Gold Miners Lag As Investment Managers Sell

This is an abridged version of our Daily Report.

Miners’ minor months

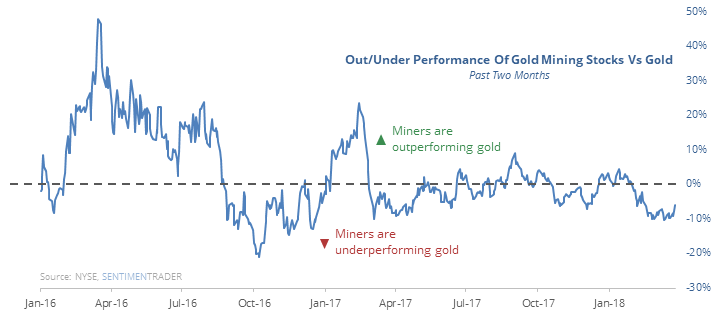

Gold mining stocks have underperformed gold prices by more than 10% over the past couple of months.

Due to their higher volatility, this is considered a negative for gold prices going forward. There is some modest truth to this, as gold (and miners) has struggled in the months after large divergences (see inside).

Investment managers cover up

Active investment managers have less than 50% exposure to stocks for the first time since May 2016. Generally, stocks do better when managers have more exposure to stocks – just not too much exposure. Most of the better bottoms have come when exposure has declined below 30% (see inside).

Hedging much?

After Wednesday’s session, options traders had traded an average of 125 puts for every 100 calls during the past week. During more than 20 years of history, the Backtest Engine shows 51 days when it got this extreme, with positive returns in the S&P 500 over the next two months after 48 of them, averaging 5.5%. For a quick video showing how we performed this exact test, visit this link. There’s no audio, it’s just a 40-second peak over my shoulder as I perform the test.

Even more extreme

The extreme short-term rout in tech stocks noted in Wednesday’s report had gotten even more extreme. Heading into Thursday, fewer than 5% of Nasdaq 100 stocks had closed above their 10-day averages over the past week. Since 2000, there have been only 17 days when the pressure had been this great. According to the Backtest Engine, six months later the QQQ fund was higher after all 17 days. You can click here to watch how I performed this test.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.