Gaps Indicate Short-Term Panic

In terms of panicky opens, we're now in rare territory.

Since the inception of the S&P 500 futures market in 1982, we have rarely seen such a concentrated period of traders selling so heavily before the open of regular trading. Typically this is seen during instances of worries about market structure (e.g. the flash crash in 2010, Black Monday in 1987) or global financial meltdown.

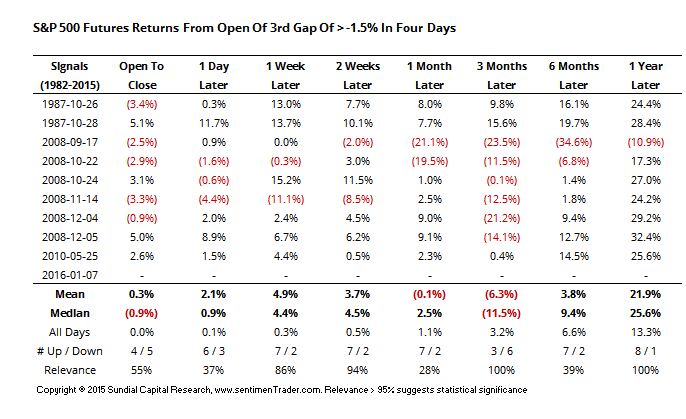

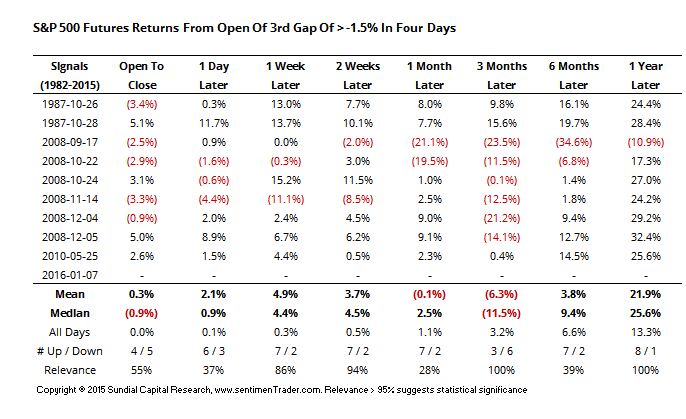

Barring a large recovery into the open, this will be the third opening gap of -1.5% or more in four days. The only times we've seen this kind of opening pressure were during the 1987 crash, the peak of the financial crisis in 2008 and during the flash crash of 2010.

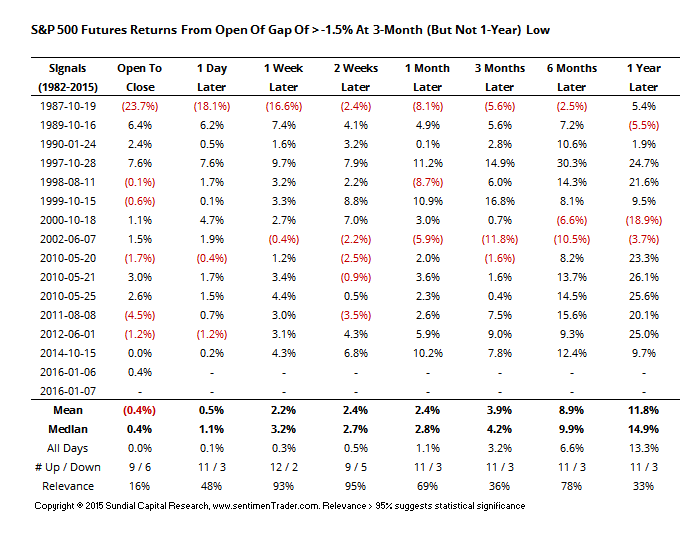

If we just look at gaps of -1.5% or more that occurred at a three-month (but not one-year) low, then we get the following. The only other time we've seen this on back-to-back days or close to it was during the 2010 flash crash.

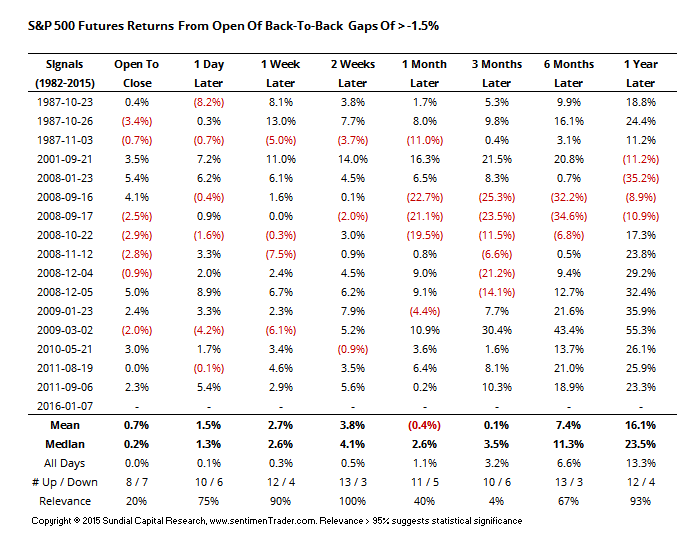

We can also look at times when there were back-to-back gaps of -1.5% or more, as shown below. Mostly the same time periods.

Shorter-term, this is more equivalent to panic conditions that trigger impulse buying and form shorter-term lows, lasting days to weeks. It is not typically the kind of behavior seen at medium-term lows of several months or more.

Most often after periods of extreme volatility like this, there is a period of testing of the panic lows that goes on for months, and which are more likely to generate the kind of pessimistic sentiment readings that we're not seeing yet, because most of the selling pressure has been focused at the open.