Fund managers find eurozone unattractive

The exodus from non-U.S. mutual funds and ETFs has become the most severe in a decade, and some surveys are showing depression-like pessimism overseas.

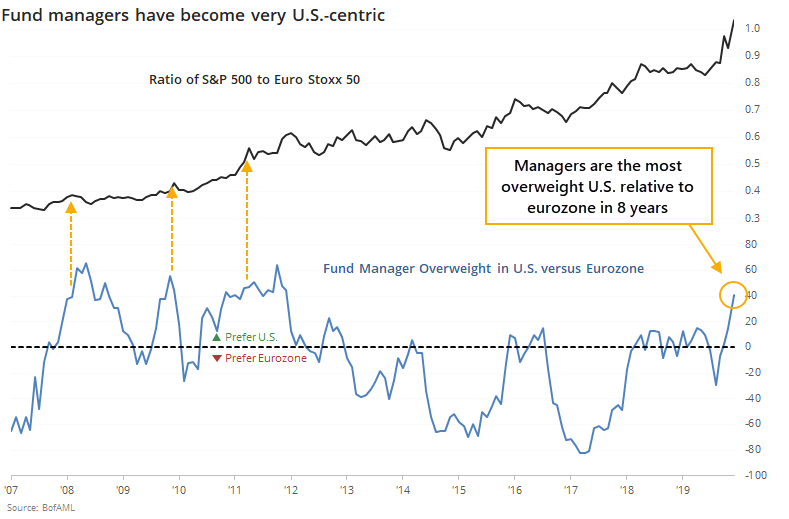

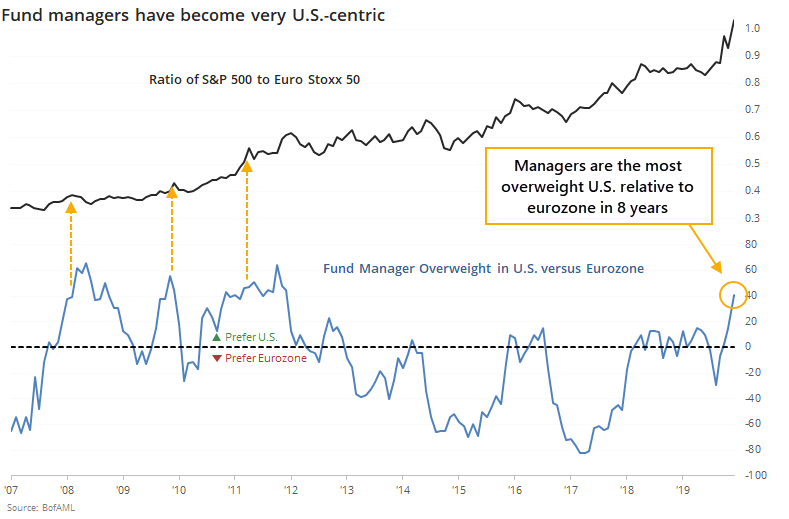

Money managers are not immune. The latest survey of large money managers from Bank of America Merrill Lynch shows another month of them preferring shares in the U.S. versus anywhere else, especially the eurozone.

Through mid-May, the survey showed that managers were 24% overweight the U.S. versus 17% underweight eurozone stocks. That's more than a 40% spread between them, the widest in 8 years.

This has a decent contrary record. When the spread was very negative (fund managers preferred euro zone shares to U.S. shares), the ratio of the S&P 500 to Euro Stoxx 50 tended to bottom and head higher for months afterward.

At the opposite extreme, where we are now, it was less pervasive simply because the U.S. has been on a relative hot streak for over a decade. But when it reached this wide of a spread, the ratio between them did flatten out or decline in the months ahead.

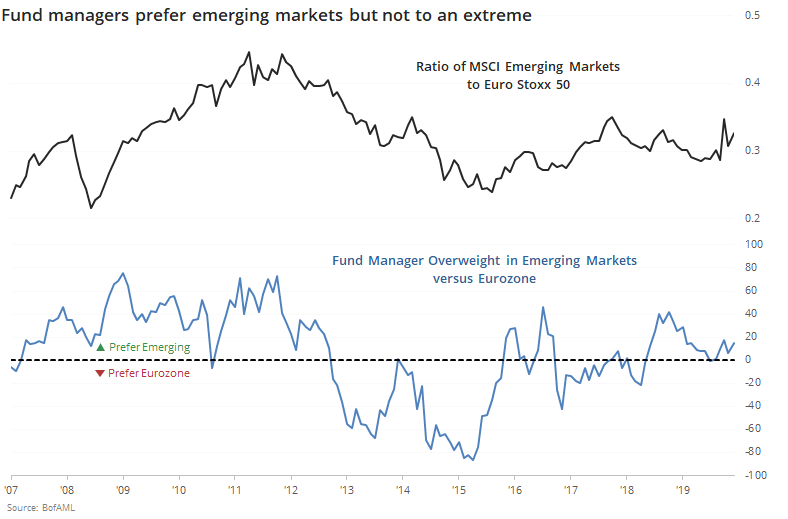

When it comes to emerging markets, fund managers also prefer those countries' shares to the eurozone but it's not quite to an extreme.

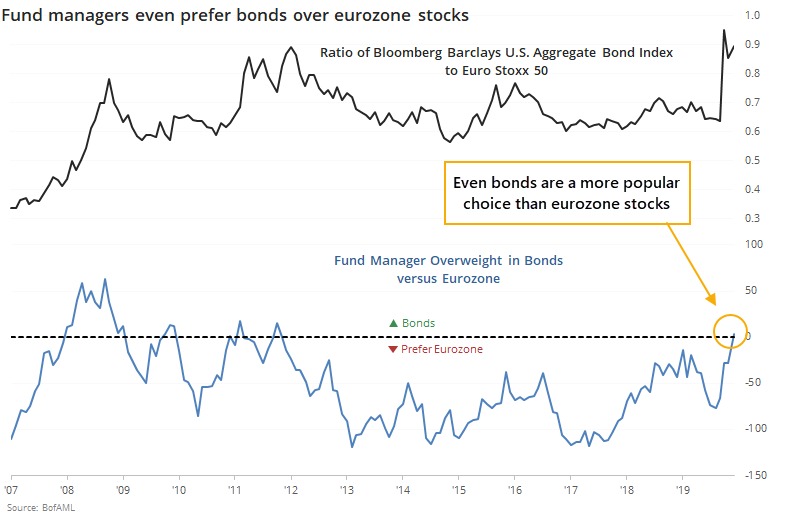

Perhaps most damning of all, fund managers even prefer U.S. bonds over eurozone stocks. It's very rare to see a bond market take preference over a stock market among a survey of primarily stock fund managers.

This wasn't necessarily a great contrary indicator since bonds have steadily risen over the past decade, but still. It's a pretty stark display of just how much apathy has built up overseas.