Global Relative Trend Underperformance

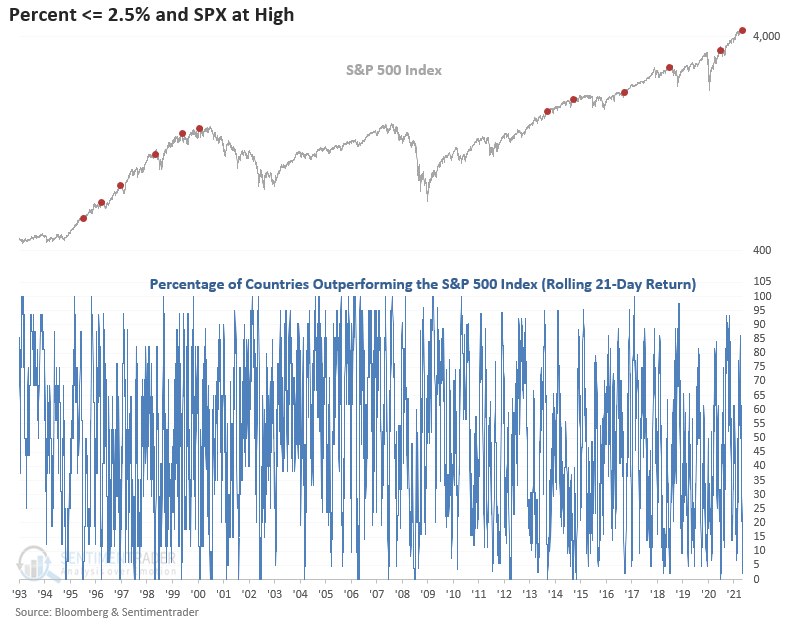

In a note last week, I highlighted that the percentage of S&P 500 members outperforming the index on a rolling 21-day basis had fallen to a historically low level of 30%. When I apply the same analysis to the 44 countries that I monitor in my weekly absolute and relative trend update, the underperformance trends are even more substantial. According to my calculation, only 2.27% of the ETFs outperform the S&P 500 on a rolling 21-day basis as of 7/2/21. I would also note that the weak global relative trends occur as the S&P 500 is trading at an all-time high.

Let's conduct a study to assess the forward return outlook for domestic and global indexes when 2.5% or fewer countries outperform the S&P 500 index on a rolling 21-day basis as the S&P 500 simultaneously closes at a 252-day high.

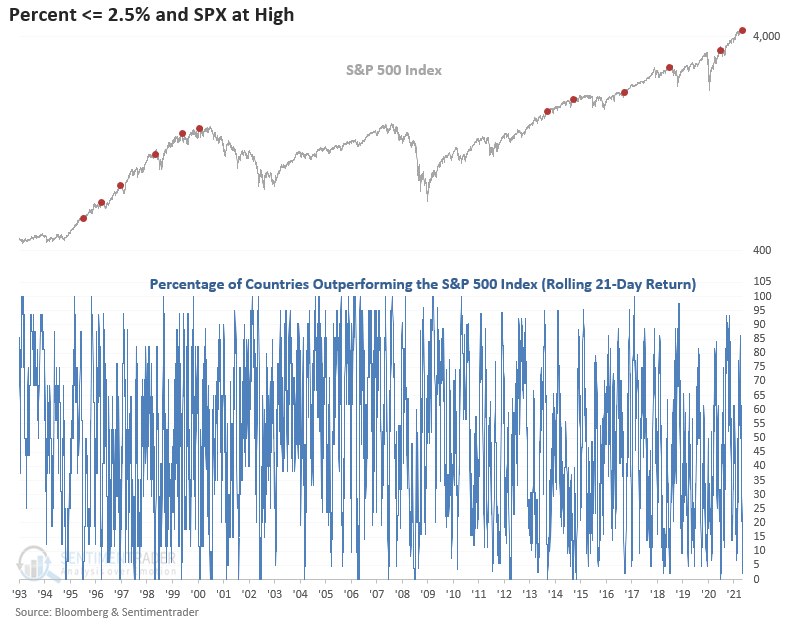

HISTORICAL CHARTS

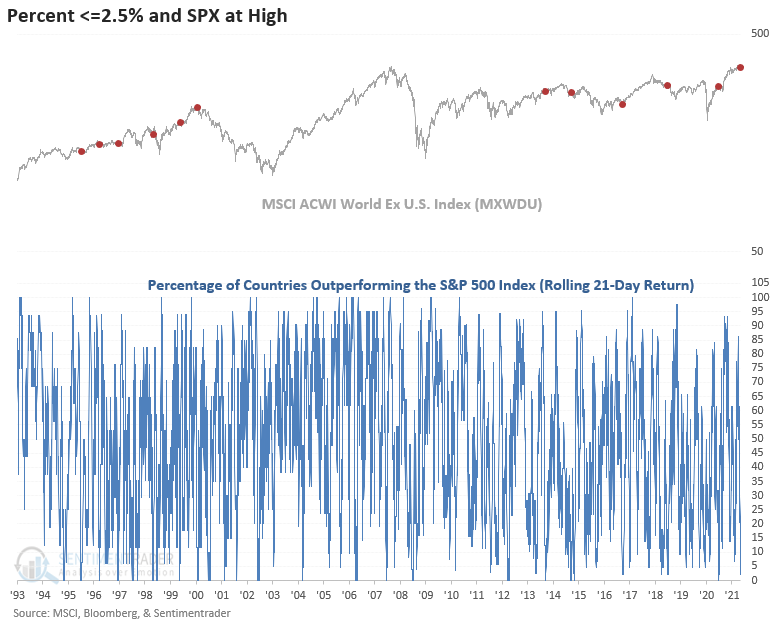

HOW THE SIGNALS PERFORMED - S&P 500

The 2-month timeframe is notably weak, with a risk/reward profile that is troubling. However, the 6-12 month timeframes suggest that the severe underperformance is more than likely to indicate a corrective phase in an ongoing bull market.

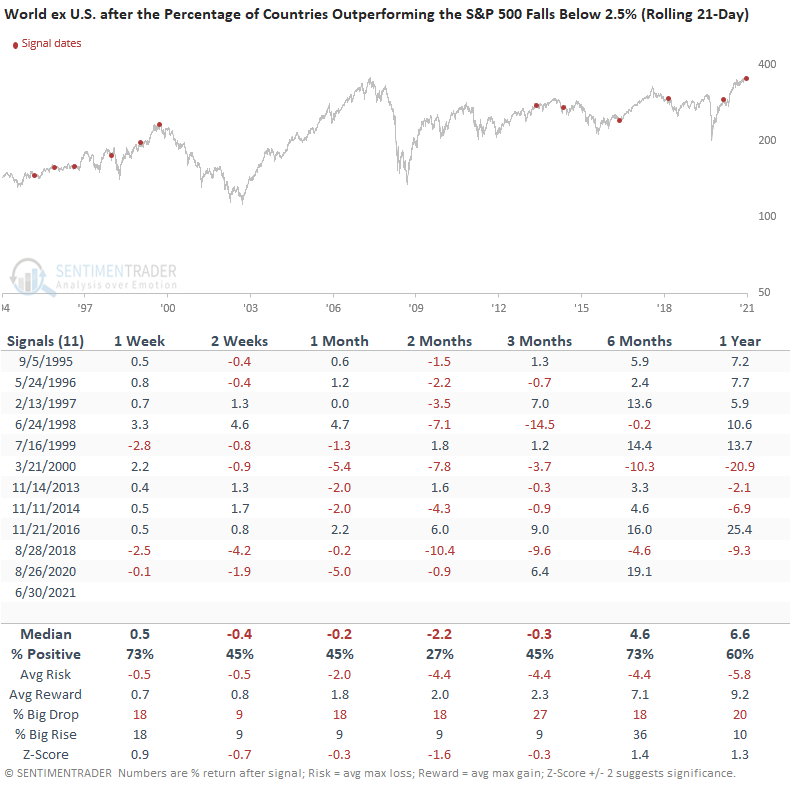

HOW THE SIGNALS PERFORMED - WORLD EX U.S.

The 2-13 week performance looks weak, and I would note that the 6-12 months results, while healthy, don't look as good as the S&P 500.

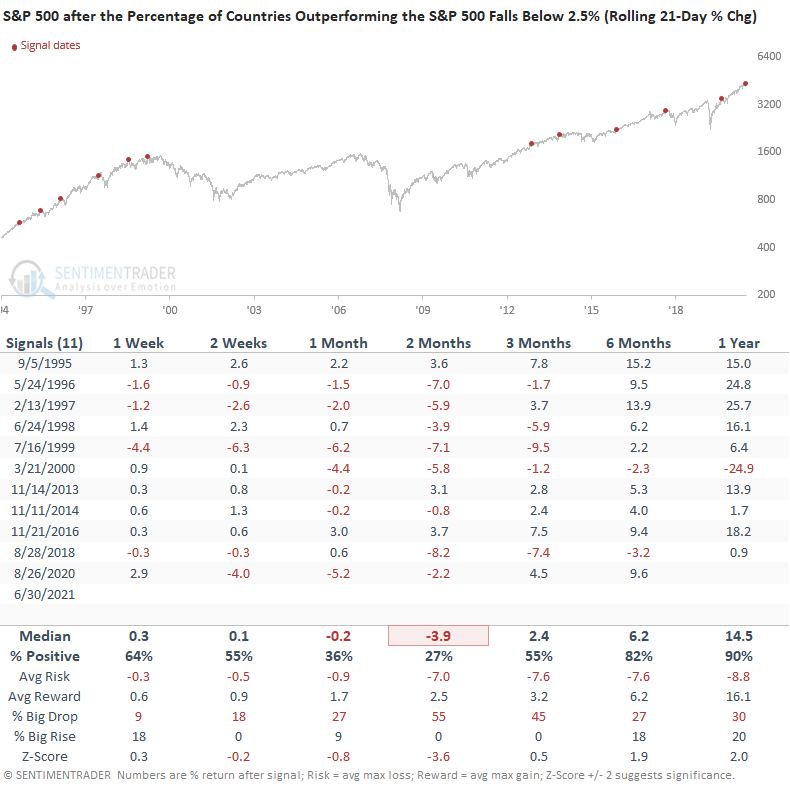

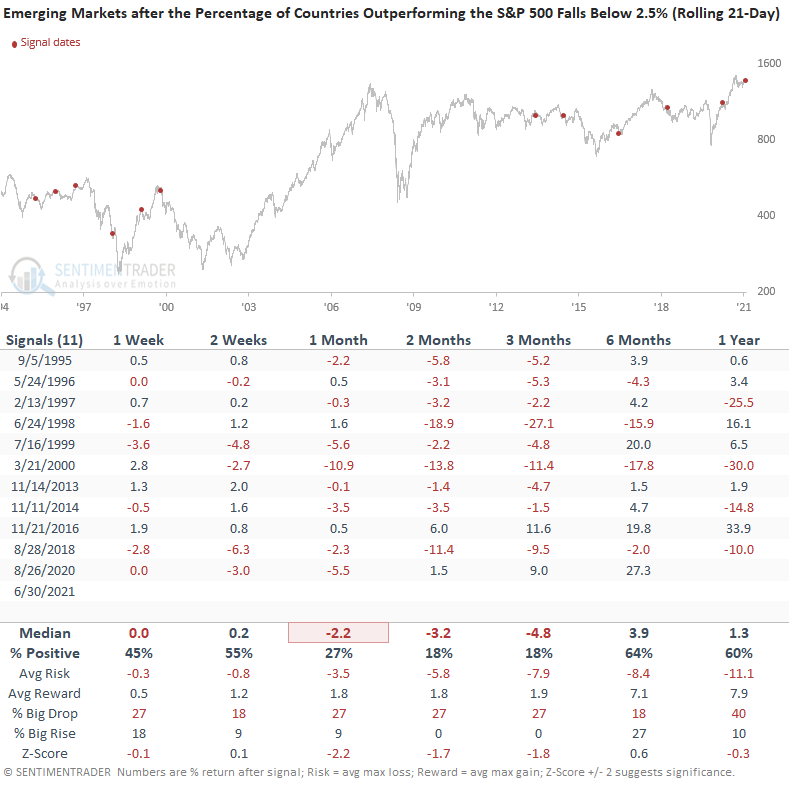

HOW THE SIGNALS PERFORMED - EMERGING MARKETS

Emerging market results look weak across almost all timeframes.

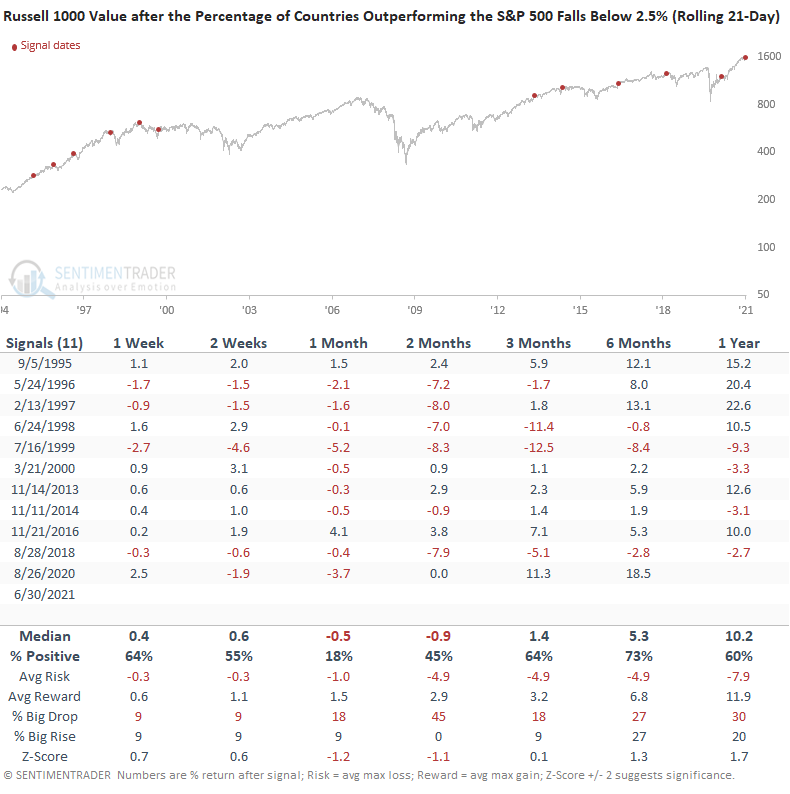

HOW THE SIGNALS PERFORMED - VALUE

The value results look weak in the short to intermediate term, especially the 1-month timeframe. The 6-12 month window looks okay. I would note that the overall return pattern for domestic value looks similar to the world ex U.S.

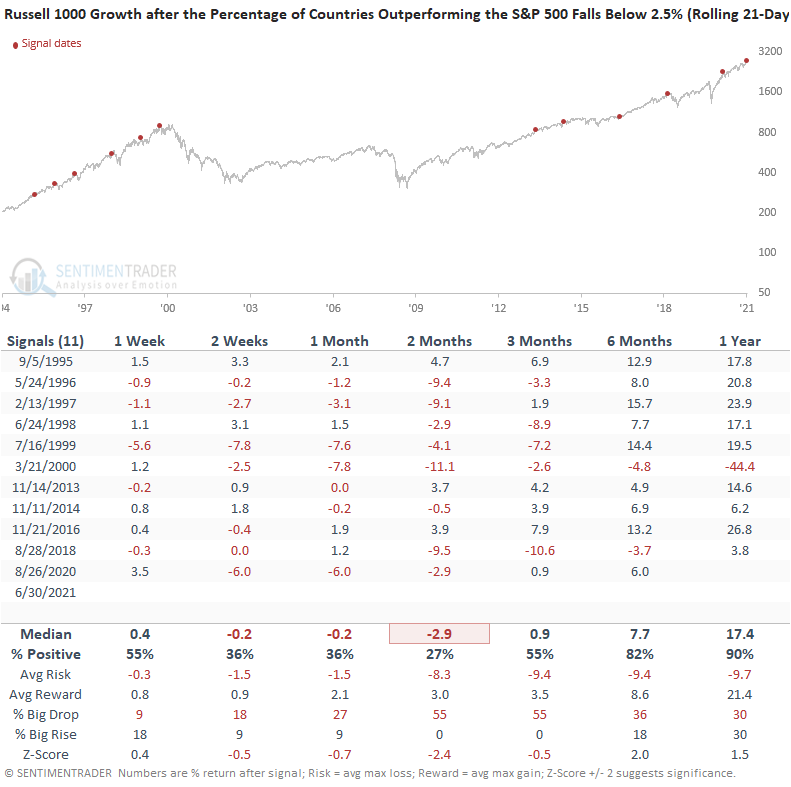

HOW THE SIGNALS PERFORMED - GROWTH

The performance profile for growth stocks looks similar to the other indexes with weak results on a short to intermediate-term basis. However, the 6-12 month timeframe looks significantly better.

Interestingly, not a single instance occurred during the 2002-07 value cycle. The severe country underperformance appears to be a signal that occurs during growth-oriented style regimes.

Usually, I would be a little more concerned about the near-term outlook for stocks, given the weak results. However, the market has chosen to ignore short-term measurements like this and others we have shared in recent notes. For now, the market is telling us that trend and long-term breadth measurements are what matter the most.