Friday Midday Color

Here's what's piquing my interest so far today.

Nice Run

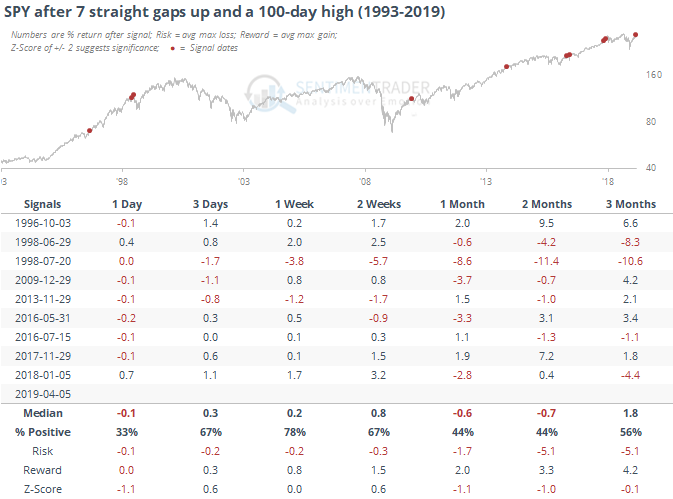

Bulls have been pushing things, with a long streak of up days and new 100-day highs. For the past 7 sessions, the S&P 500 fund, SPY, has gapped up at the open. We haven't seen that kind of pre-market enthusiasm since January 2018.

It's potentially notable that this is occurring in the aftermath of the Nonfarm Payroll report, typically the most important economic report in terms of market impact. There haven't been many times when SPY closed higher for at least 5 straight days ahead of the report.

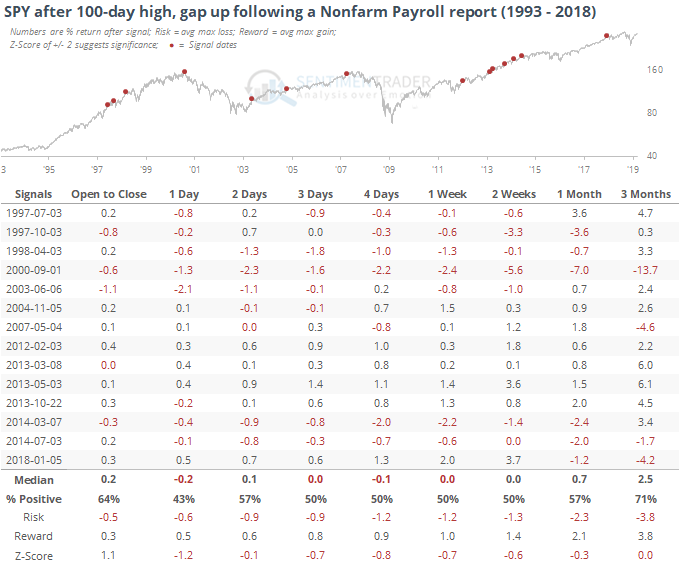

It's also been relatively unusual to see SPY hit a 100-day high, then gap up the morning of the report.

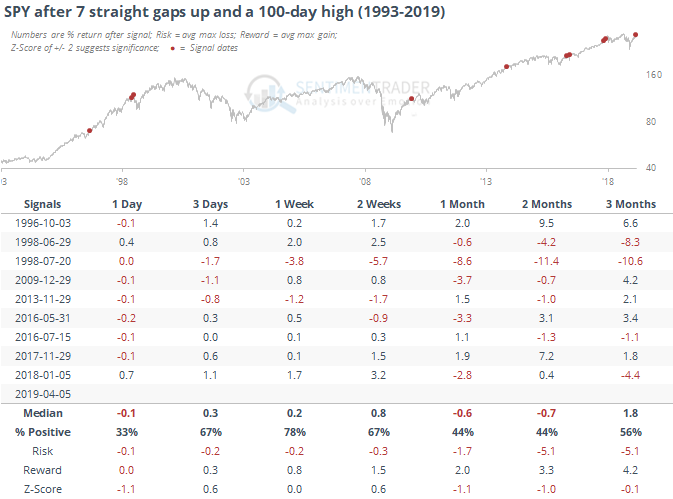

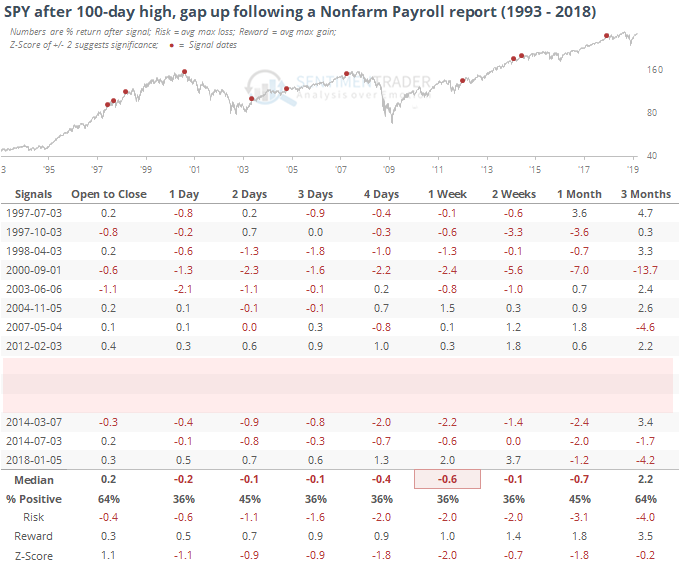

Returns weren't too bad, but that was due in large part to the mo-mo market of 2013. Taking out that one year, we get this:

Here, the risk/reward was quite a bit less enthusiastic. All but one of the signals showed a negative return at some point between the next 3 days and 1 month.

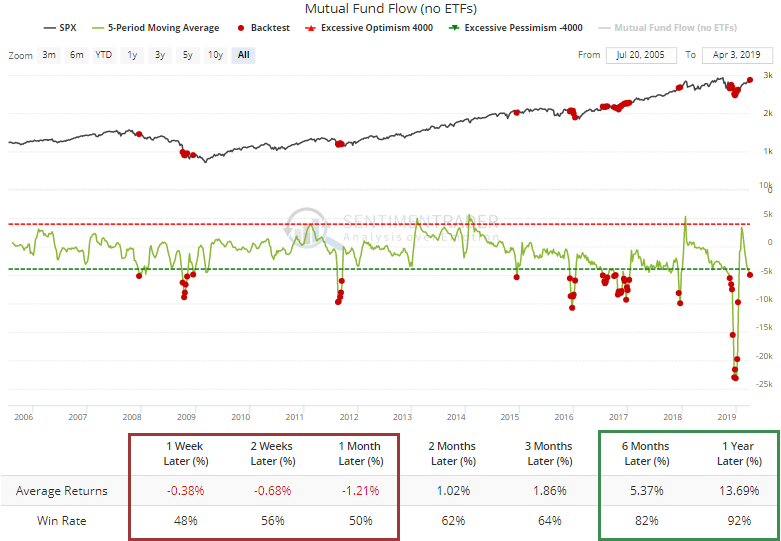

Flows

Over the past 5 weeks, investors have yanked an average of almost $5 billion / week from equity mutual funds. Even given the secular decline in mutual fund assets (for equities), this is getting extreme. Curiously, it hasn't been a great shorter-term sign, but longer-term returns were very good.

Utes

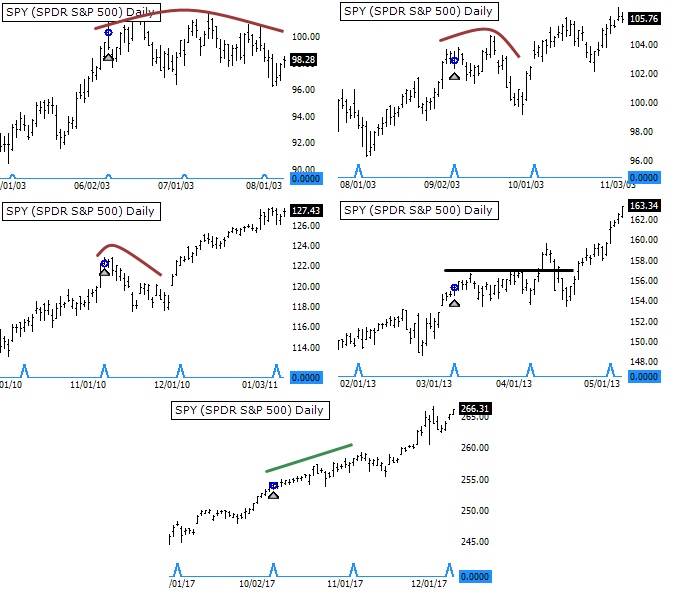

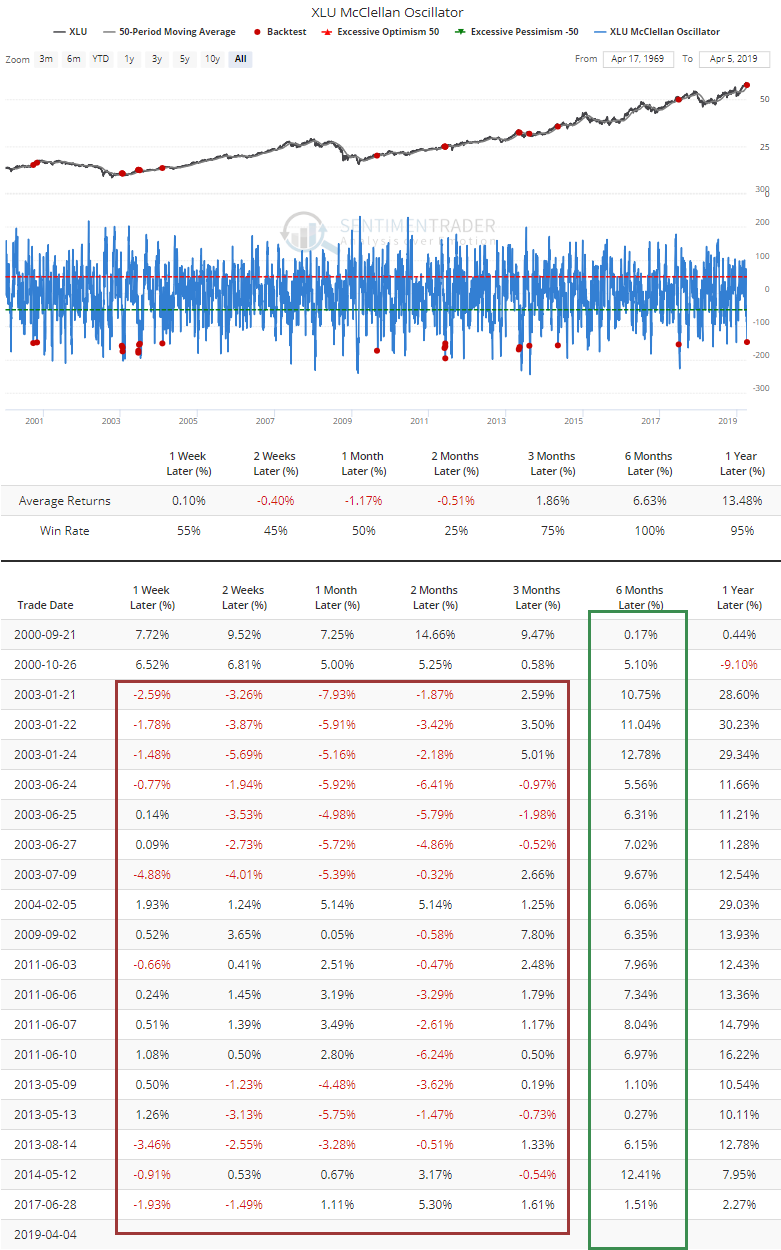

A couple of weeks ago, we saw that breadth in utilities was "too good." When a defensive sector like that sees the kinds of readings it did in late March, it almost always pulls back.

Now that momentum is seeping from the sector, the McClellan Oscillator for utilities is quickly cycling to the opposite extreme. There haven't been too many times when the Oscillator dropped below -145 when XLU was still trading above even its 50-day moving average. Almost every time, XLU continued to erode over the next 2-12 weeks, but every time it was trading higher 6 months later.

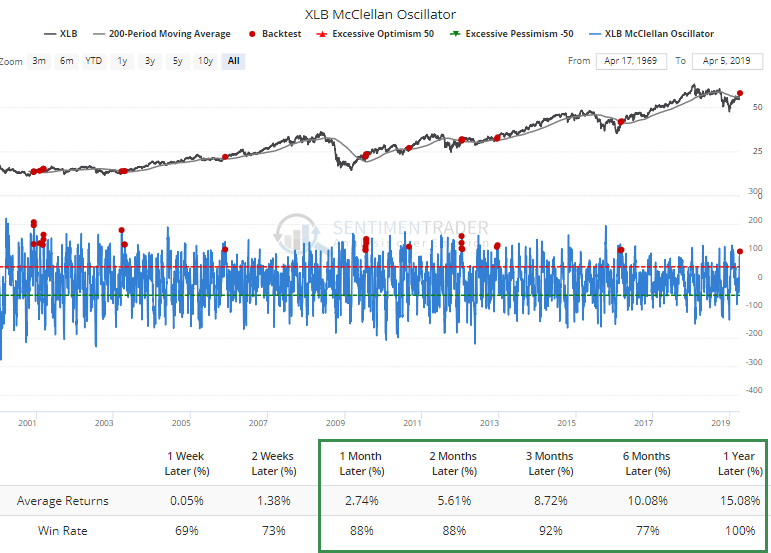

Material stocks have been among the best gainers lately, and the Oscillator for the sector has jumped above 100. When that triggers and XLB is trading above a downward-sloping 200-day average, it has led to consistently good returns. These indicate breath surges following a recovery from a downtrend.