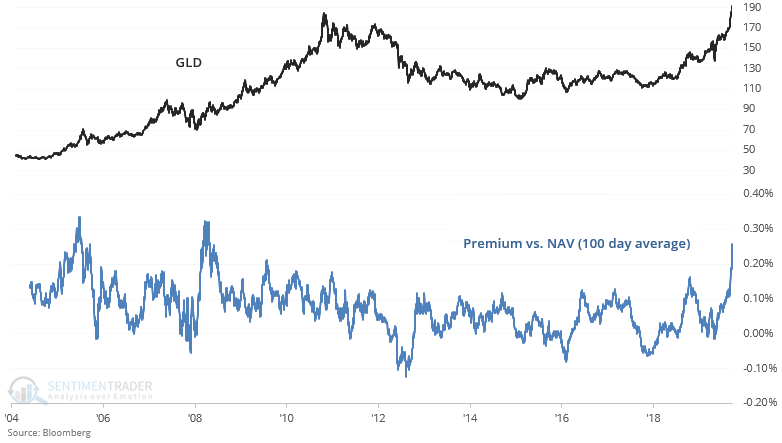

Gold bugs push their biggest ETF above what it's worth

As The Market Ear noted, GLD and SLV are trading at a significant premium to net asset value. This is to be expected given investors' and traders' headlong rush towards precious metals.

Looking at a longer-term version of this indicator, GLD premium to Net Asset Value (NAV)'s 100-day average is at the 3rd highest level of all time. The last 2 spikes occurred during the previous 2 precious metals bull markets:

Those 2 historical cases saw gold climb further in the short term (animal spirits!) before a multi-month pullback/correction began.

The annualized return for GLD is actually higher when the premium is above .15% than it is when the fund is trading at a persistent discount. While some of the extremes in premium/discount preceded peaks/troughs in gold, respectively, trying to identify those peaks/troughs in real-time proved inconsistent.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- The silver ETF, SLV, is at an extreme premium to its net asset value, too

- We keep seeing odd breadth readings in big up days in the S&P 500

- Gold and silver are nearing a near-historic extreme above their short-, medium- and long-term moving averages

- The VIX term structure is hitting new lows for this move

- The Nasdaq has been extremely volatile, what that's meant before