From Risk-On To Risk-Off In Near-Record Time

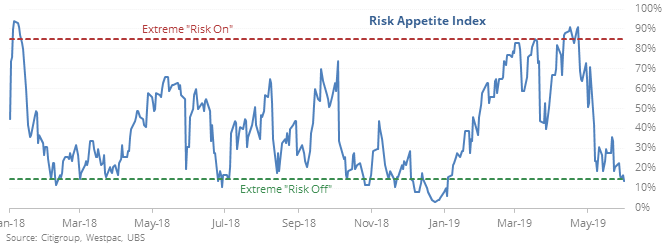

Risk-on to risk-off in a month

In April, investors were showing extreme risk-on behavior, according to their eagerness to buy some markets over others. Barely a month later, that has cycled to extreme risk-off behavior.

The first risk-off reading following risk-on behavior has usually led to a return of riskier preferences. The S&P 500's returns tended to be a modest positive, especially over the next 3-6 months, though the returns were not exceptional.

In other markets, there wasn’t much of a bias. Once we hit risk-off status, the dollar had a minor tendency to rebound, as did both bonds and gold. None of them were exceptional.

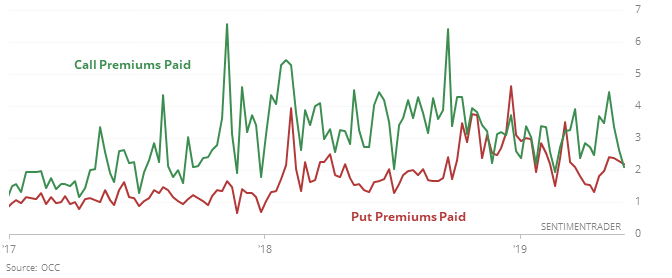

Call premiums collapse

Last week, options traders spent more on protective put option premiums than they did on calls. That’s only the second time since December, and it was even more extreme for the smallest of options traders.

This is one of the heaviest spending on puts for a week when the S&P 500 was within 10% of a peak. Many of these weeks since 2000 triggered in 2016, so returns were impressive on all time frames.

Tech corrects

The Nasdaq Composite pulled back 10% (rounded) from its peak. This is the 3rd time it has quickly corrected from a multi-year high since the financial crisis, which both led to limited downside. Typically there was a small chance that these corrections would morph into more serious bear markets within the next few months.

Not chasing beta

Rydex mutual fund traders have been so hesitant to chase high-beta mutual funds that the 20-day Beta Chase is nearly at a record low. According to the Backtest Engine, after the 34 days when the 20-day average was below 0.9, the S&P rose over the next month 31 times.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.