Gold breaks from its main driver

Last week, we saw that gold was breaking away from other safe-haven assets, suggesting "something" was driving its price higher.

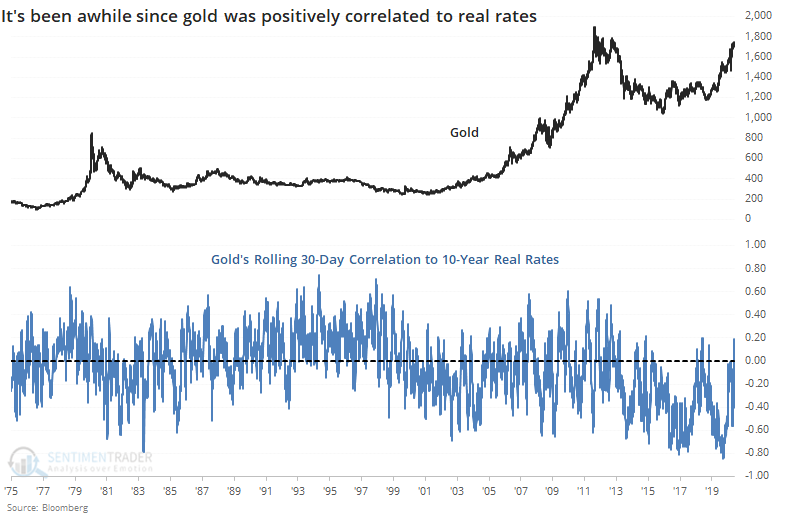

The metal now has a high positive correlation to speculative assets like bitcoin (aka "new gold") while its traditional relationships are breaking down. One of the most fundamental of those is its negative correlation with real interest rates.

The thinking goes that since gold doesn't pay its owners anything, any yield-bearing investment competes for investors' dollars. The more those investments pay their owners in interest, the more competition they provide, to the detriment of gold. Now, interest rates are at or below zero when accounting for inflation, so it makes sense that gold has taken off.

The thing is, gold is rising quickly even though real rates haven't tumbled as much. Over the past 30 days, the correlation between daily changes in gold vs real rates has actually turned positive. That's been an extremely rare scenario over the past 7 years, though since it's a short time frame, there have been other periods when the two were periodically in sync.

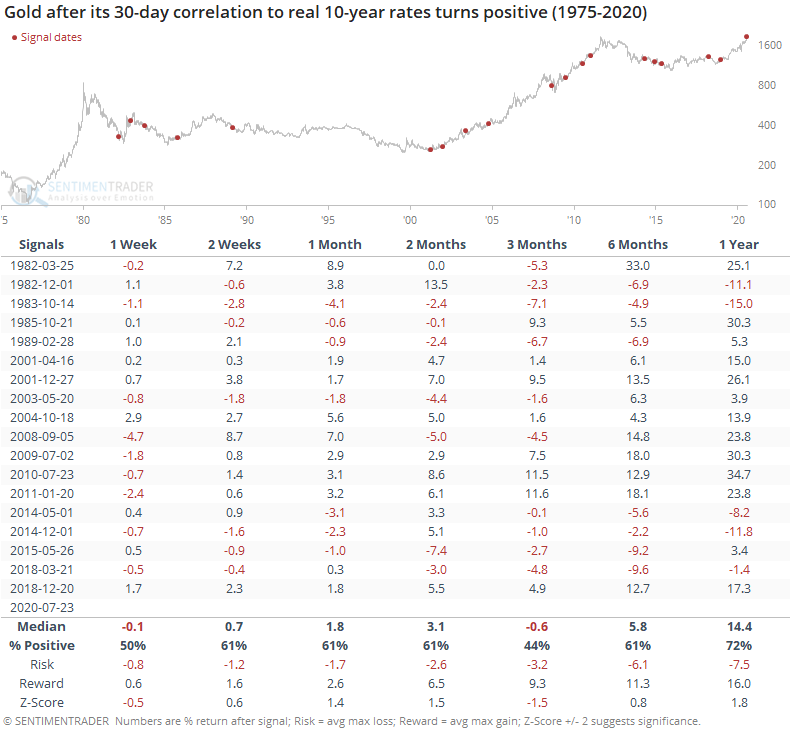

As for what it might mean, the table below shows every time the correlation between gold and real interest rates was negative for at least 90 days, then turned positive.

While these could all be signs that "something" was driving the price of gold other than its fundamental value as a competitive investment, it wasn't necessarily a sign that speculators would continue to drive it higher. Over the next three months, it actually showed a negative median return, though the risk/reward was still solidly positive, mostly thanks to the 2000s.