Gold Sentiment Sours As High Yield Bonds Near Positive Change

This is an abridged version of our Daily Report.

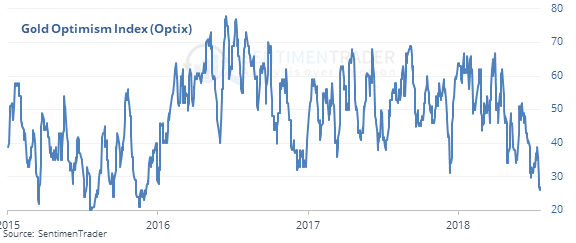

Gold sentiment sours

Optimism on gold dropped to one of its lowest levels in its 7-year bear market, and the lowest since December 2015.

When holding through all days when sentiment was this low, gold’s returns over the next few months were excellent, especially the risk/reward.

The 2nd-best losing streak

The high-yield bond market has seen more 52-week lows than highs for 124 days. That’s its 2nd-longest streak, which is close to ending, a good longer-term sign. The market has a much better annualized return when there are more highs than lows.

A positive search result

Google has gapped up more than 3% and above its 52-week high 9 times since 2007. From the equivalent of Tuesday’s open through the close four days later, it showed a negative return 5 times.

Stock screen

Among the notable stocks on the S&P 1500 Long Ideas Screen is Netflix. Its 5-day Optimism Index dropped below 23 while the stock was trading above its 200-day average.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |