Gap To New Low

I mentioned yesterday that I may be out of the office today to join a last-ditch call for the search for Jayme Closs. Having a daughter the same age and growing up in the same area, it hits close to home.

Markets aren't making that easy, with futures indicated to gap down to new lows. For the S&P 500, it would challenge its intraday low from a couple of weeks ago, and exceed its prior closing low.

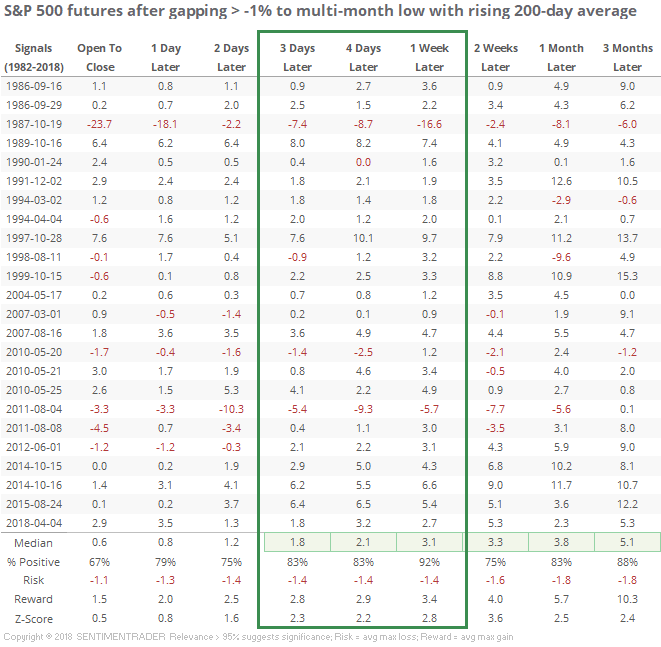

We saw something similar in April, otherwise it's been years. The table below shows every time the S&P gapped down more than -1%, below its prior closing low over the past few months, while its 200-day moving average was still trending higher.

The 3-5 day time frame is compelling. Out of 24 signals, only 2 showed a negative return from the open through a week later. Unfortunately, one of those was Black Monday and the other, in August 2011, also led to bad losses that weren't made up until three months later.

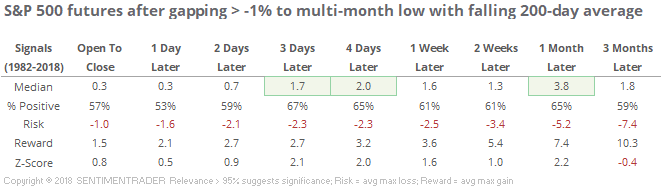

The trend filter made quite a bit of difference. If the 200-day average was declining as stocks were gapping down, the tendency to bounce was less pronounced.

Out of 49 signals, 33 of them bounced over the next few days, but the risk/reward was less positive and it was just generally less attractive as a setup, which makes sense.

If buyers step in before the open, it would lessen the tendency for the bounce to last, so unless we're headed into a really ugly period of intense selling pressure, a large gap down should ultimately bring in buyers in the day(s) ahead.