Gapping Up On Nonfarm Payrolls

Stock futures are indicated to gap open at least 0.5% as the Nonfarm Payroll (NFP) number exceeded estimates, and for the moment, traders are taking that as a good sign. It could change dramatically before the actual open.

We've often discussed in the past how extreme reactions to the NFP number coincide with short-term extremes in stocks, especially when stocks have been at or near a price extreme. A gap of 0.5% or so isn't exactly "extreme" but it's coming on the heels of excellent gains over the past few weeks.

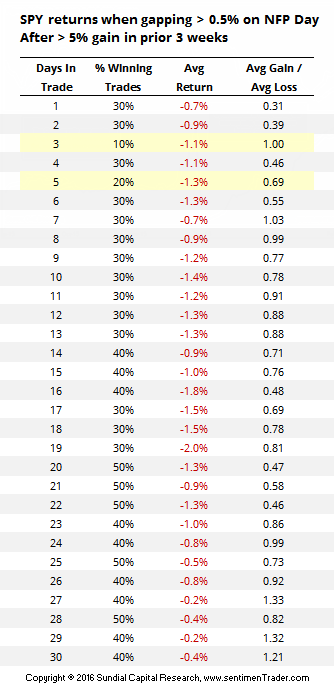

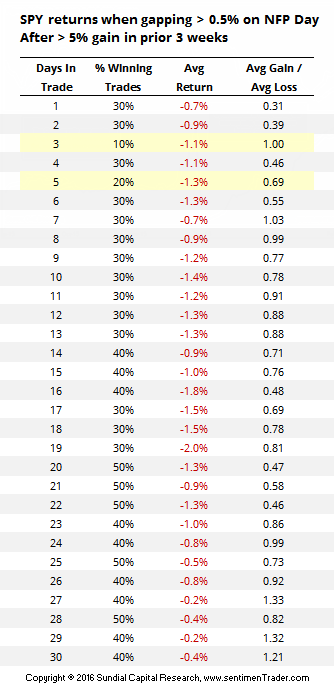

When the S&P 500 fund, SPY, gapped up at least 0.5% on NFP day after already having rallied at least 5% in the prior three weeks, it tended to lead to weakness over the next 3-5 days (buying the open of NFP day):

From Friday's open through the close on Wednesday, 9 out of 10 trades were losers, averaging -1.1%. The sole winner was in March 2011 as stocks were coming out of a decline, and it led to even more gains over the next two months. As we've been harping on in the Daily Report, a market that doesn't do what it should in the short-term typically keeps doing it over the following weeks.

A sample size of 10 is awfully small, so if we adjust the parameters to get more precedents, the overall tendency stays the same. If we require only a 3% rally, then over the next 3 days 14 out of 16 traders were losers. A rally of any size led to 58% losing trades. If we look for a gap up of any size when the S&P was below its 200-day average, then 14 out of 19 trades were losers.

The bottom line is that with a plethora of short-term sentiment extremes, a seasonal soft spot after the first few days of March and typical reactions from gap ups on NFP days, the risk/reward into mid-week next week is tilted to the downside.