Friday-Monday Selling

With some early selling pressure this morning, futures are indicating a gap down opening for the major stock indexes.

Follow-through from heavy selling on Friday is not unusual, but not consistent enough that it was "predictable" on Friday. We've often discussed the pattern following Friday-Monday selling, the last time being in a Note from June 27.

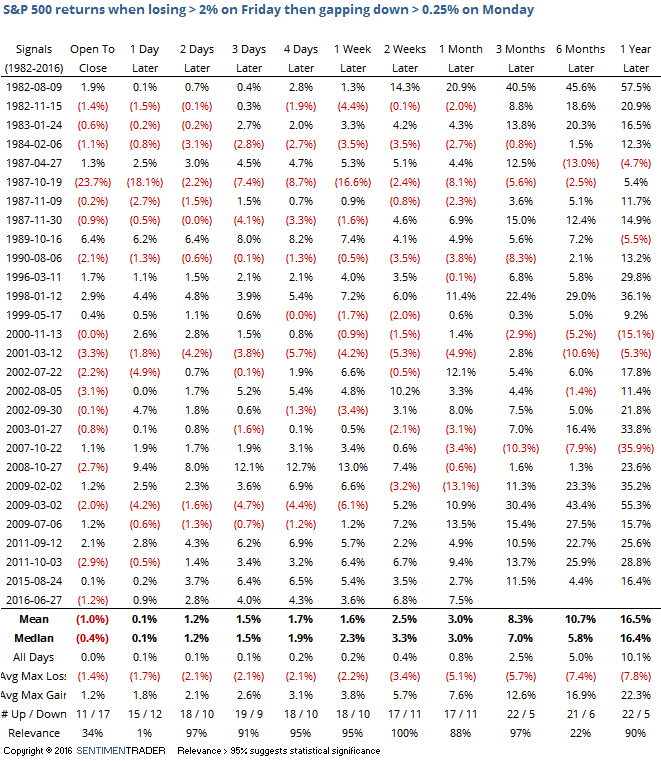

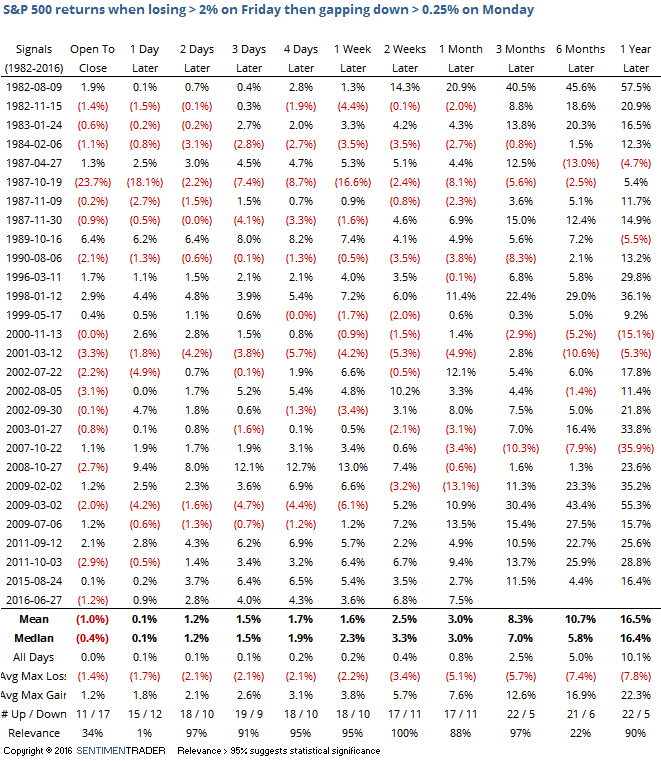

Assuming the current pace of selling holds, let's take a look at returns in the S&P 500 futures following a loss of 2% or more on a Friday, which is then followed by a gap down open of at least 0.25% on Monday morning (all returns are from the open on Monday).

There was a positive edge going forward, particularly in the shorter-term, which is no surprise since it's a short-term pattern. We wouldn't want to read much into the one-year returns, anyway, based on two days of trading activity.

The edge was especially positive over the past 20 years. Of the 18 occurrences since 1996, only 3 of them led to negative returns over the next two days.

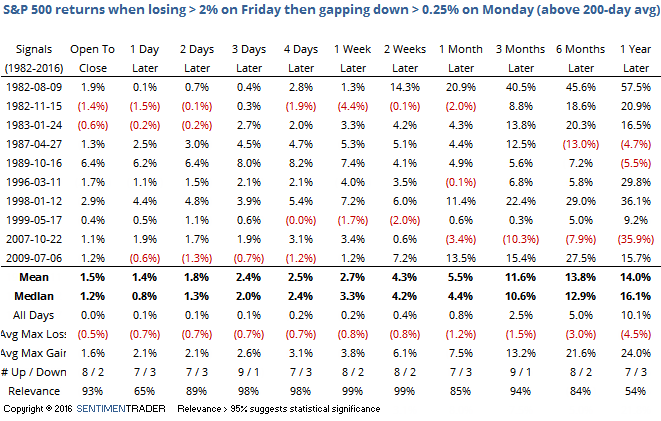

Our current instance is unusual in that the S&P is still trading above its 200-day average. Let's add that as a filter:

Here the returns are significantly more consistent and positive, though of course the sample size is smaller and that's an issue. Over the next three days, the S&P showed a negative return only one time, and that one was small. The risk/reward was also heavily skewed to the upside.

As this is being published, some buying is coming in. If stocks do NOT gap down by 0.25% or more, then any edge in this data becomes dulled. A moderate or up opening on Monday led to mixed returns going forward, so ironically it would be best for short-term bulls if the sellers held way heading into Monday's open.