Getting KOLDer

Key Points

- This is a follow up to an earlier piece

- Natural gas is in a seasonally unfavorable period

- Natural gas also appears to be breaking down technically

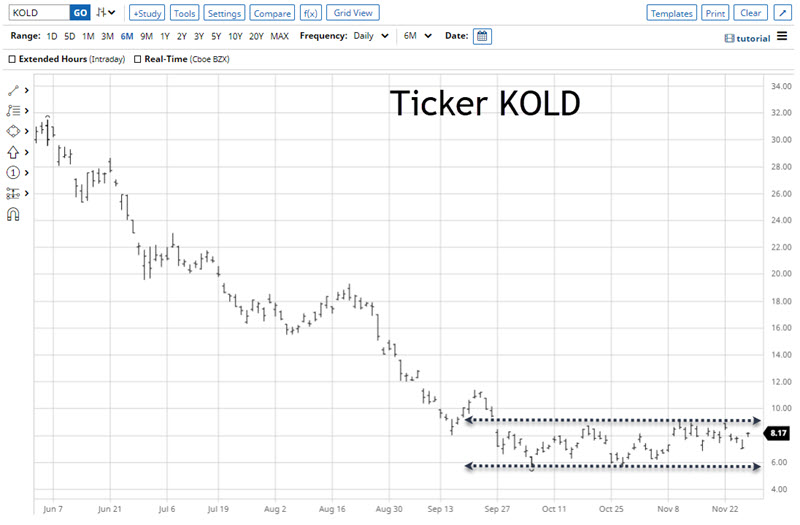

- KOLD, a leveraged inverse ETF that tracks natural gas futures, gives speculators the potential to profit from a decline

The state of natural gas

The chart below displays January 2022 natural gas futures. Note at the far-right that price is attempting to break below a previous support level. There is no guarantee that this breakdown will follow through to the downside. But if it does, the decline could be significant.

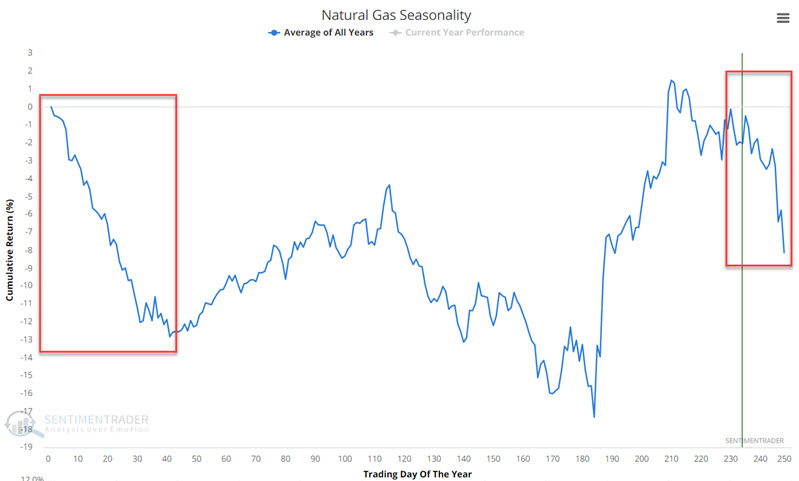

An unfavorable seasonal period

What makes the breakdown highlighted above especially worrisome is that it is occurring during a period when natural gas often shows significant weakness.

The chart below displays the annual seasonal trend for natural gas futures. Between trading day of the year (TDY) #230 and TDY #31 of the following year is often a period of price weakness - from early November into mid-to-late February.

The combination of a negative seasonal trend and a breakdown in price in the direction of the seasonal trend offers speculators a potential opportunity. One of the most straightforward ways to play this opportunity is buying shares of KOLD, a 3x leveraged inverse ETF that tracks natural gas futures. In other words, if natural gas declines -1% today, KOLD should advance roughly +3%.

The fund has been stuck in a range since September, even though gas prices have dropped. Thus the difficulty in trading leveraged funds.

In the days immediately following the original article, KOLD plummeted over -17% before rallying +15% on Monday and another +13% on Tuesday morning. Triple-leveraged ETFs are among the riskiest and most volatile trading vehicles available and are not for everyone. At the very least, it is essential to take steps to limit risk when trading them.

A few thoughts on speculation

There is a difference between "investment" and "speculation." Speculation involves significant risk of immediate loss. As a result, the keys to successful speculation are appropriate positing sizing and decisive risk management.

As a point of reference, my personal opinion is that a trader buying shares of KOLD should commit no more than 1% to 5% of their total trading capital. A trade such as this should never be viewed as a get-rich-quick play. One advantage with KOLD is that the shares trade at a relatively low price (in the $9.30 range), so even a speculator with a relatively small account could play.

Consider a trader with a $25,000 trading account. If they are willing to commit 5%, that means they could buy $1,250 worth of KOLD shares. At $9.30 a share, that works out to roughly 130 shares. This is a large enough position to make some money if KOLD does, in fact, rise. At the same time, if KOLD were to decline below its recent low of $5.66 a share, the trader would lose roughly -1.9% of their trading capital:

- Buy 130 shares at $9.30

- Sell 130 shares at $5.60

- Net $ loss = -$3.70 x 130 shares = -$481

- Net % loss = -$390 / $25,000 = -1.9%

On the upside, let's consider an optimistic scenario whereby KOLD rallies back to its August 2021 high of $19.30 a share.

- Buy 130 shares at $9.30

- Sell 130 shares at $19.30

- Net $ gain = $10.00 x 130 shares = +$1,300

- Net % gain = +$1,665 / $25,000 = +5.2%

What the research shows…

Natural gas has demonstrated a clear tendency to decline into February. Buying shares of KOLD is an aggressive speculative bet that it follows through on that tendency. When making an aggressive, speculative play, the keys to success are appropriate positing sizing and decisive risk management.