Gold Concerns Help Fuel Possible Intraday Reversal

Traders have been watching the precious metals markets with a wary eye in recent weeks Most traders focus on gold as opposed to silver, so let's look at a few of the factors that have been worrying those betting on a further rally:

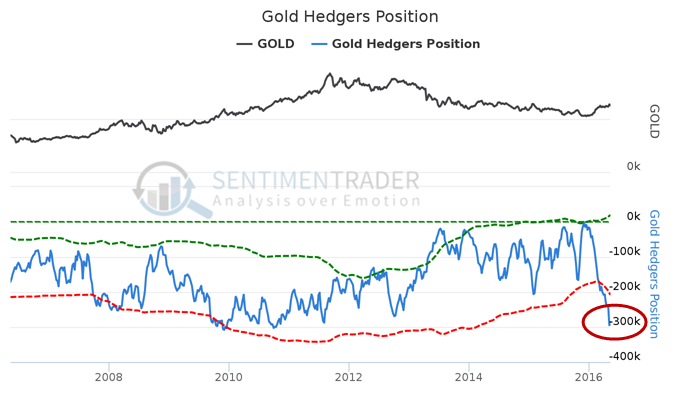

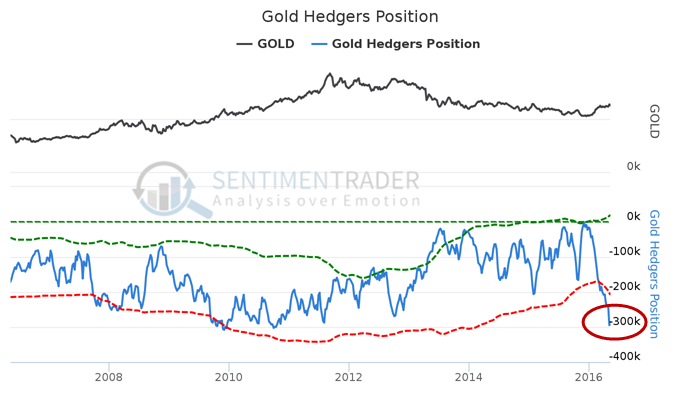

1."Smart money" hedgers are holding extreme short positions against gold, nearly to a record degree.

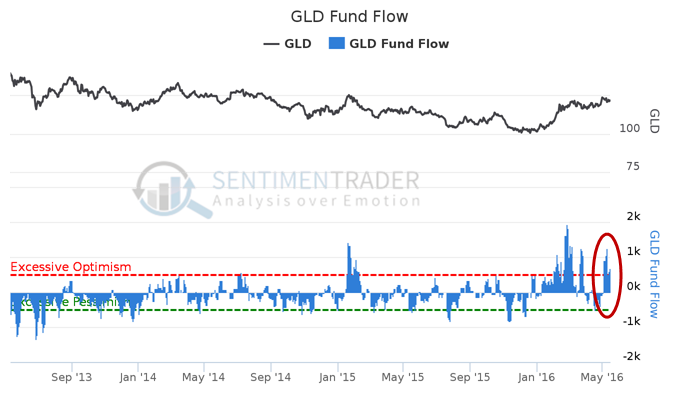

2. Speculators take the opposite side of those hedger positions, which means that fast-money traders are net long the metal to a huge degree. That has helped to drive money into the GLD exchange-traded fund.

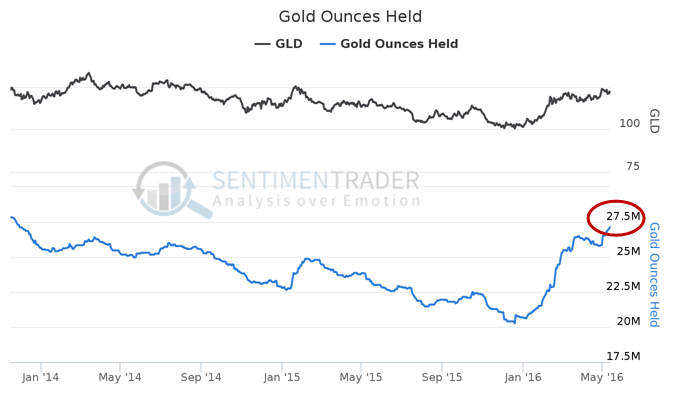

3. Assets in the fund are now the highest in years.

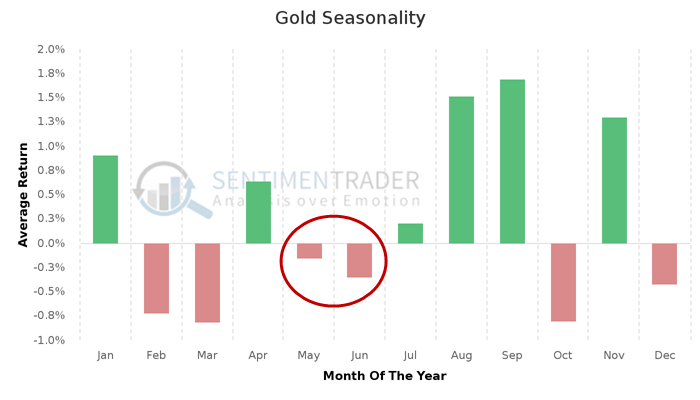

4. Just as precious metals near a traditionally soft spot in the calendar.

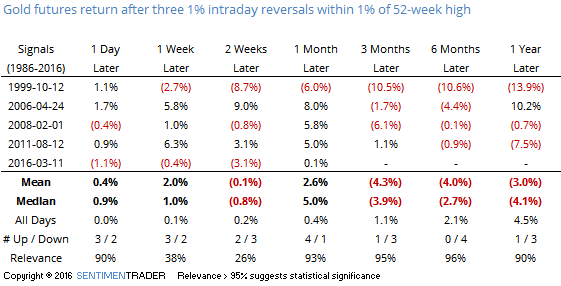

5. Perhaps due in part to those concerns, gold is in danger of reversing from a 1% intraday gain yet again. If it closes lower today, it would be the 3rd time it suffered a 1% intraday reversal from within 1% of a 52-week high in the past month. Other clusters of intraday reversals have led to poor medium- to long-term returns in the past 30 years.

For those looking to establish positions in the metals, it's a high-risk time, especially if we see yet another reversal today.