Global Indexes are breaking down on a relative basis

Key points:

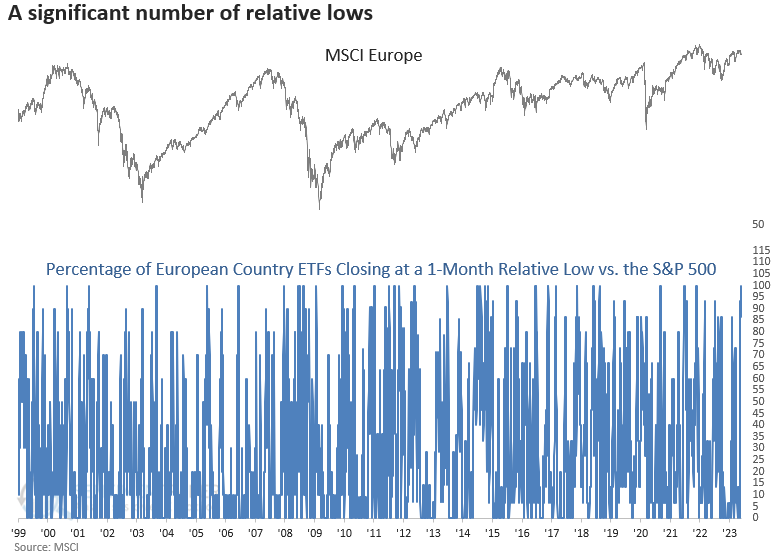

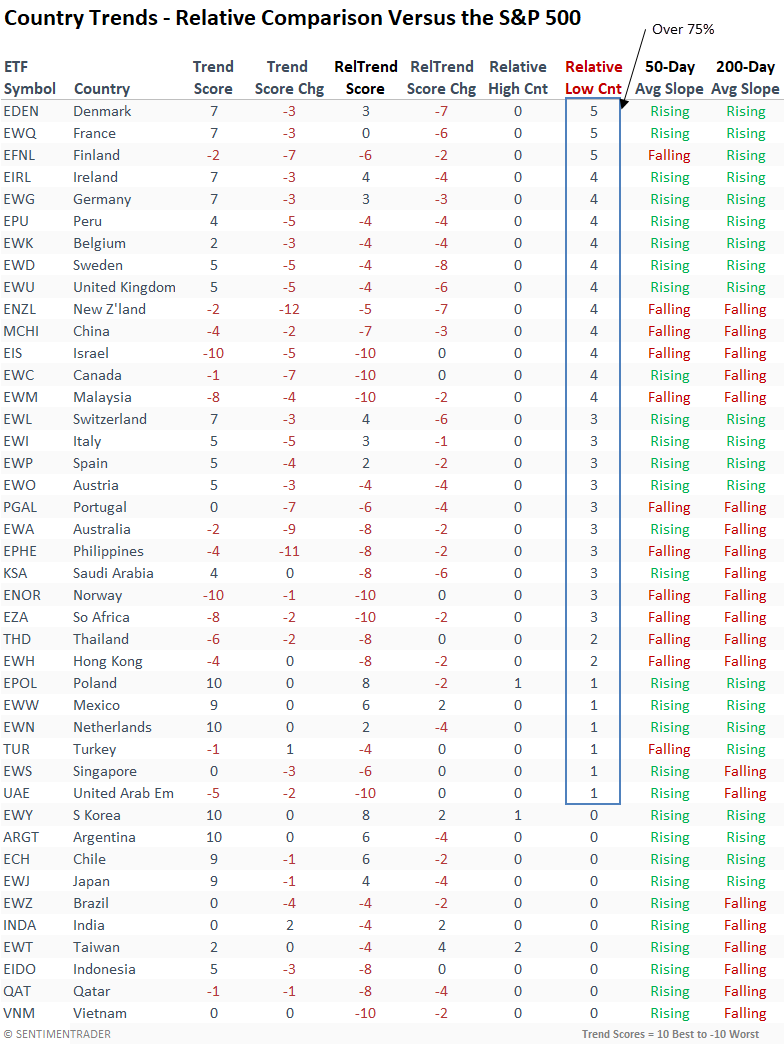

- Every European country ETF closed at a 1-month relative low versus the S&P 500

- Similar comparative breakdowns led to a near-term bounce that eventually failed

- Across the globe, relative lows have surged to a level that suggests unfavorable returns

Global index trends are starting to deteriorate, especially in Europe

The current crowding into mega-cap growth-oriented stocks has made almost everything look unfavorable compared to the S&P 500, including global indexes, which hold a larger weighting in value-oriented stocks.

Europe, one of the more favorable regions around the globe, shows signs of fatigue.

On Tuesday, every European country ETF closed at a 1-month relative low versus the S&P 500. The surge in relative lows occurred with the MSCI Europe Index down less than 5% from a multi-month high.

The previous surge in relative lows near a high occurred in November 2021, which was an ominous sign.

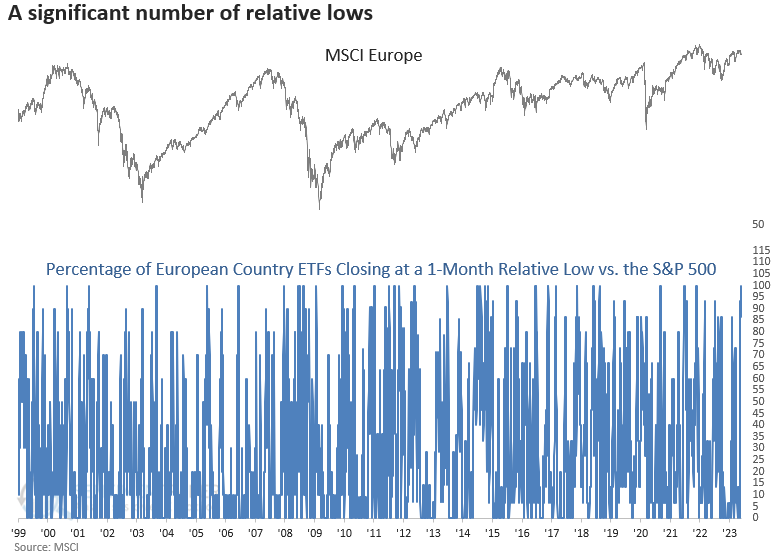

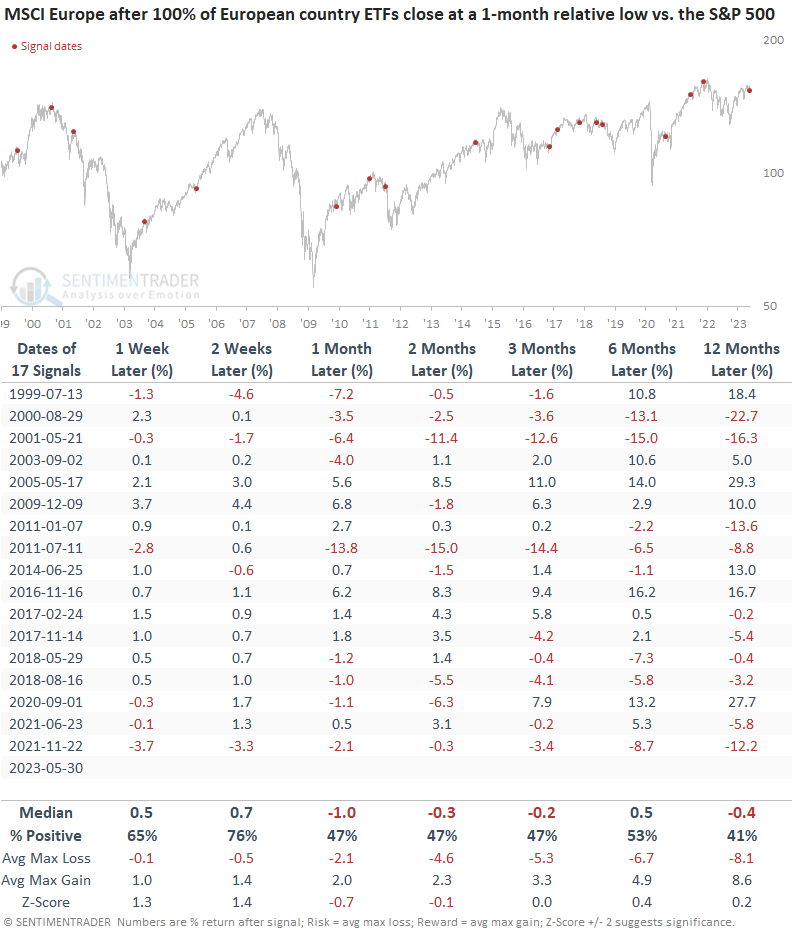

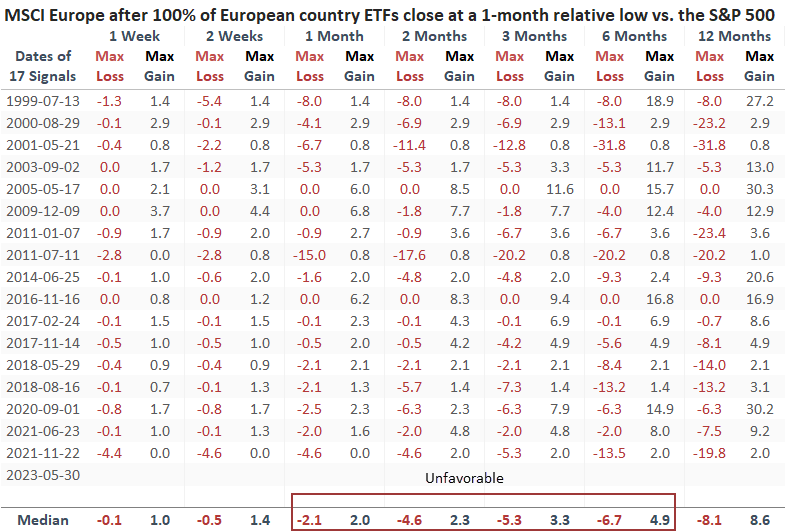

Similar comparative breakdowns led to a bounce that typically failed

When every European country ETF registers a 1-month relative low versus the S&P 500 near a high, the MSCI Europe Index tends to bounce soon. However, after a few weeks, the rally falters, with negative returns over the next one to three months. Even a year later, results are not exactly encouraging.

The median max loss exceeds the median max gain from one to six months later. And a year later, it's barely favorable.

Almost everything is breaking down relative to the S&P 500

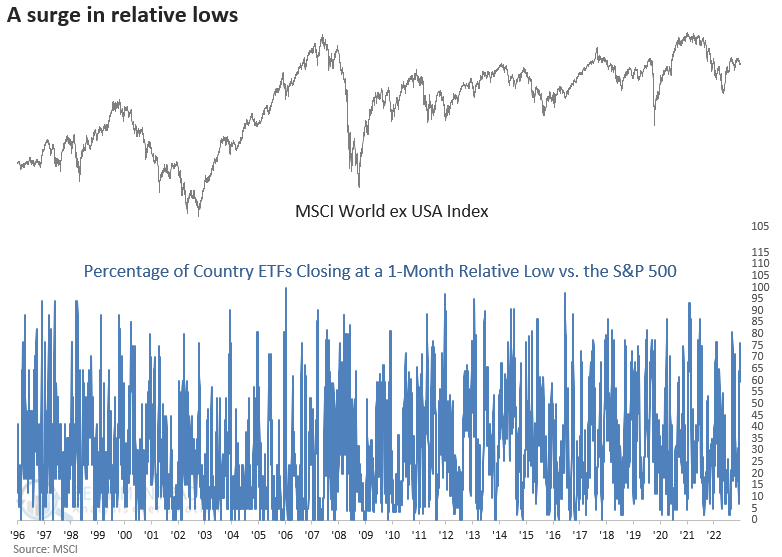

The relative breakdown versus the S&P 500 is a global phenomenon, with over 75% of countries registering a 1-month relative low. And in most cases, a cluster of lows has been triggered over the last five sessions.

Some countries we highlighted recently with bullish trends, like Japan and Brazil, have not broken down on a relative basis.

More than 75% of country ETFs closed at a 1-month relative low, with the MSCI World ex USA Index within 5% of a multi-month high.

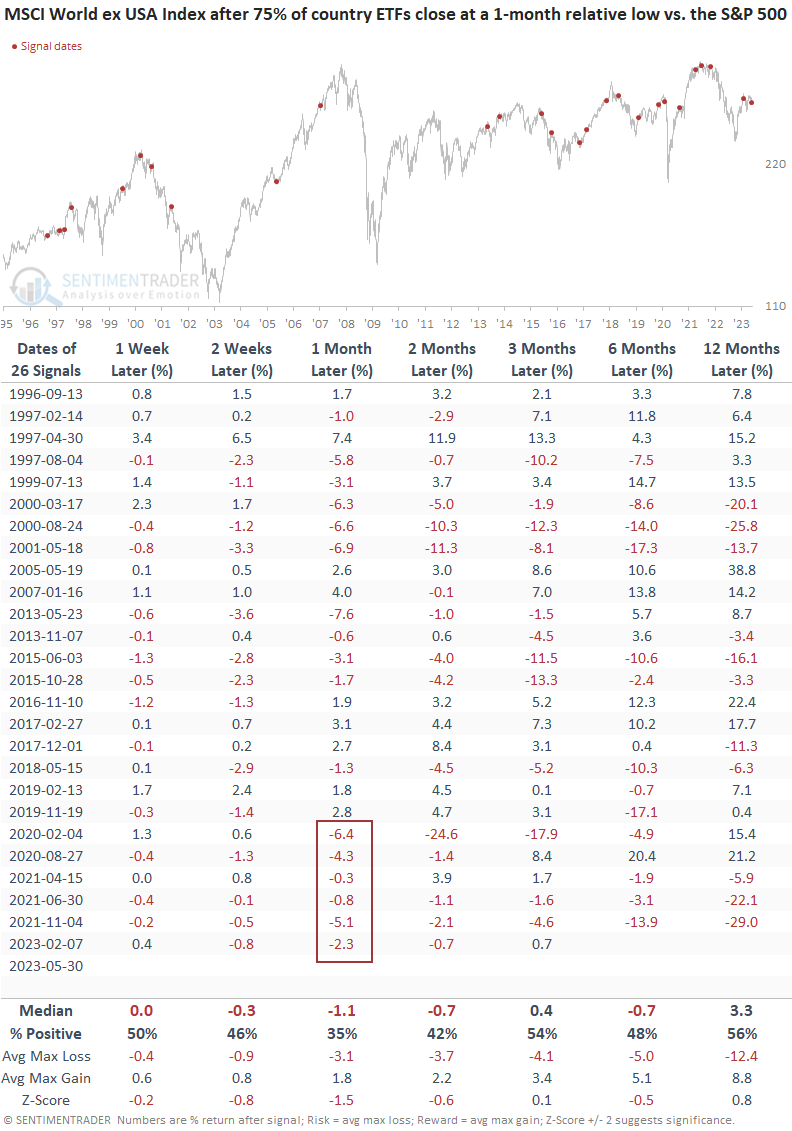

Similar relative low surges led to mostly negative returns

The severe relative breakdown for country ETFs near a high does not bode well for the MSCI World ex USA Index over the next six months. Unlike Europe, the odds of a short-term relief rally don't look good. A month later, the global index was lower 65% of the time.

What the research tells us...

With meg-cap growth-oriented stocks, which dominate the weightings in the S&P 500 significantly outperforming the average stock, it's not surprising to see global indexes, which lean toward value, break down on a comparative basis. However, the magnitude of relative underperformance is so severe that it typically leads to unfavorable absolute returns. After similar surges in comparative lows, global indexes could struggle over the next one to six months.