Friday Midday Color

Here's what's piquing my interest so far today.

Gap

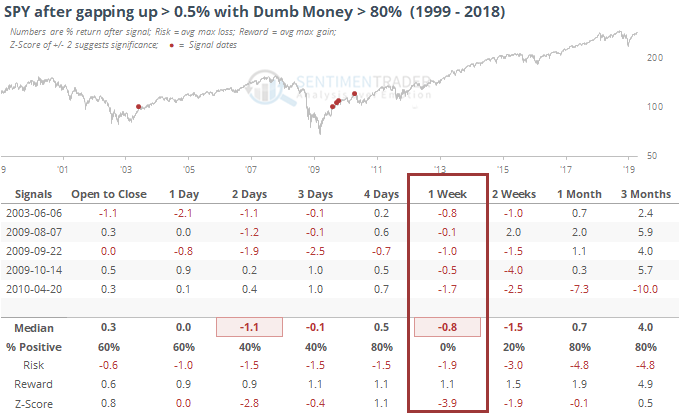

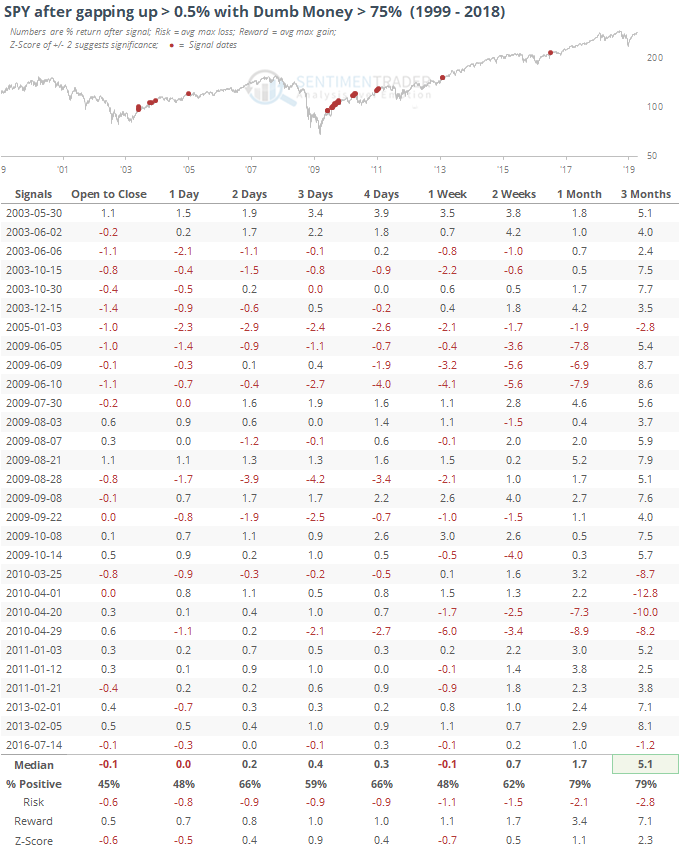

Dumb Money Confidence is holding above an extreme of 80%, and buyers were enthusiastic enough to push a pre-market gap more than 0.5% above the prior close. That's only happened five times before, all of which pulled back during the next week.

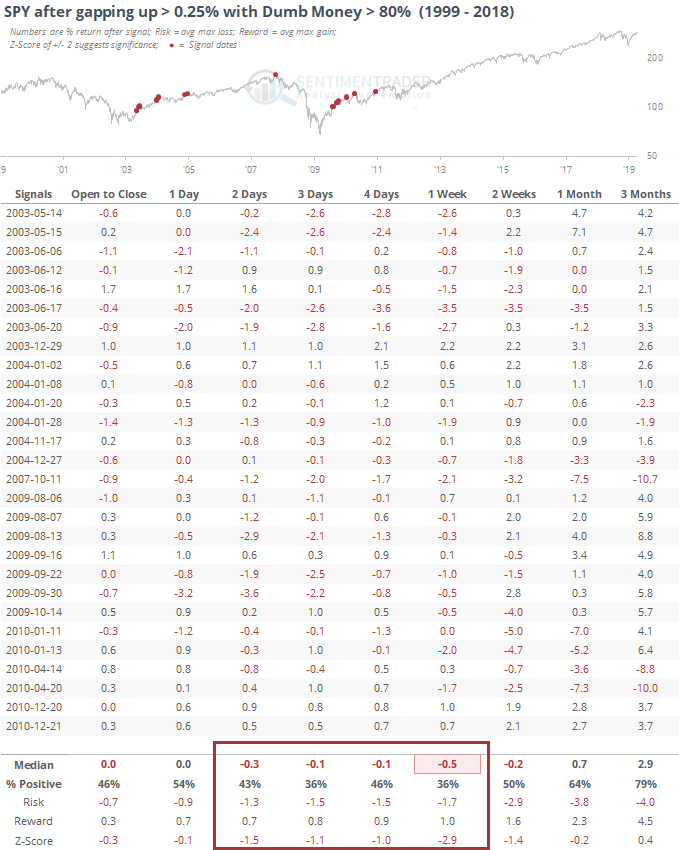

If we try to get a bigger sample size by reducing the size of the opening gap, it's pretty much the same story.

If we go the other way and keep the size of the opening gap the same but lower the level of Confidence, then forward returns weren't as negative, but still below average over the next week.

Earnings Divergence

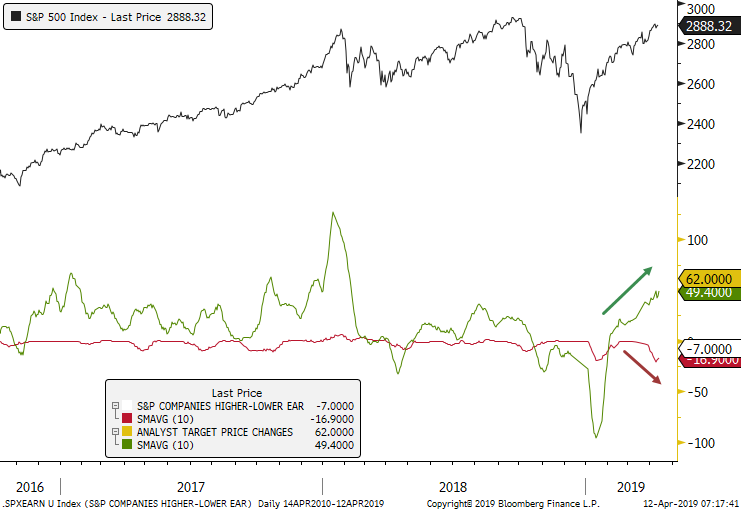

It's barely getting started, but it's interesting to note that while Wall Street analysts are busy raising their price targets on stocks within the S&P 500, they have been lowering their earnings estimates. In other words, analysts are anticipating higher stock prices despite lower earnings. Usually, there is a positive correlation between the two.

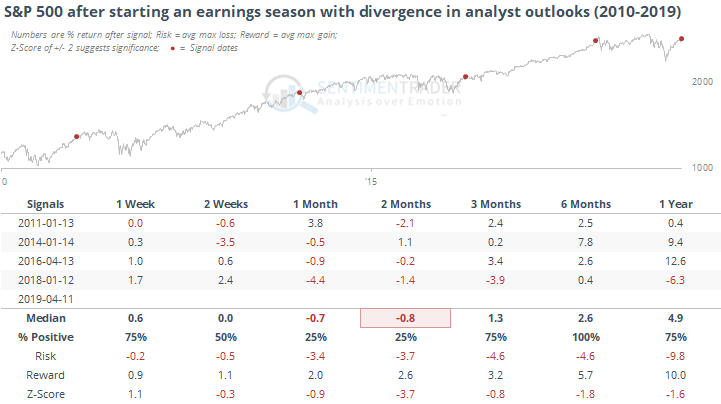

There have been four other times when we got to this period in an earnings season and analysts' price targets were much more optimistic than their earnings outlooks.

Dollar Going For A Ride

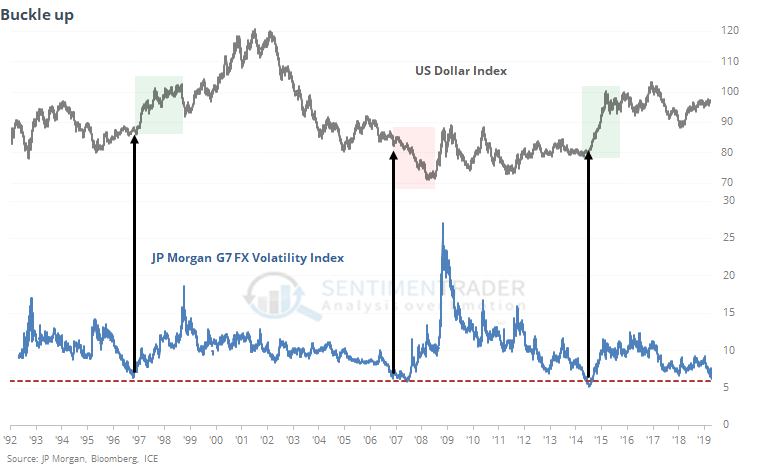

The WSJ noted that foreign exchange volatility continues to collapse. A measure by JP Morgan has just slid to a multi-year low. Based on the few other times it has sunk to this degree, the dollar's going to be in for a major ride over the next 6-12 months.

There aren't many direct ways to take a position on the assumption that FX volatility is going to pick up. An options strategy like a straddle or strangle on currency futures is one way, but it can be convoluted and higher-risk than intended depending on which currency pair is chosen, then there are considerations like quarterly futures rolls, etc. There are some ETFs like UUP, but that tends not to move much and may not be a good way to go.

Overall, it's just a heads-up that the relatively smooth ride in currency markets is probably about to do an about-face.

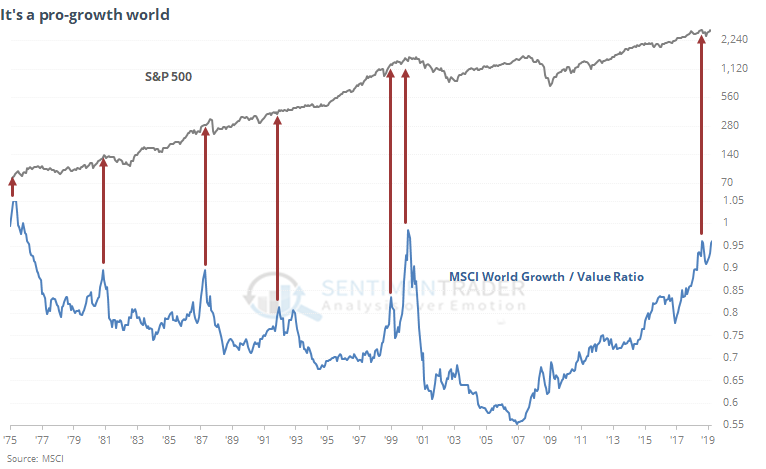

Pro-Growth

Bloomberg noted the yet-again preference of investors toward growth stocks over value.

If we zoom out and take a longer-term view, it has not been a great sign for the S&P. Of course, that's assuming there is some kind of upper-bound on the ratio, which there isn't - it does't have to peak here, it could just keep going. But if we make the dubious assumption that this is the natural limit, then it would be a long-term negative.