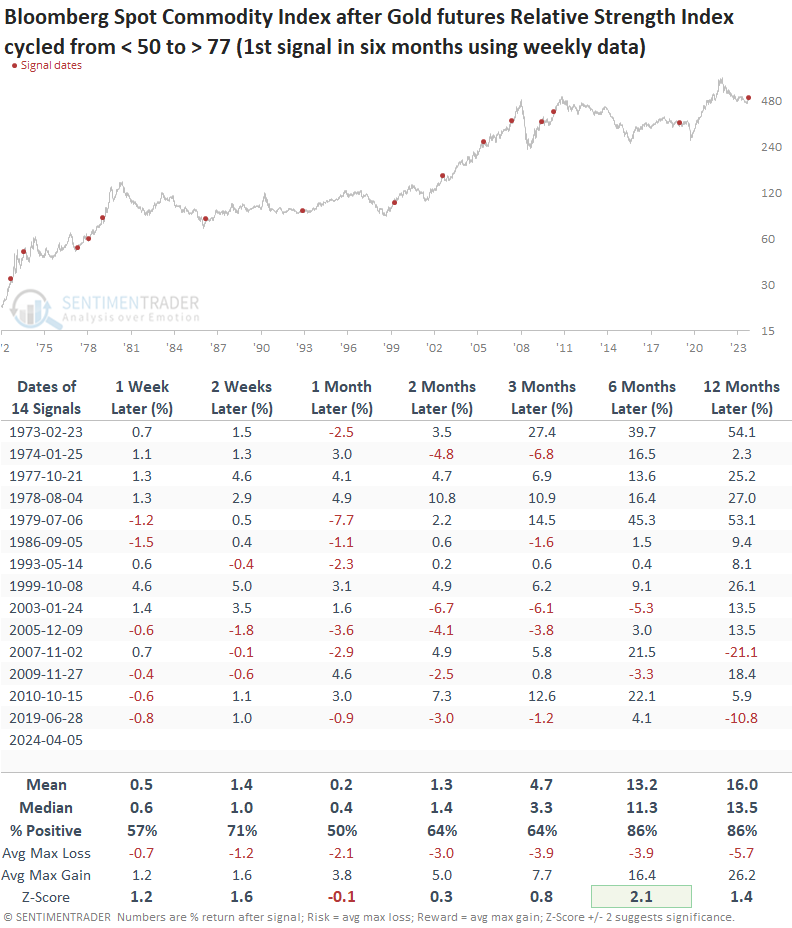

Similar precedents in Gold's Relative Strength Index tended to coincide with broad-based commodity uptrends. Over the subsequent six and twelve months, the Bloomberg Spot Commodity Index rallied 86% of the time.

It's conceivable that Gold is signaling the beginning of a new commodity market upswing.

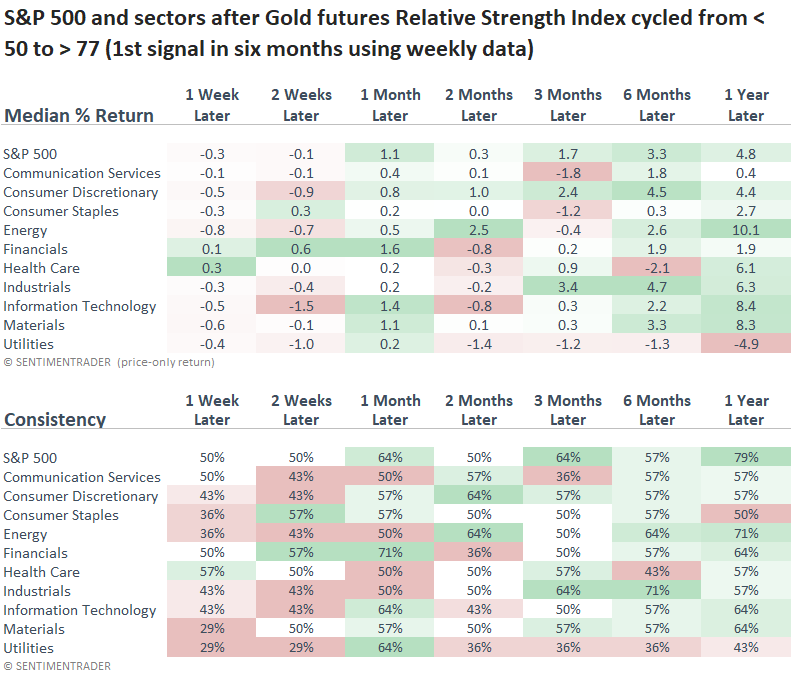

Suppose I apply the signals to the S&P 500 and sectors. In that case, we see a reasonably mixed message from sectors over the ensuing three months. A year later, commodity-oriented groups like Energy and Materials outperformed the S&P 500.

What the research tells us...

Price momentum in Gold has been nothing short of spectacular, lifting its Relative Strength Index to one of the highest levels in years. Similar RSI readings for the precious metal tended to occur within uptrends. A year later, the commodity was higher 86% of the time. What's good for Gold was generally good for a broad basket of commodities, with a spot commodity index also rallying 86% of the time over the ensuing year. Should history rhyme, commodity-oriented sectors like Energy and Materials could outperform the S&P 500.