Fund managers scramble for cash as they sell stocks

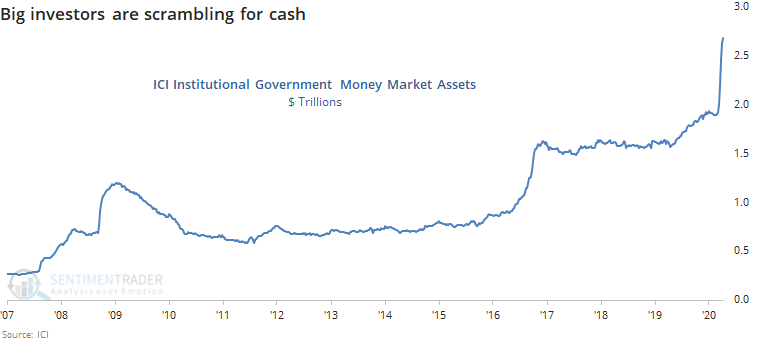

Big fund managers fled to cash over the past month, helping to drive assets in the safest money markets to record highs.

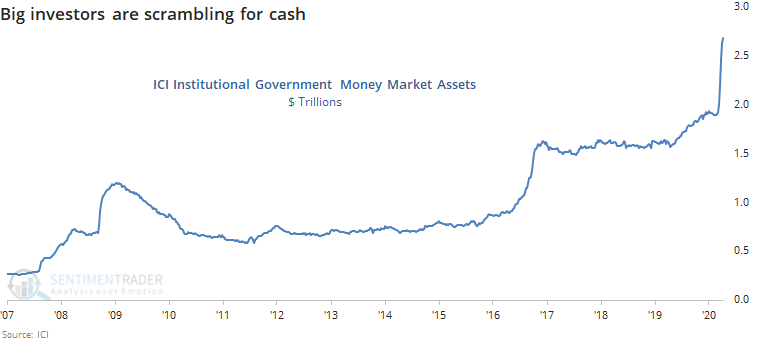

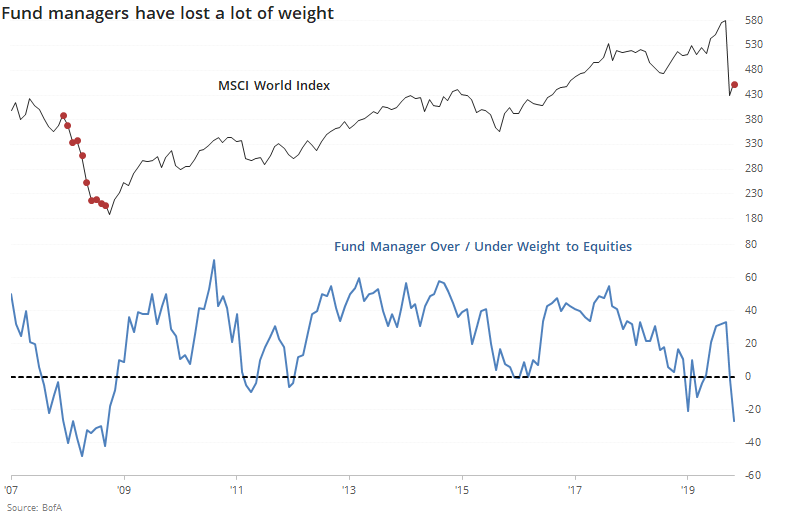

According to the latest Bank of America survey of money managers, they're holding the most cash reserves since aftermath of the 9/11 tragedy. That means they had to sell something, and that something was stocks. Their allocation to equities plunged to the lowest level since the financial crisis.

While it's always tempting to assume everything is a contrary indicator, when it comes to "big money" or "smart money" surveys, the evidence is mixed. Very generally, they tend to be contrary indicators at true extremes, but it's not as consistent as most other indicators.

When these managers were heavily overweight equities, stocks tended to struggle, and vice-versa. The caveat is that they became very defensive early in the financial crisis, which was good for their clients as stocks continued to slide.

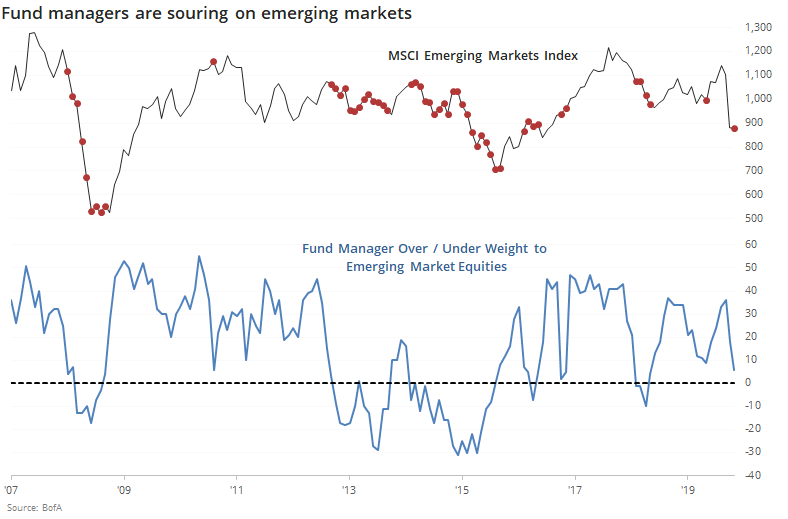

Their allocation to emerging markets also took a dive, but they remain overweight, which has preceded mixed returns.

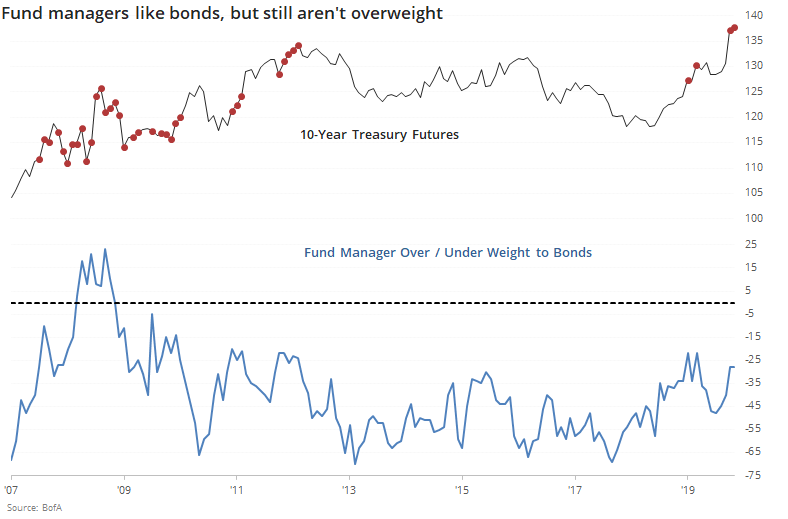

They've stayed stable on bonds. They're underweight position is among the lowest in a decade, but it's not like the financial crisis when they were actually overweight.

If the equity survey showed an underweight to stocks of 40% or more, then we could comfortably say it's a sign of panic and extreme enough to be a long-term contrary indicator. As it stands, it's not enough. During a bull market, an underweight position has been a good sign, but during a bear market, larger extremes are necessary.