Friday Midday Color

Here's what's piquing my interest so far today.

Momentum

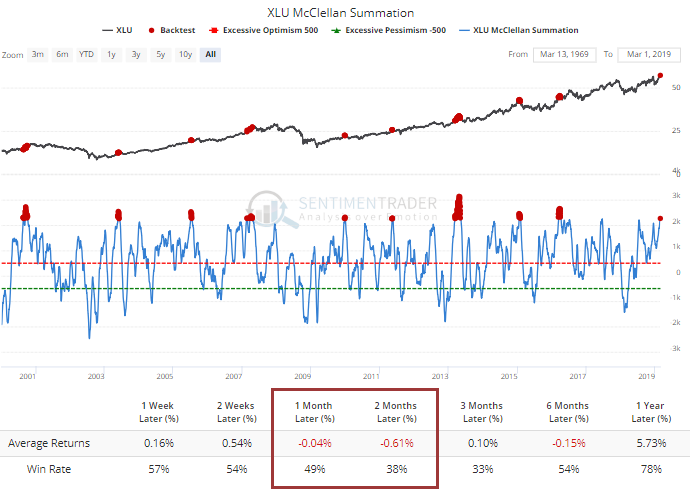

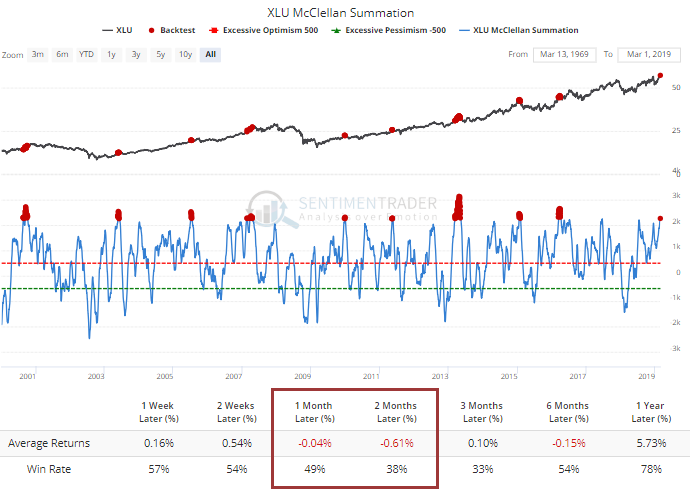

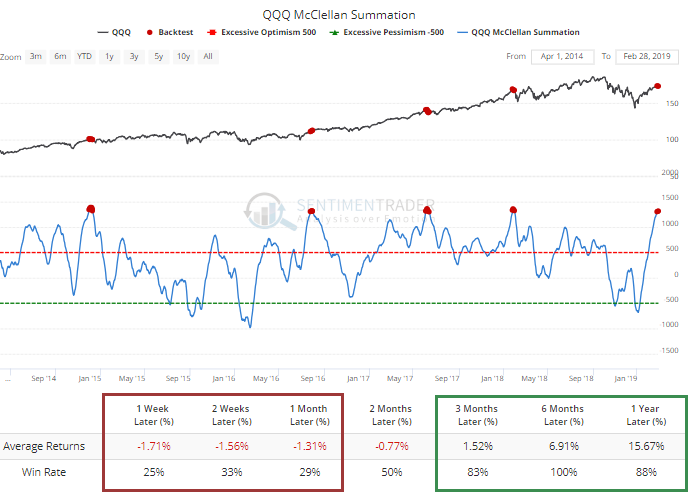

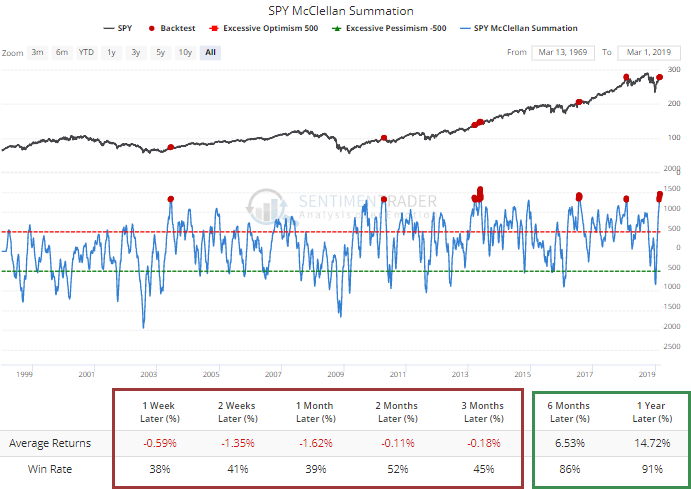

The level of breadth momentum across markets, index, and sectors is staggering. It has been so forceful and sustained that the McClellan Summation Indexes for several sectors are nearing multi-decade or all-time extremes. While often a good longer-term sign, it has been hard to sustain gains after moves like this.

Like in utilities.

And technology (no signals prior to the last 5 years).

It's also at one of the most-stretched levels for the S&P 500 in 20 years.

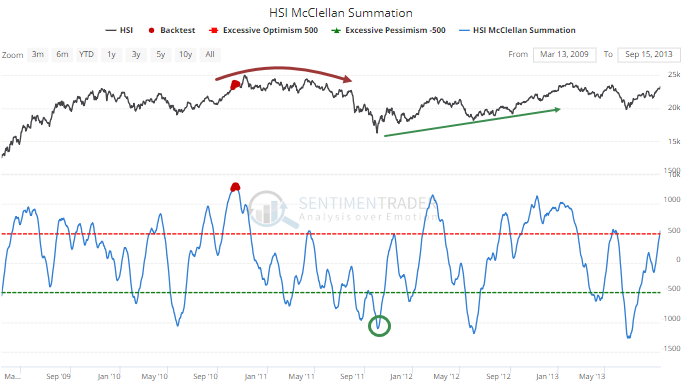

It's happened twice before in the Hang Seng index, first in 2011, which led to a rolling peak and substantial decline. Once the Summation Index cycled back down to -1000, a new uptrend took hold.

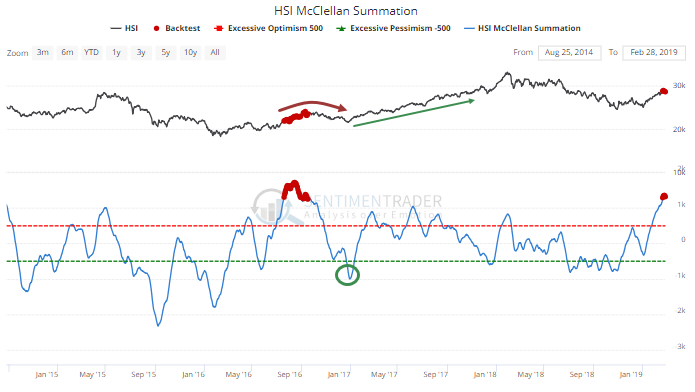

Something similar happened in 2016-17. Once it reached this level of overbought, the Hang Seng continued to gain in the month(s) ahead, but gave them all back. Once the Summation Index cycled down to -1000 again, the uptrend resumed in earnest.

No Sudden Movement

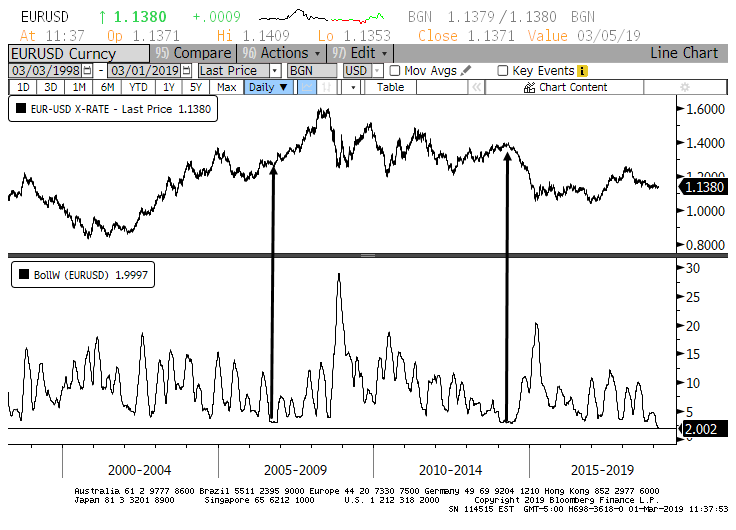

The WSJ noted that 30-day volatility in the EUR-USD cross is at a low point. It's not just the past 30 days. The volatility over the past 90 days is now the lowest on record. Two other times it got close, once leading to a large rally in the euro and the other a large decline. Volatility doesn't often predict movement, but it does tend to cycle from high to low, suggesting a big move either way in the months ahead.

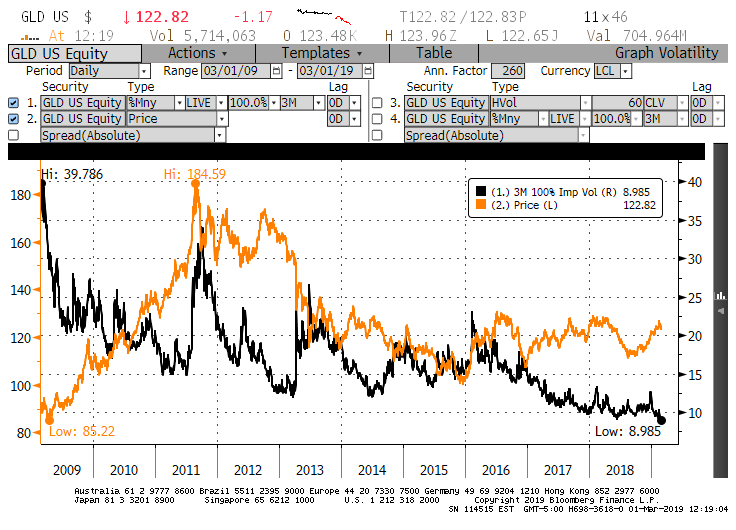

The WSJ also noted that implied volatility on the GLD gold fund is the lowest in a few years. It's actually the lowest in at least a decade. But unlike in stocks, implied volatility in other markets isn't very straightforward, with ebbs and flows occurring just as often during rallies as declines. There is a mentality that low volatility is bearish going forward (a habit from the stock market) but that hasn't been the case for GLD.

Exhaustion

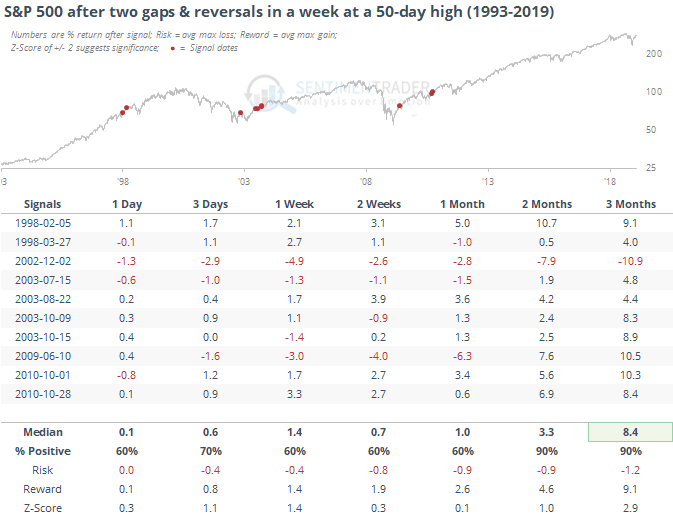

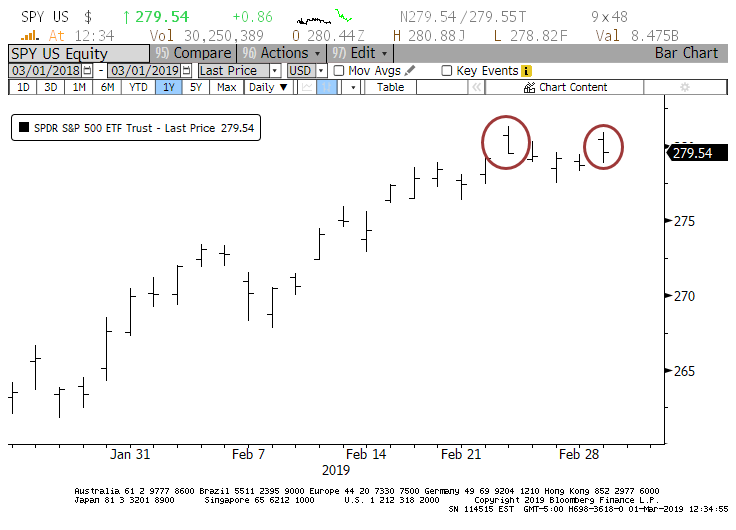

Stocks look exhausted here, as they're working on the 2nd gap up and intraday reversal in a week.

We should know better than to rely on looks, however, and that's the case here. Reversal patterns have not been reliable indications of future weakness.