Getting Out When Averages Cross

Basic, long-term trend-following systems have become all the rage. Backtested results show that owning stocks, or almost any other asset class, when they are above a long-term moving average (such as 10 or 12 months), and not owning them when below the average, is superior on a risk-adjusted basis to simply buying and holding those assets.

Unfortunately for adherents, when a simple strategy gains popularity, triggering assets in ETFs dedicated to the strategy, it's usually bound to stop working like it did in the past.

Another one that has been making the rounds is that when the 10-month moving average of the S&P has fallen below the 20-month, it preceded the worst losses of the last two bear markets, as published by MarketWatch.

We often discuss how various behavioral biases impact sentiment, and recency bias, or fighting the last battle, is among the most nefarious. Most of those managing investments today lived through at least the last bear market, and usually the last two. That's what has imprinted, and that's what they measure patterns against. Those time periods are also historical outliers that are unlikely to repeat in a similar fashion in the near future.

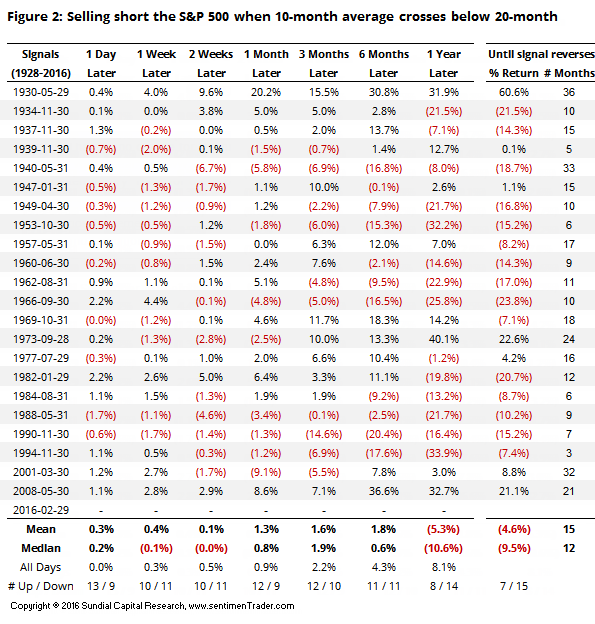

But that's just opinion. Let's look at the facts. Here is how we would have done if we sold short the S&P 500 when the 10-month average crossed below the 20-month average. Note that this is being generous, because it's assuming that we were watching the market on the last day of the month and sold when it looked apparent that the averages would cross.

Remember, these are results from selling short, so a positive return means that stocks declined, and a negative return means that stocks rallied.

As bears are eager to point out, it did great in 2008. Selling short would have been a wonderful strategy. That wasn't so much the case in 2001, as we would have lost nearly 10% when stocks rallied over the next month. Would we have been able to stick with our short position at the time?

This strategy also did well in 1930 and a few times when markets underwent wide swings around the 1970s. That's assuming we knew when to get out, however. If we had waited until the signal reversed (when the 10-month average crossed above the 20-month average), then we would have taken a loss on our short position 15 out of 22 times, holding the trades for an average of 12 months.

In any time frame, does it make sense for a typical long-oriented investor to worry about this signal? Perhaps over the next 1- to 3-months. Then, the short position showed a gain 12 times and actually sported a positive return (meaning stocks declined). But when it didn't work and stocks rallied, they rallied hard seven times, which would be tough to stomach if one is sitting in cash waiting for this signal to play out.