Gaps Galore As Another Streak Ends

This is an abridged version of our Daily Report.

Gaps galore

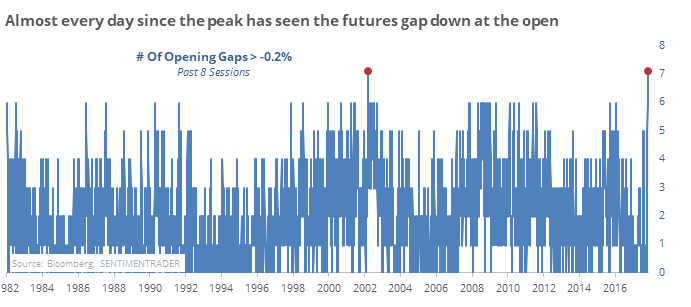

Heading into the peak in January, stock futures were gapping up almost every day. Now, they’ve gapped down at the open almost every day, tied for the most in history over an 8-day span.

Other tight clusters of gap down opens led to positive returns with one major exception.

Another streak gone

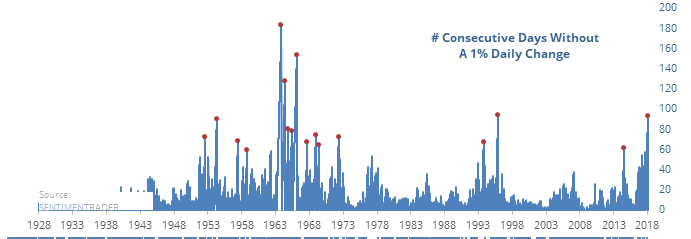

The S&P 500 ended its streak without a 1% daily change almost two weeks ago.

The streak was one of the longest in history, and now we’ve seen 5 moves of more than 1% since the streak ended. That’s the most ever, with only the 1960s seeing a few similar streaks ended with a sudden bout of high volatility.

Futilities

We’ve looked at the Utilities sector a few times over the past several months. In November, it looked like they might turn from utilities to “futilities” after a spike in 52-week highs and a negative reversal. It was another bad sign in December when they sunk down to the 200-day average for the first time in a while, and then again in January when they diverged so negatively from the Industrials...now it's getting so bad it should be good.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.