Gold Just Did Something For The 1st Time In 25 Years

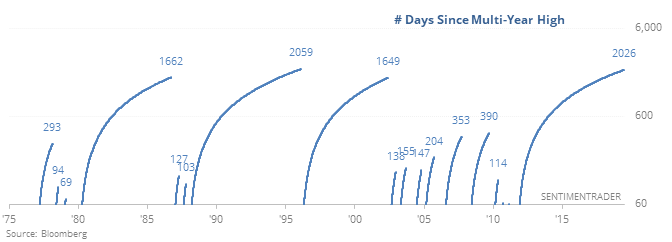

Gold’s near-record streak

Gold broke out to a multi-year high for the first time in more than 2,000 days, which was nearly its longest streak in 40 years.

The ends of other super-long streaks without a new high all saw the metal trade lower over the next couple of months. The dollar tended to be weak, as did gold miners, but stocks were strong.

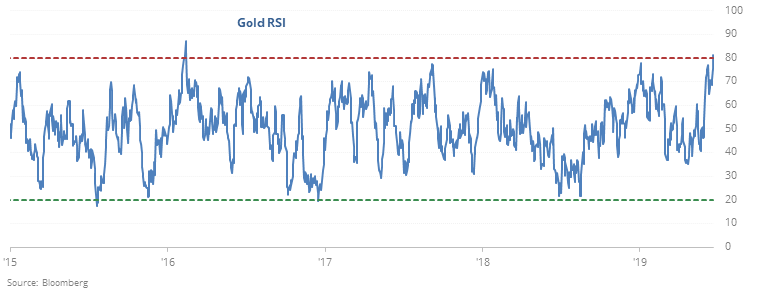

Overbought and volatile

The new high in gold was accompanied by the it most-stretched Relative Strength Index reading in four years, and it has struggled to hold momentum with readings this high.

Options traders’ bets of future volatility have also skyrocketed, which has coincided with turning points in recent years.

Missing out

The S&P has fully recovered from its May pullback and sits at a new high. Yet the latest survey of individual investors from AAII still shows more bears than bulls. Their persistent pessimism is rare, with only four similar cases in the past 30 years.

Big push

The S&P 500 hit a new high, and the percent of issues on the NYSE at a new high hit its highest level in 350 days. When both hit a 350-day together, the S&P was higher 36 out of 41 times a year later, with average risk of only 3.1% versus average reward of 15.2%.

Low debt

Over the past 3 months, margin debt as a percentage of stocks’ market cap has averaged only 1.88%, the lowest in more than a decade.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.