Friday Midday Color

Here's what's piquing my interest on what is yet another fade of early-morning strength.

Mushed Metal

One of the most extreme moves this week has been in palladium, which knocked a quick 15% off its high. It's sometimes suggested as a leading indicator for stocks (some theory about it being an important input for the auto industry, which could be a leading indicator for economic growth, which could be an indicator for stocks...it's a stretch).

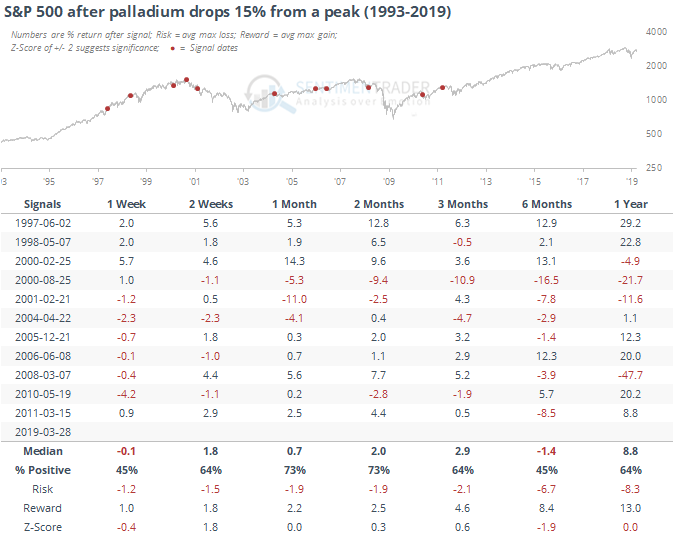

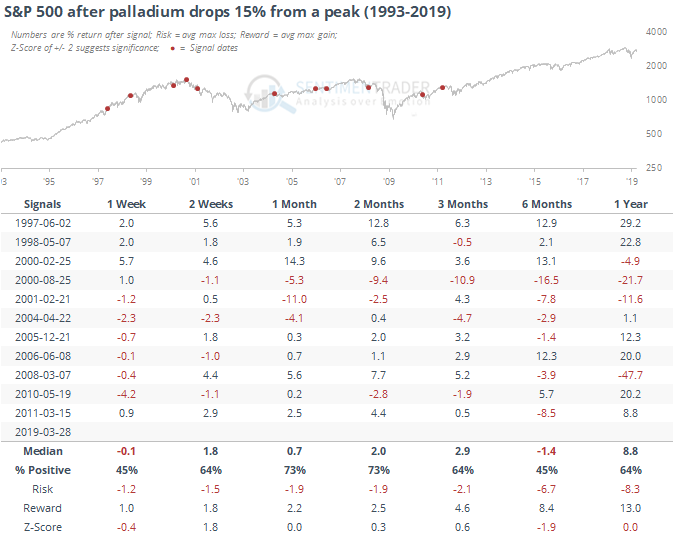

Whatever the theory, big drops in the metal from a peak have not dented future S&P 500 returns much.

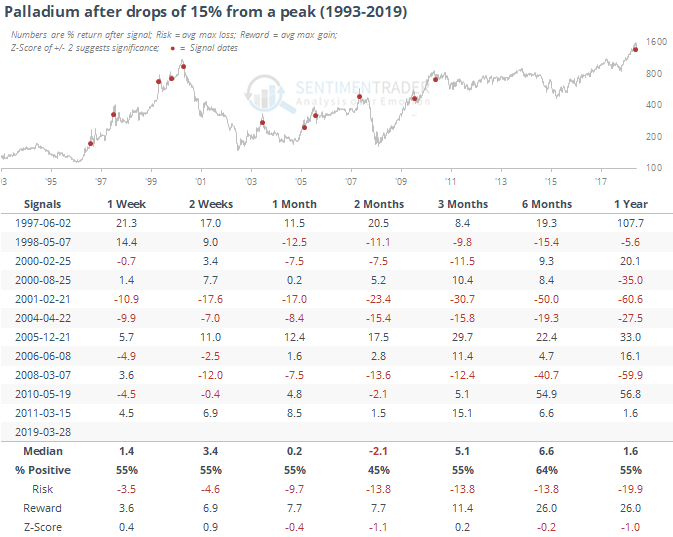

For palladium itself, it led to mixed returns.

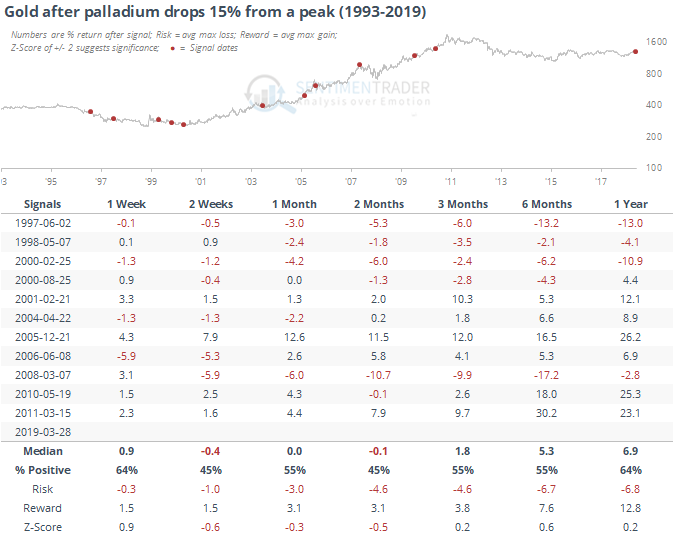

Same for gold.

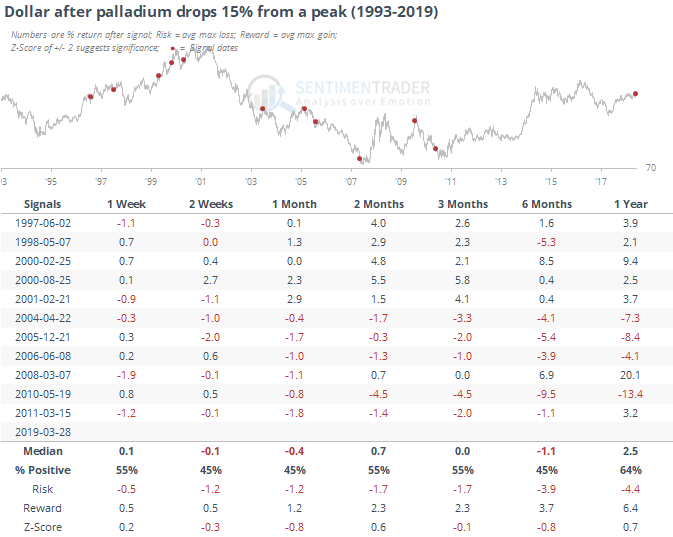

Kinda negative for the dollar, but it's weak.

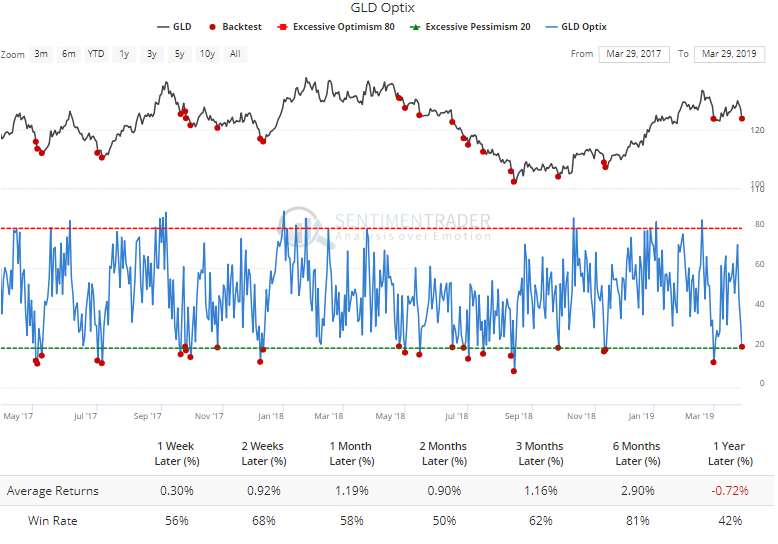

Speaking of gold, it got hit pretty hard this week, and the Optimism Index on GLD dropped to 20. Over the past two years, that has been a decent (not great) short-term signal of pessimism.

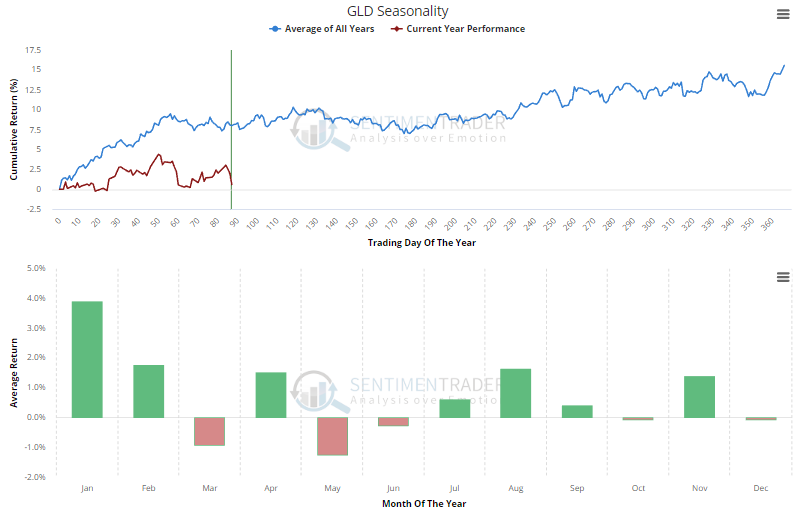

A very minor positive is seasonality. GLD has held pretty closely to its typical pattern. For what it's worth, it averages a rise through April.

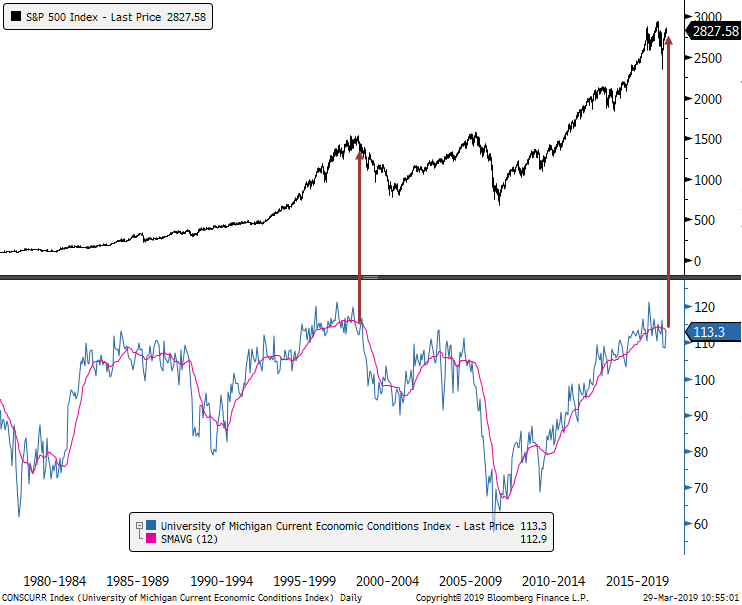

Waning Confidence

In a report earlier this week we saw evidence that consumers' attitudes toward their present condition has peaked. That has been a terrible longer-term sign for stocks.

The latest survey from the University of Michigan showed that consumers' gauge of current conditions rebounded from last month, but it still below its declining 12-month average.

The only other time it got above 110 and started to decline was at the bubble peak in 2000.

Lyfted

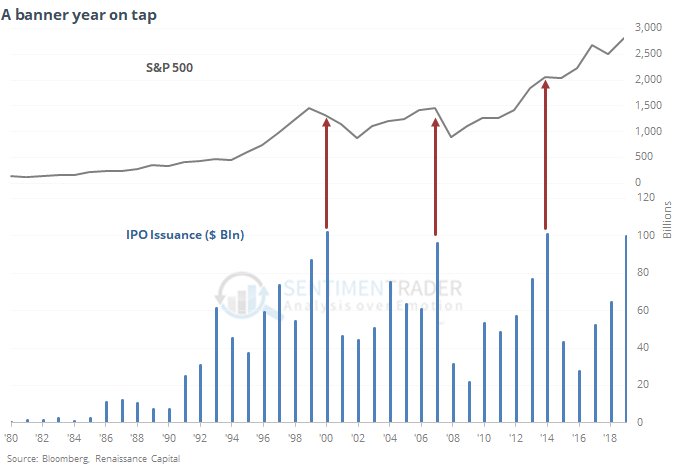

With the big IPO today, we should look at the obligatory hand-wringer about a surge in potential IPO issuance this year. According to Renaissance Capital, we're on track for a $100 billion year.