Gold Is Holding Up While Miners Struggle

When gold tries to change its long-term trend, it usually struggles, as we discussed in May. Its sensitivity to economic surprises and interest rates also didn't help the outlook.

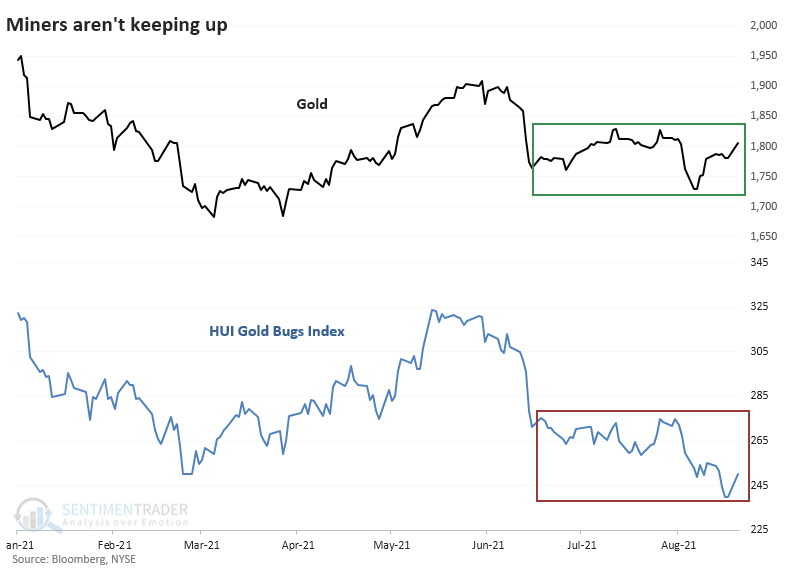

After a June plunge, though, gold has been treading water until recently. After a good week, gold is now trading in the upper end of its 2-month range. Gold mining stocks, however, are struggling.

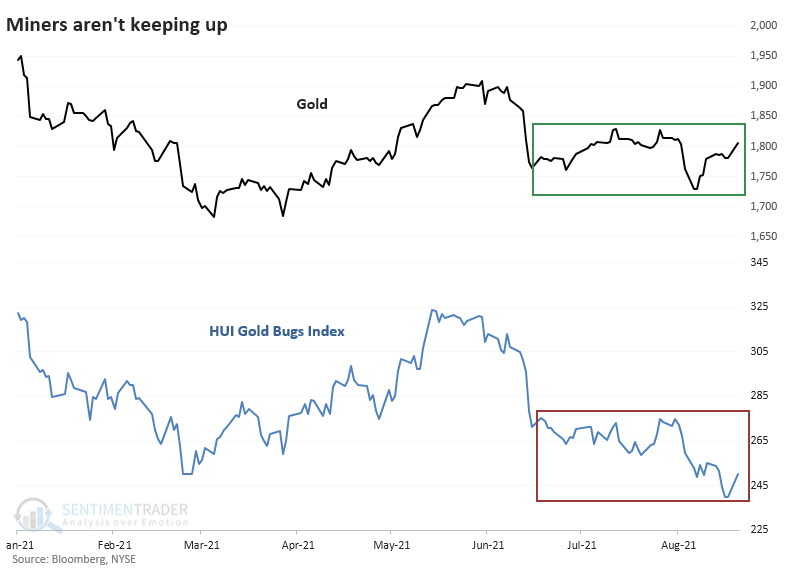

Looking at each of them relative to their ranges of the past 2 months, we can see how stark this divergence is.

NOT A GREAT SIGN FOR MINERS

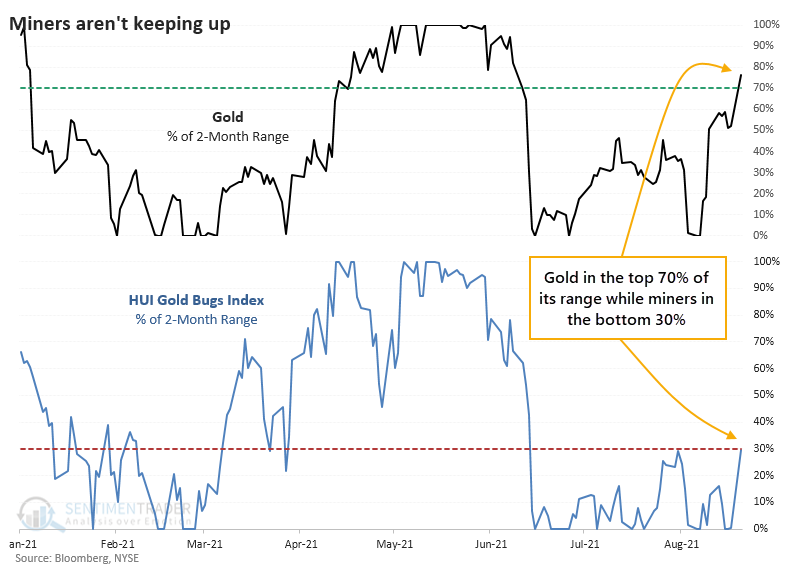

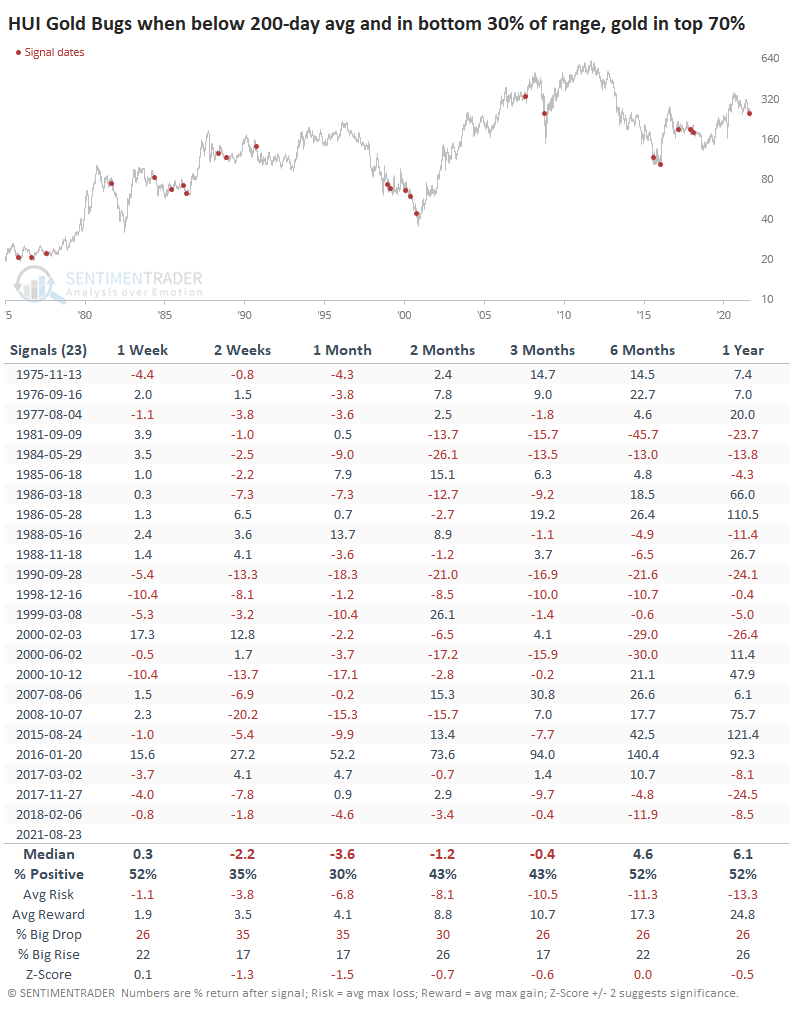

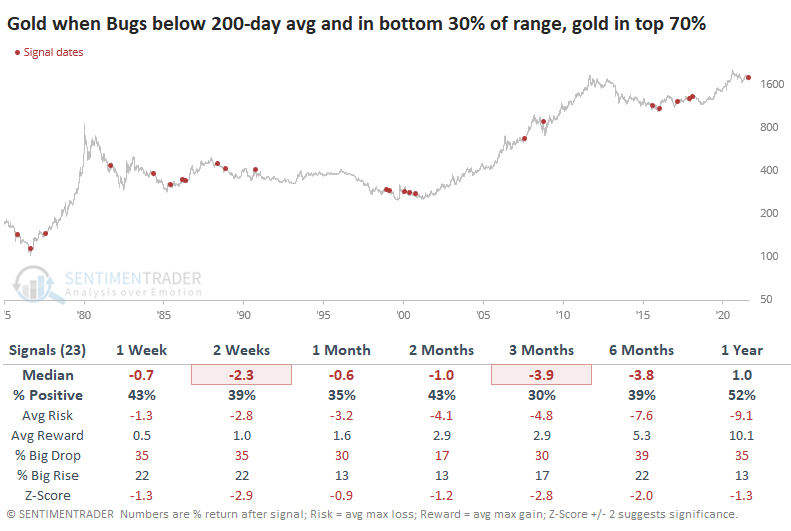

When mining stocks were in a downtrend at the time, this was not a good sign. The table below shows returns in the HUI Gold Bugs index when there were similar divergences between the price of gold and miners. This only includes signals when the Gold Bugs index was trading below its 200-day moving average.

Medium-term returns for miners were weak. Consistency was very poor, and the risk/reward was either skewed toward risk or was evenly matched at best. That's not the best setup for gold bugs.

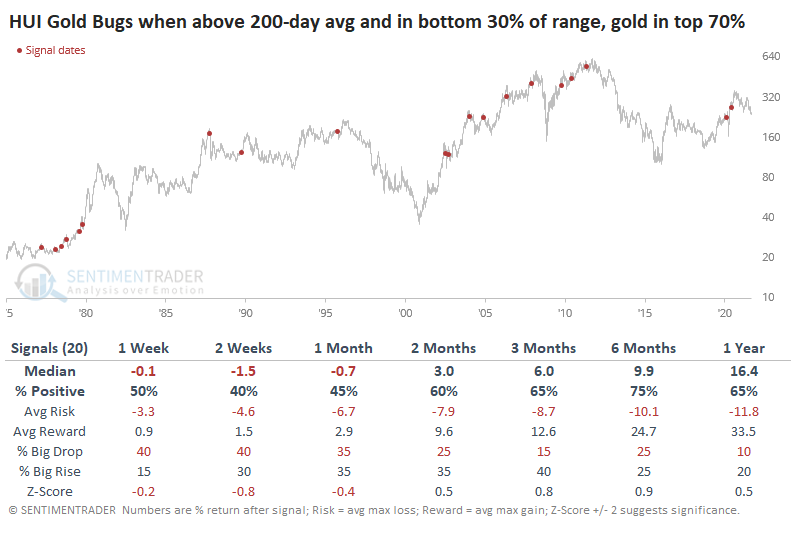

If miners were in an uptrend at the time of these signals, it was better for medium- to long-term returns.

NOT GREAT FOR GOLD, EITHER

While there is a high positive correlation between the price of gold and the performance of gold mining stocks, it's not perfect. So, we might think that if gold is doing relatively better than miners, it was a good sign for gold going forward. 'Twas not to be.

Across all time frames, gold performed worse than during random periods. Relative strength in gold didn't translate into stronger returns.

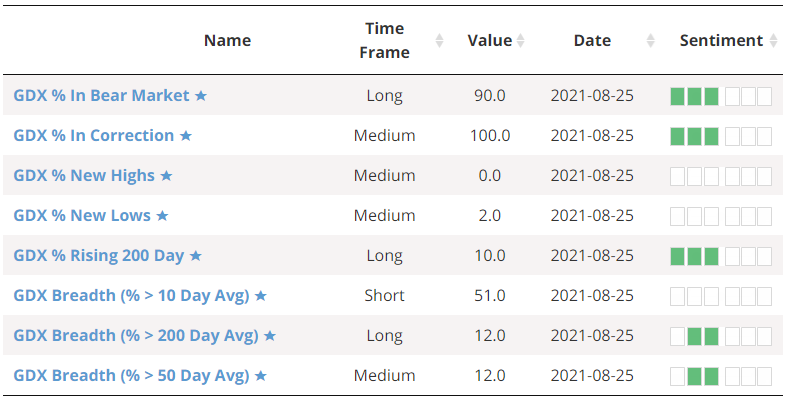

Weakness over the past few weeks, in particular, has meant that some of the breadth metrics among miners are starting to reach oversold levels.

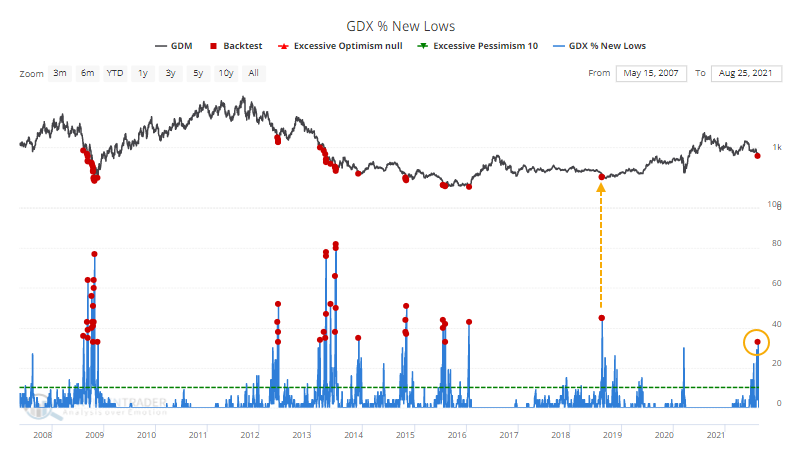

On August 19, more than a third of mining stocks fell to a 52-week low, the most in 3 years. It triggered right at the bottom in 2018. It's a high number for a medium-term washout but is well under the 50% or higher figure we see during long-term panics.

Since May, we've struggled to find much that has consistently preceded strong positive returns in gold or miners. That's still the case. There are some modest extremes among miner breadth metrics, maybe even enough to expect a multi-week or longer bounce. There just isn't enough consistency among what we've been watching to suggest that it's a high probability setup.