Gap Opens On Nonfarm Payroll Day

With a (mostly) better-than-expected Nonfarm Payroll (NFP) report, stock futures spiked higher and are estimated to open about 0.4% higher than yesterday's close.

We noted yesterday that the NFP report has a habit of occurring near market inflection points when stock prices are at/near a price extreme. Whether that's due to the report itself or simple seasonality since it is released several days into a new month is up for debate.

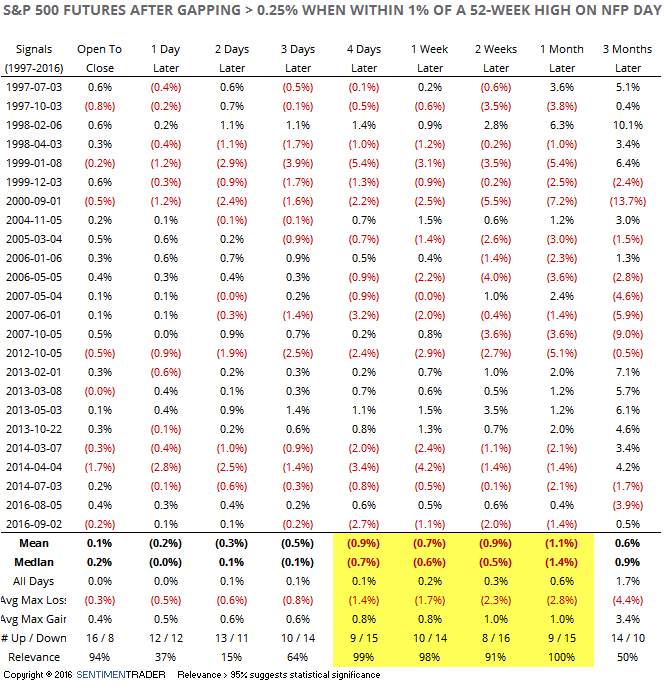

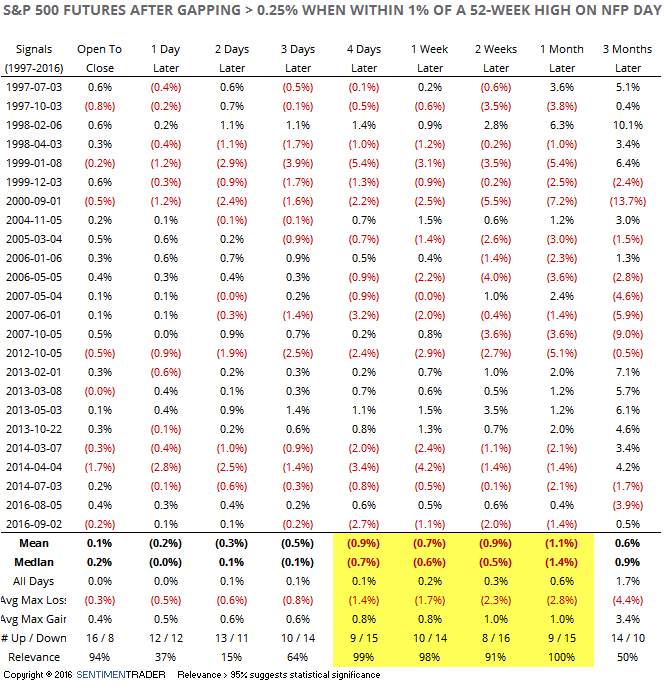

The table below shows every time since 1997 that the S&P 500 futures gapped open at least +0.25% the morning of a NFP report when it had closed the prior day within 1% of a 52-week high.

We can see that buying the equivalent of today's open and holding for anywhere between 4 days and a month yielded a negative average return and poorly skewed risk/reward ratio. Two weeks later, the trade sported only 8 winners out of 24 occurrences. Most of the winners were concentrated solely in 2013.

Since then, the gaps led to negative returns every time over the next 1-3 months. None of them saw the S&P rise more than 1% from the open at any point over the next week, so if stocks manage to add meaningfully to their gains this time, we'll be seeing a change in pattern from the past couple of years.