Futures traders' odd position in Treasuries

In recent weeks, futures traders have been taking unusual positions in long-term Treasury contracts. As noted by Bloomberg, it looks like bets on the yield curve.

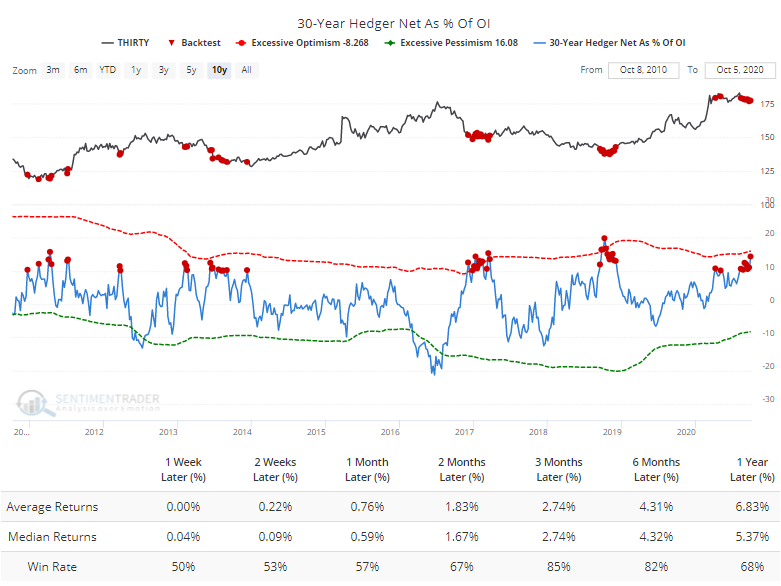

The differences in positioning are stark depending on whether we look at the 10-year note or 30-year bond. In the 10-year, "smart money" commercial hedgers are net short more than 5% of the open interest. Over the past decade, the Backtest Engine shows that the note declined after similar extremes.

But in the 30-year contract, hedgers are heavily net long, which the Engine shows has led to mostly higher returns. This is exactly as it should be for a "smart money" indicator.

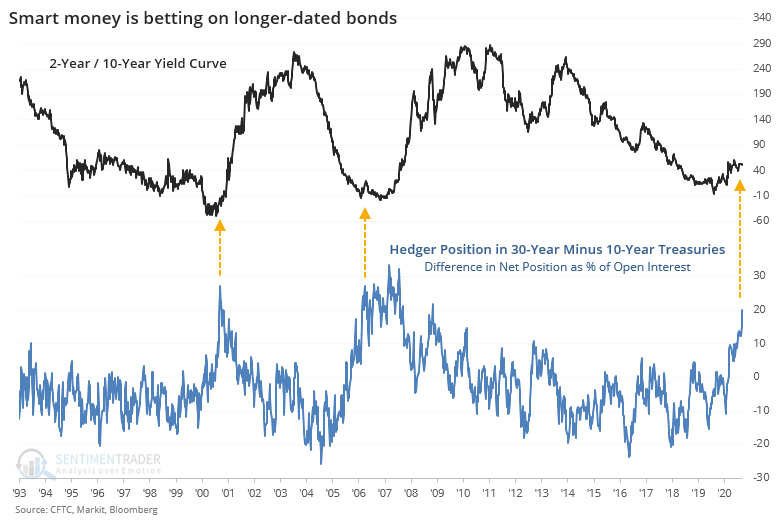

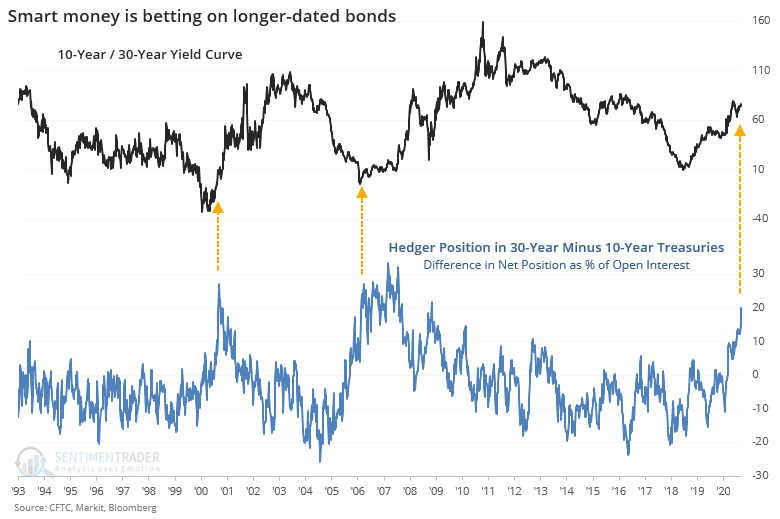

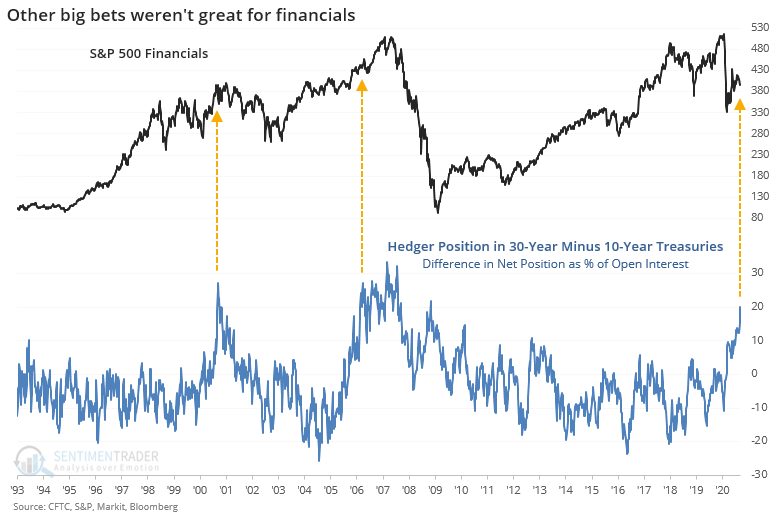

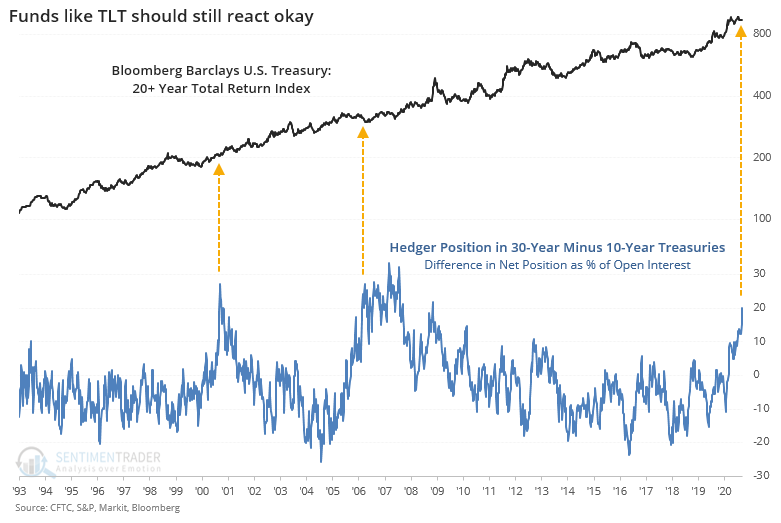

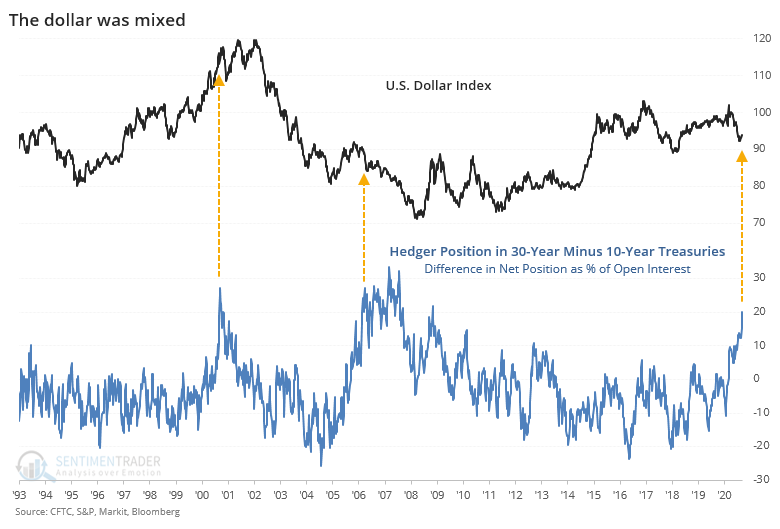

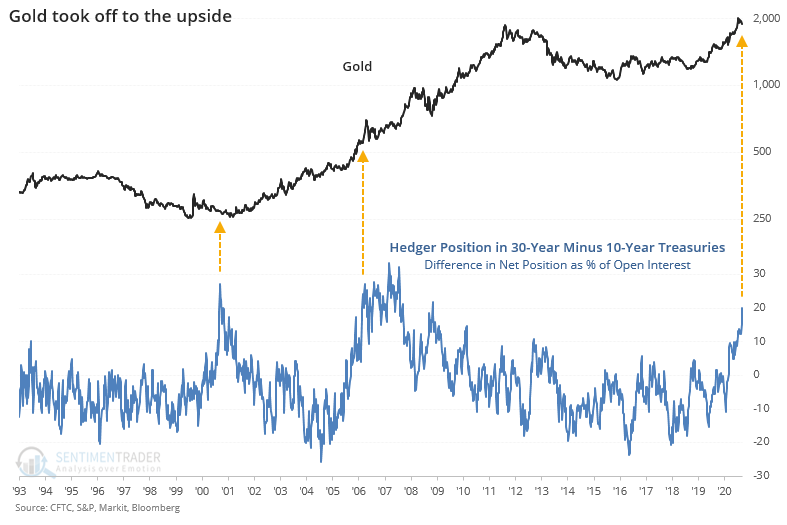

To see whether these bets have meant anything for the yield curve in the past, the chart below shows the difference in hedger positions in 30-year minus 10-year Treasury futures, expressed as a percentage of open interest. The higher the blue line, the more hedgers are betting on rising long-term bond prices and/or against intermediate-term note prices.

Looking at the typical 2-year / 10-year yield curve, this spread is rather astounding - it reached +20% right before the spread blew out and soared higher over the next 2-3 years. Both times, the spread went from being negative to the 10-year yielding at least 2.5% more than the 2-year.

If we instead use the yield curve of the 10-year and 30-year contracts themselves, then it's a similar story. Both times, the yield on the 30-year jumped much more than that of the 10-year, which may not be what we would expect given how the contracts have behaved over the past decade following extremes in this data.

This is often used as a fundamental input for the financial sector. Using that as the comparison index does not look encouraging. While not necessarily top-ticking the bull markets, financials struggled mightily.

This difference in positioning causes a dilemma for the mom-and-pop trader, who uses funds like TLT as a proxy for "bonds" yet key off the 10-year yield as their guide to what the "bond market" is up to. The TLT fund has an effective maturity of about 25 years, so definitely skewed toward the longer end. When the spread in hedger positions reached this extreme the other two times, the total return of the underlying index fared very well, rising more than 44% within the next 3 years both times.

For the U.S. dollar, it preceded a couple of choppy years then a plunge the first time, and just a plunge the second time.

Both preceded massive gains for gold, rising more than 40% within the first 3 years of the September 2000 signal and 78% after the March 2006 one.

There are a whole lot of guesses about the upcoming presidential election, deficit spending, and economic recovery. While the sample size is painfully small, using the positioning of traders in 10- and 30-year Treasuries, it looks like a good bet is a steeper yield curve and rising gold.