Friday Midday Color - Flows, Breadth Extremes, Shanghai

Here's what's piquing my interest so far on this Friday.

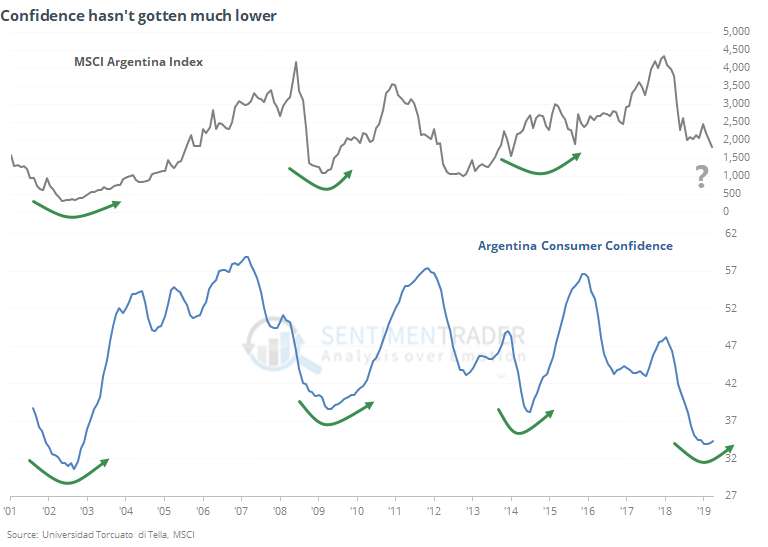

Argentinian Angst

The WSJ notes that consumer confidence in Argentina has taken another hit due to political instability. I know next to nothing about the country, but it's at least worth noting that over the past 6 months, consumer confidence in that region has been as sour as it has been in the past 17 years, but the average is starting to potentially curl higher. Unlike some other countries, consumer confidence has a high correlation with the stock market.

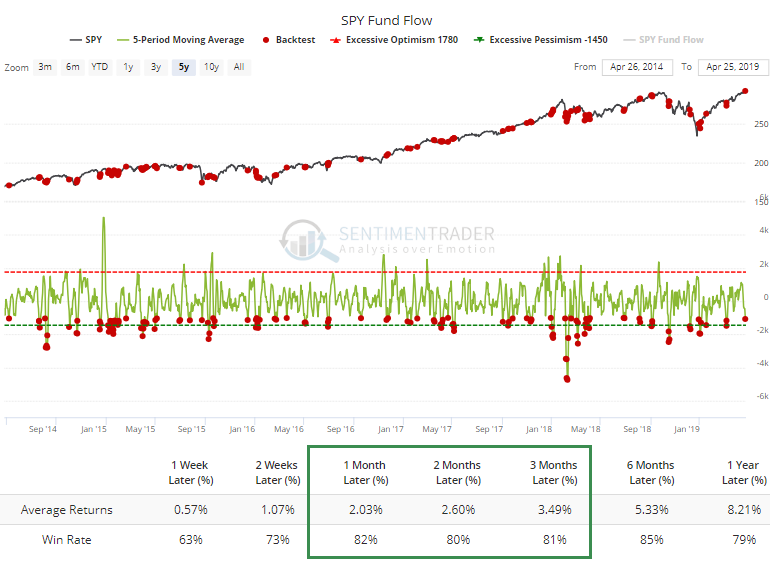

Flow

It's kind of curious to see investors leave SPY even as it rallies. The 5-day average shows an outflow of more than $1 billion per day. While fund flows are an iffy read on sentiment, similar outflows over the past five years have been a mostly positive sign for SPY.

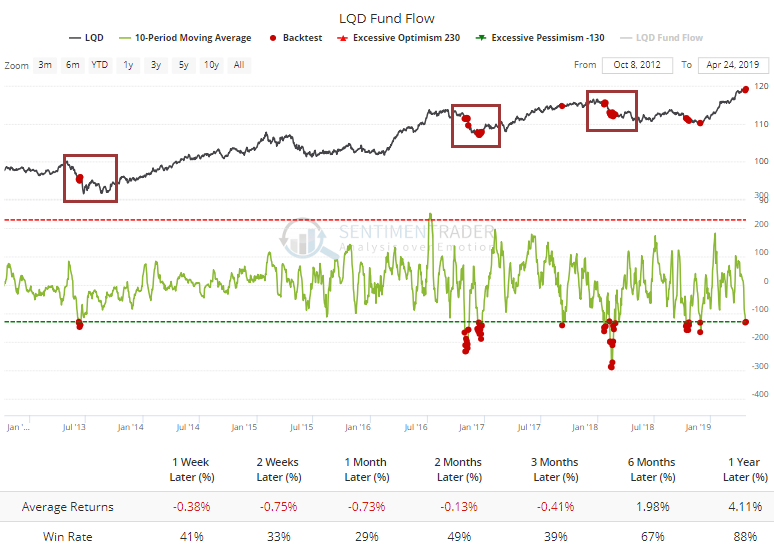

There have also been consistent outflows in some bond funds like LQD (investment-grade bonds). Over the past 10 days, the fund has suffered an average daily outflow of more than $125 million. Curiously, several peaks have seen a steady outflow - there is less of a contrary nature to these flows than there is with many other funds.

Breadth Review

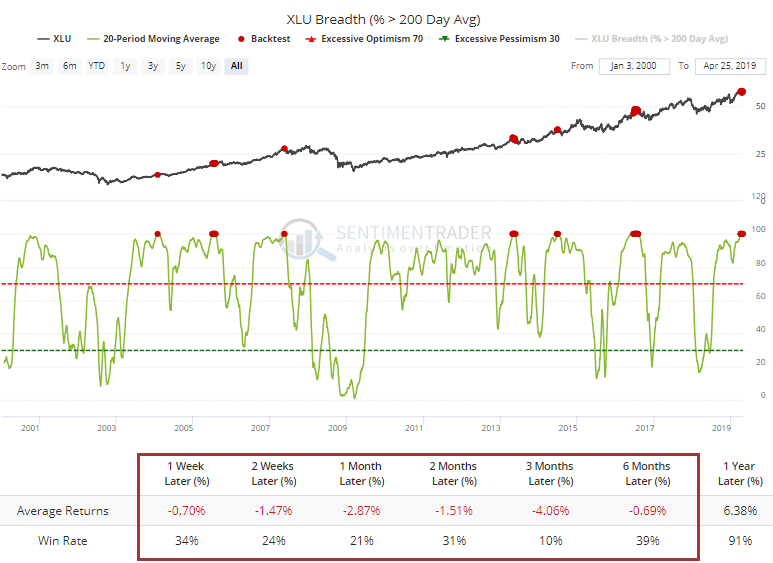

Every utility stock has been able to hold above its 200-day average for 20 days. The sector hasn't seen a sustained levitation like this very often. Almost every time, it ended up leading to a negative return in XLU over the next three months.

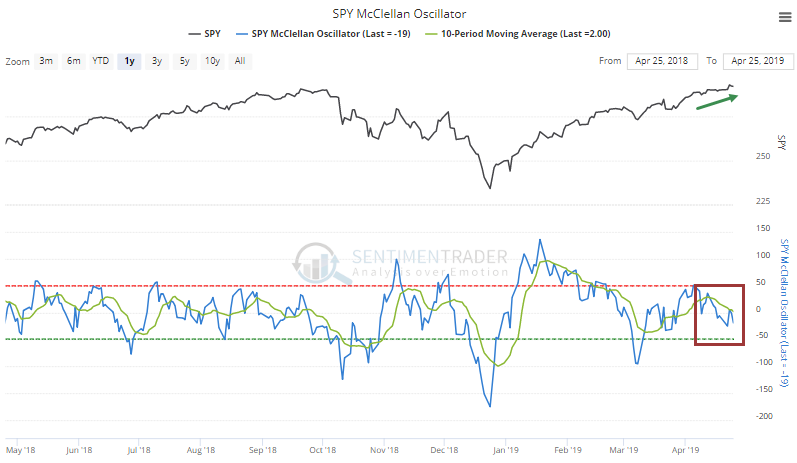

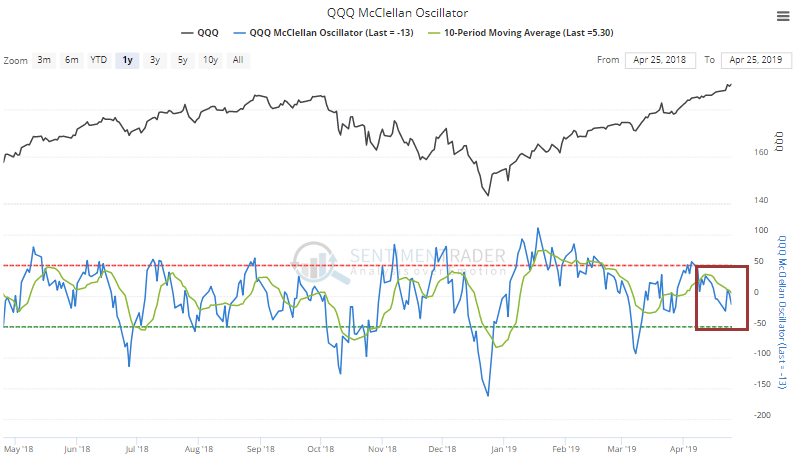

One thing I don't like is that while the S&P 500 has been moving higher, momentum has continued to be low and declining. The McClellan Oscillator for SPY has been hanging below zero, and below its 10-day average.

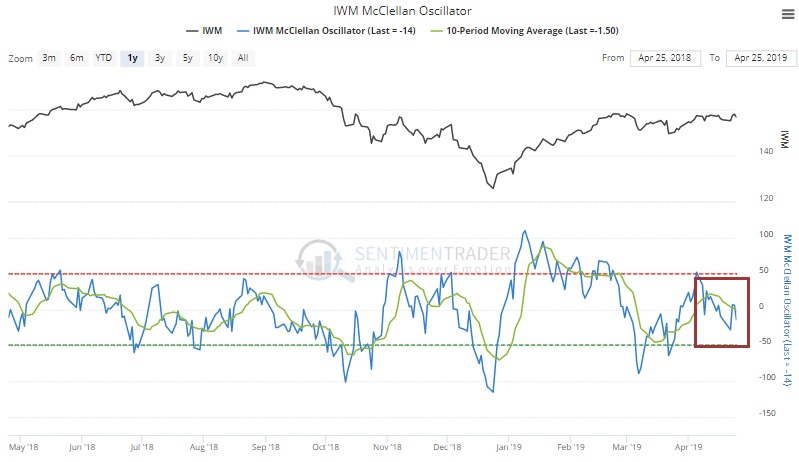

Same for small-caps, which isn't much of a surprise.

But it's also happening in the Nasdaq 100, which is (a surprise).

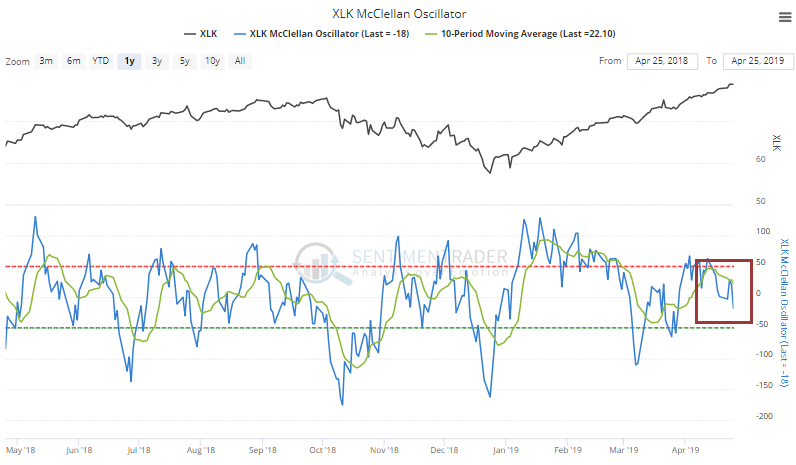

And also the broader tech market.

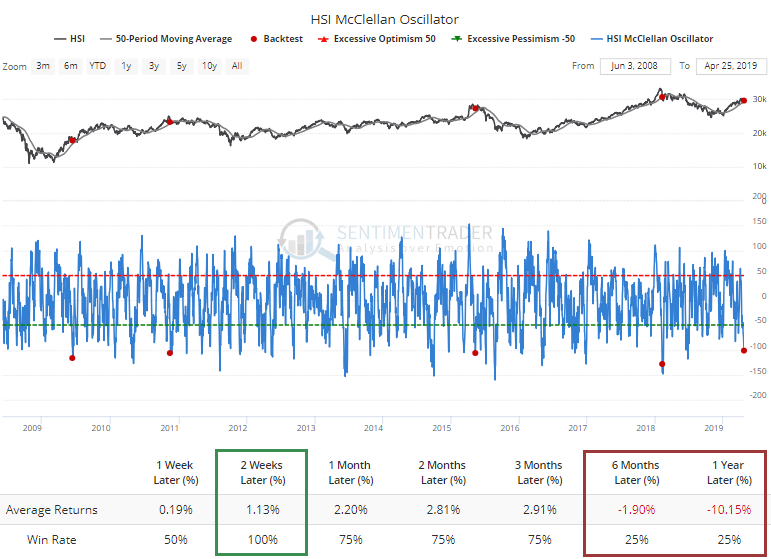

In overseas markets, there has been quite a bit of a thrust in selling pressure underlying some of the indexes like the Hang Seng, where the Oscillator has dropped below -100 while the index is still above its 50-day average. The few other times that happened, it rebounded in the short-term, but the impulse preceded a peak 3 out of 4 times.

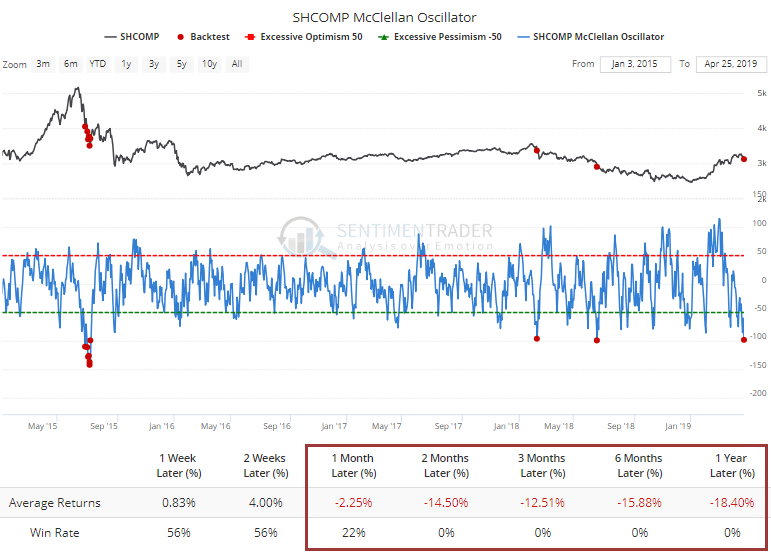

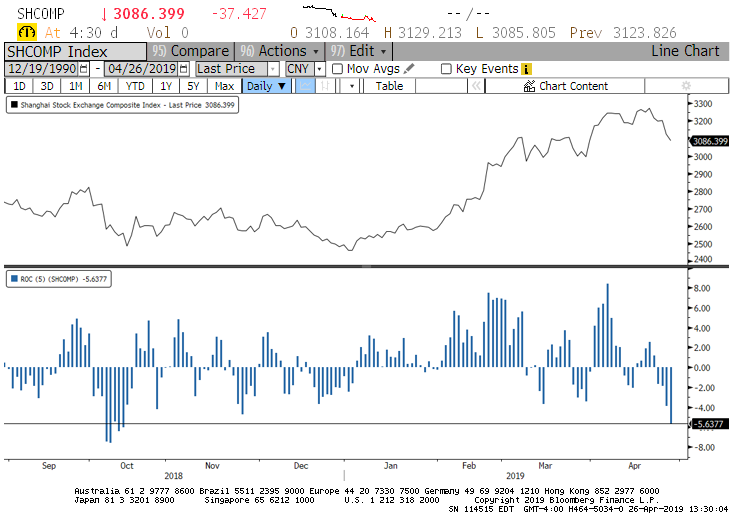

And while the huge thrust in the Shanghai had mostly positive longer-term implications when we looked at it a few weeks ago, it's a bit disturbing that underlying selling pressure has been enough to push that Oscillator below -100 as well. It's only been this low three other distinct times, and they marked selling impulses that didn't end immediately.

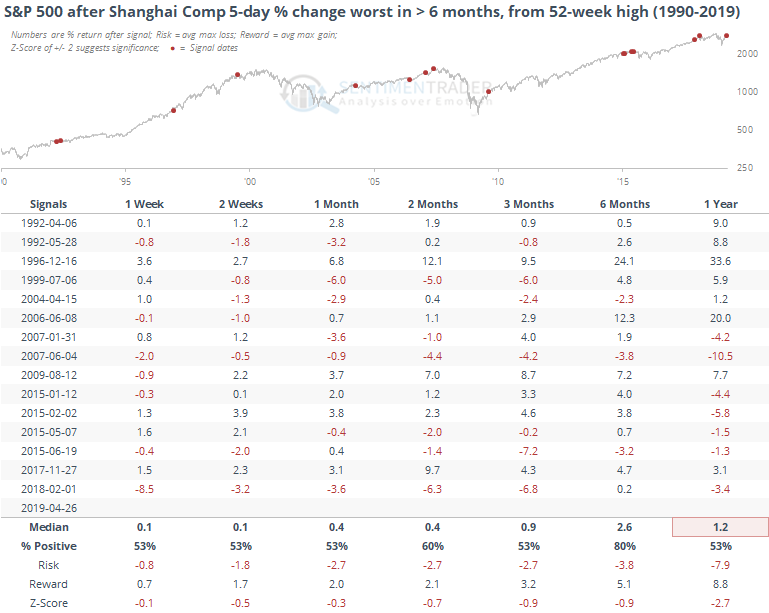

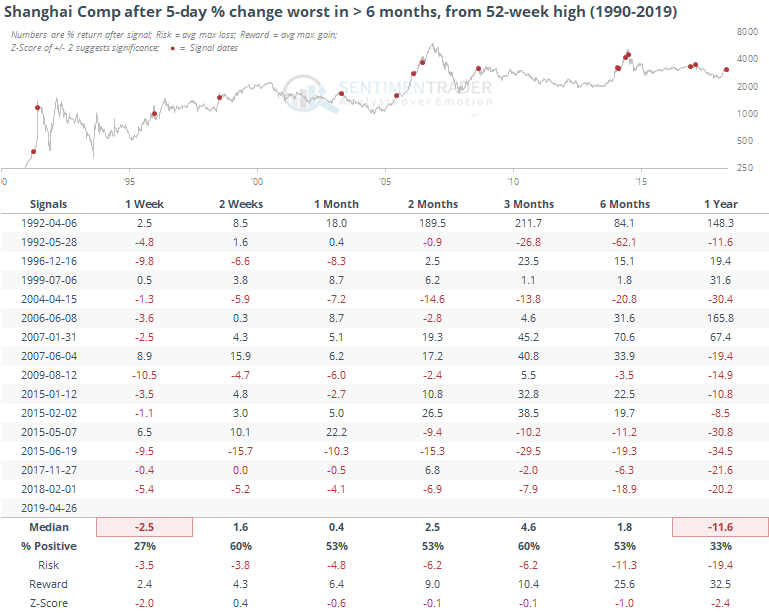

For the Shanghai, it had its worst 5-day return since last October.

That hasn't been such a good sign for the Shanghai.

It also hasn't been a great sign for the S&P 500.