Global Momentum Spurs Melt Up Chatter

This is an abridged version of our Daily Report.

Global synchronized momentum

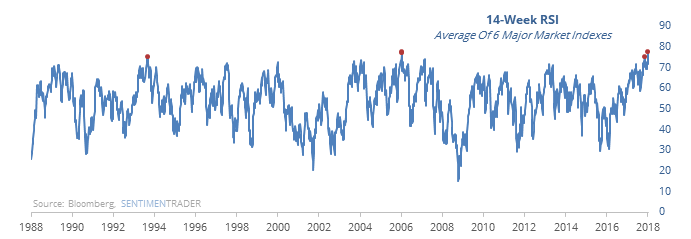

Most major stock markets are not only rallying, they’re showing extreme momentum. The weekly Relative Strength Index across 6 major global indexes is now the highest in history.

High readings in that indicator suggest overbought conditions, but extremely high readings suggest momentum. Other times it hit an extremely high level, markets did well, especially the MSCI World Index.

It’ll never go down

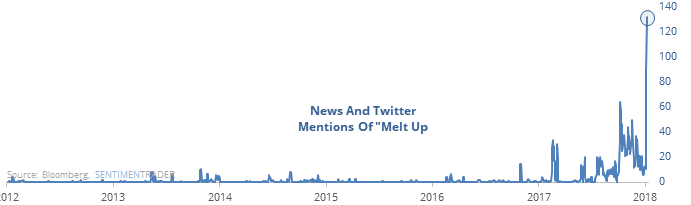

Over the past few days, there has been a jump in presidential celebration about the stock market. There has also been skyrocketing interest from the pubic about the potential for a melt up.

The only time that we’ve seen a spike in both displays of supreme confidence was mid-October last year. It’s hard to blame them, as the S&P has managed 5 consecutive all-time highs for the first time since October.

More bandwagon-jumping

In late December, we noted that Wall Street analysts were busying upgrading the price targets of the S&P 500 stocks they cover.

Volatility buyers

The Total Put/Call Ratio dropped to a low level on Monday, thanks to heavy trading in call options on the VIX. The ratio for the VIX dropped below 0.10 for one of the lowest readings in years.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.