Friday Color - Wipeout, Extremes, HiLo Too High

I'm technically out of the office today, but with the volatility wanted to touch on a couple of things. We were humming along fine, until the renewed bout of chest-pounding hit the tape and now stocks are suffering relatively large losses.

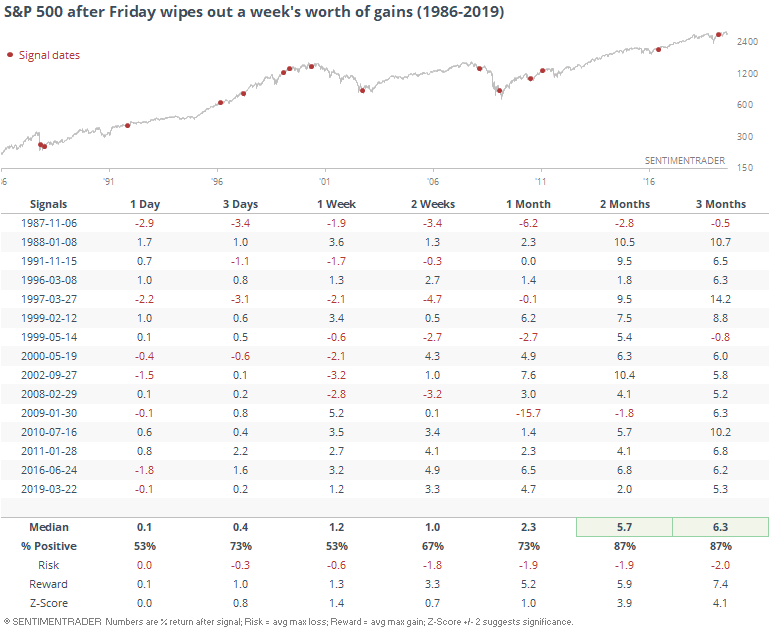

Friday Wipeout

There is a concern that a big wipeout on a Friday sets us up for a crash kind of scenario on Monday's. I can't remember how many times we've looked at that kind of thing over the years, but it has to be dozens. None of them panned out, like usual. Even 30 years later, the specter of 1987 hangs over investors.

Who knows how the trade rhetoric will ramp up in the day(s) ahead, and it's a real risk. As far as price action is concern, this is a fairly unusual situation, with Friday wiping out what had been more than a 1% gain through Thursday. That happened several times in the 1930s, but not at all from 1950 through the mid-1980s. Since then, we can see the dates in the table below.

None of them preceded a very large drop, but there were smattering of lesser ones in there. Mostly, the week-ending panic led to bounces. For what it's worth in the age of setting policy via off-the-cuff tweets.

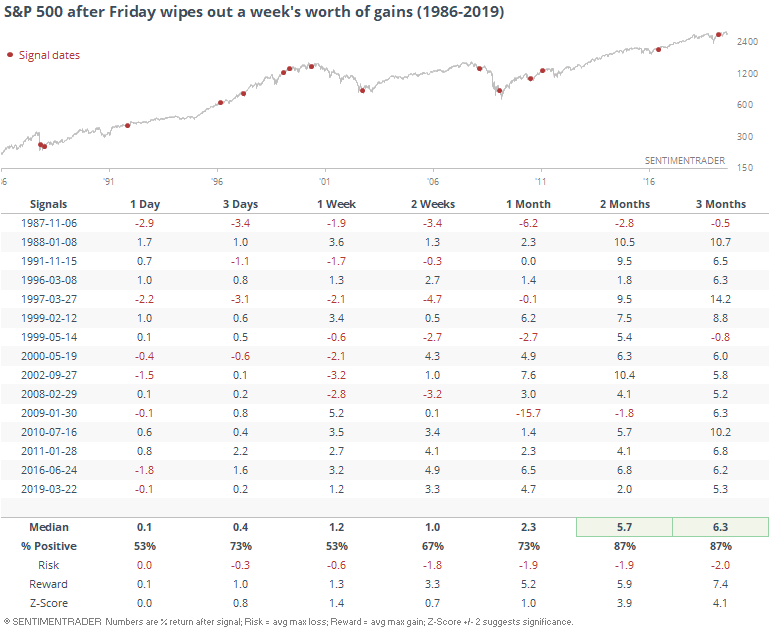

The intraday drop has been enough to push the shortest-term indicators toward extremes, but not enough yet to really reach oversold levels.

As far as "fear" goes, there has been uptick in the prices traders are willing to pay for puts versus calls on SPY, but it's not anywhere near extreme levels.

Mostly Positive

Troy has been going over some core fundamental and momentum indicators recently, and they're still almost all pointing higher for stocks. Most of the other sentiment and breadth indicators we've looked at over the past couple of weeks do so as well.

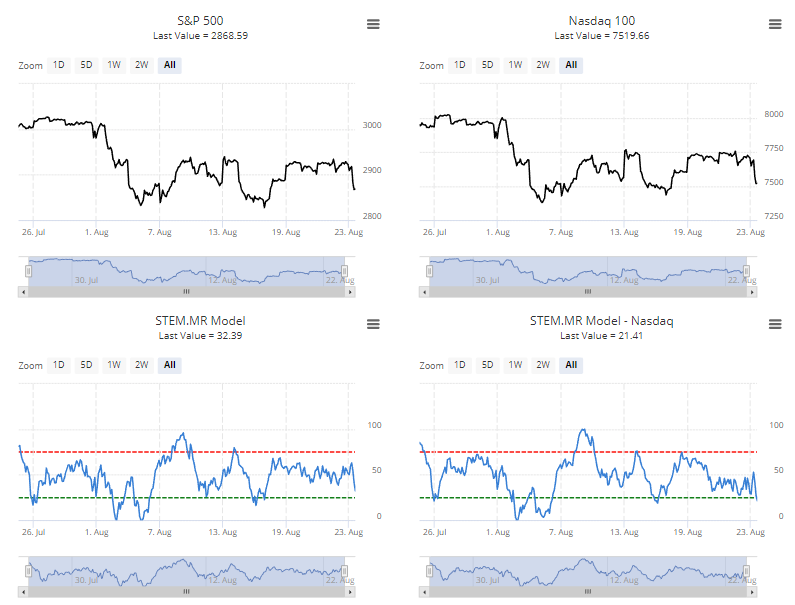

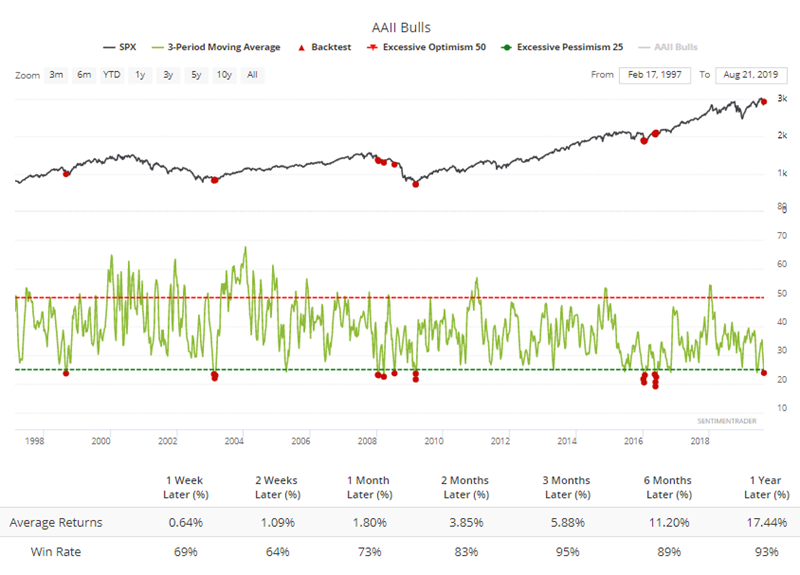

Adding to the pile, the latest AAII survey dropped the 3-week average to an exceptionally low number of bulls.

Bears are high, too, so the Bull Ratio has receded to one of the lowest levels ever when the S&P was trading above its 50-week average at the time.

Except For The "Split"

About the only negative we've look at is still a concern. Despite the losses today, the NYSE is showing more than 100 securities that have hit a 52-week high, and also more than 100 hitting a 52-week low. That's more than 4% of total issues, so the HiLo Logic Index is soaring again, meaning that we're in the midst of a very split market.

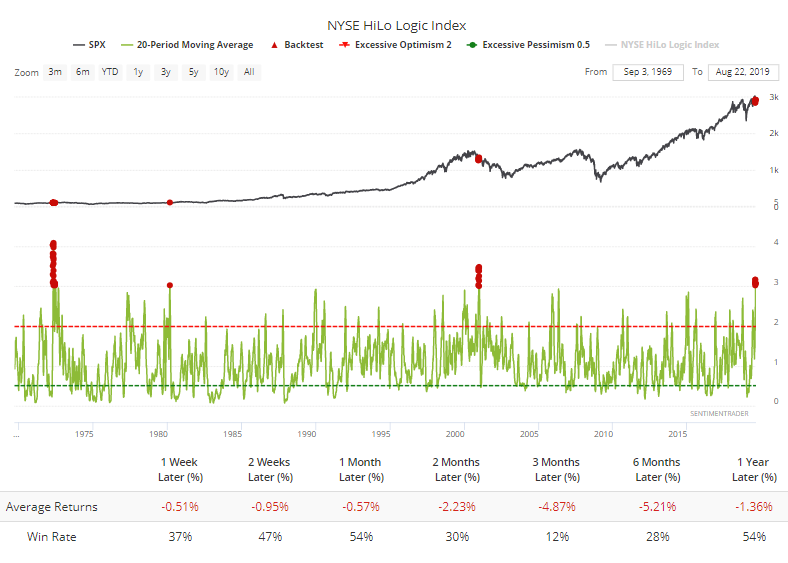

The 20-day average of that indicator is now above 3, something that has rarely been seen since 1962. Returns in stocks after the other three instances were not good.

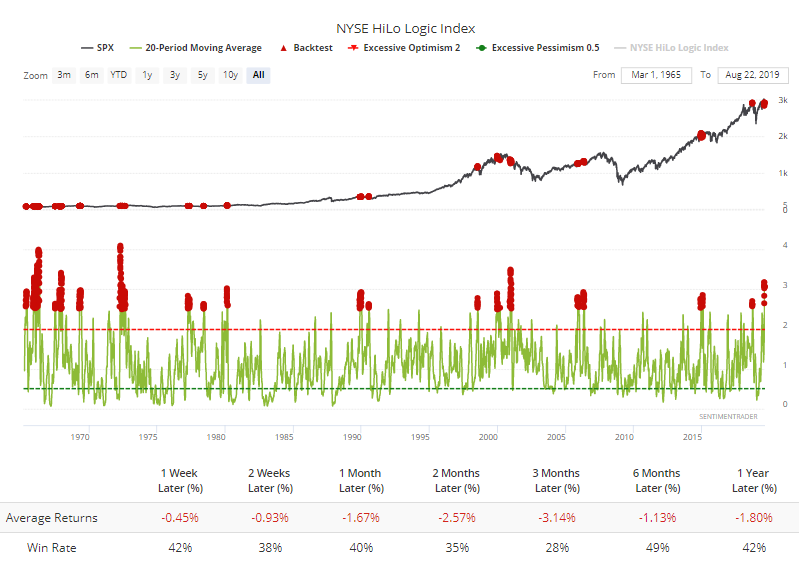

If we relax the parameters to a 20-day average of 2.5% or higher, there were more signals but returns didn't improve much.

It's hard to say whether this is enough to derail what has been a pretty heavily skewed positive picture. I don't think it is, not yet, but it's definitely a worry.