Foreign markets are outperforming the S&P 500

Key points:

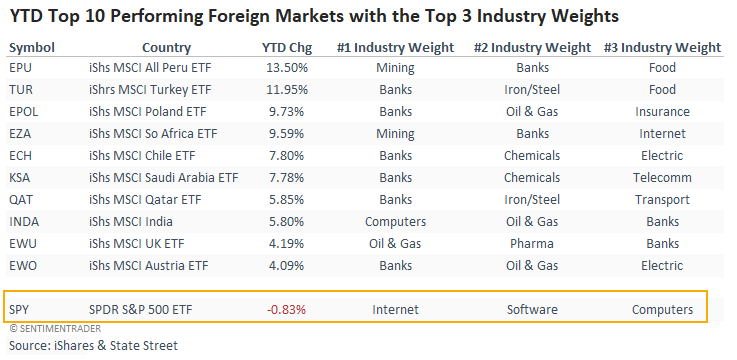

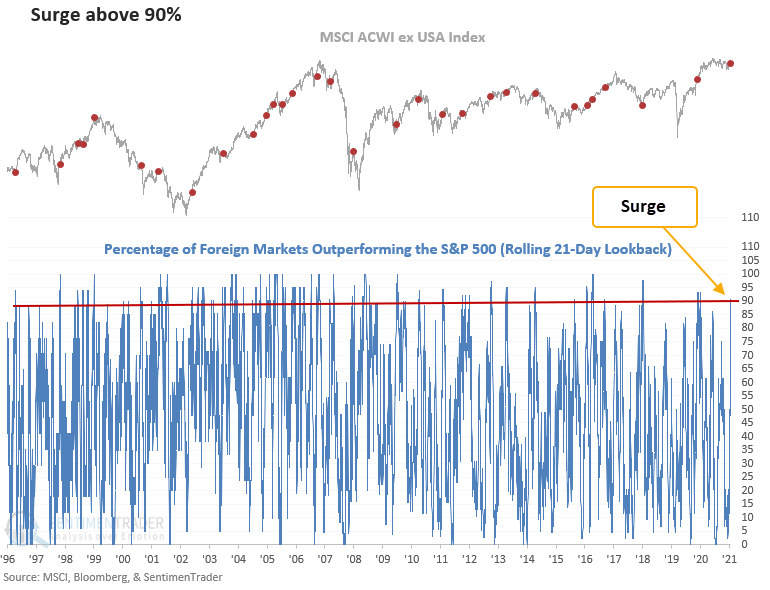

- The number of foreign markets outperforming the S&P 500 surged above 90%

- The surge in outperformance follows a period of severe underperformance

- The MSCI ACWI ex USA Index has rallied 83% of the time over the next month after similar reversals

What's the market message from value-oriented foreign markets

In a note on Tuesday, Jason discussed the violent rotation into value stocks at the expense of growth stocks. The study suggested that value could outperform growth over the next few months.

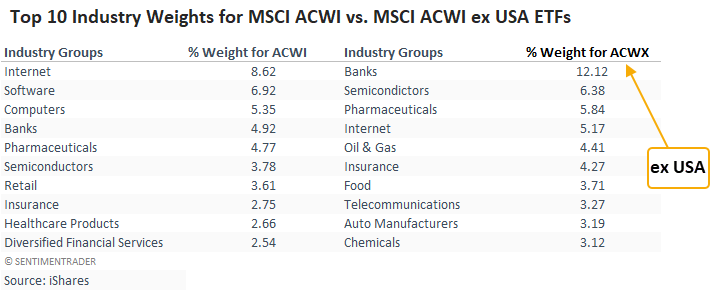

Suppose you compare industry weights for two widely followed global benchmarks. In that case, one will find that the MSCI ACWI Index leans more toward growth-oriented groups. In contrast, the MSCI ACWI ex USA Index favors value. So, when comparing a USA-dominated world index to the world ex USA index, it's one big growth versus value trade.

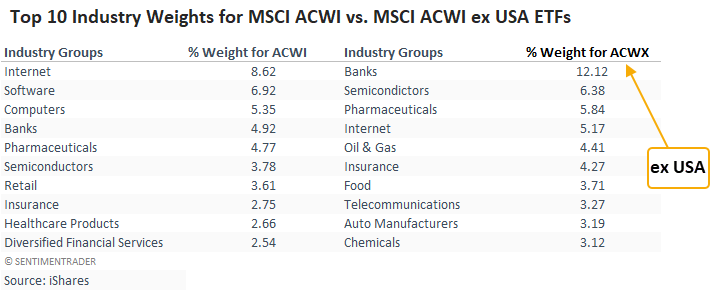

The value outperformance is even more pronounced when you look at YTD winners

Foreign markets are surging relative to the S&P 500

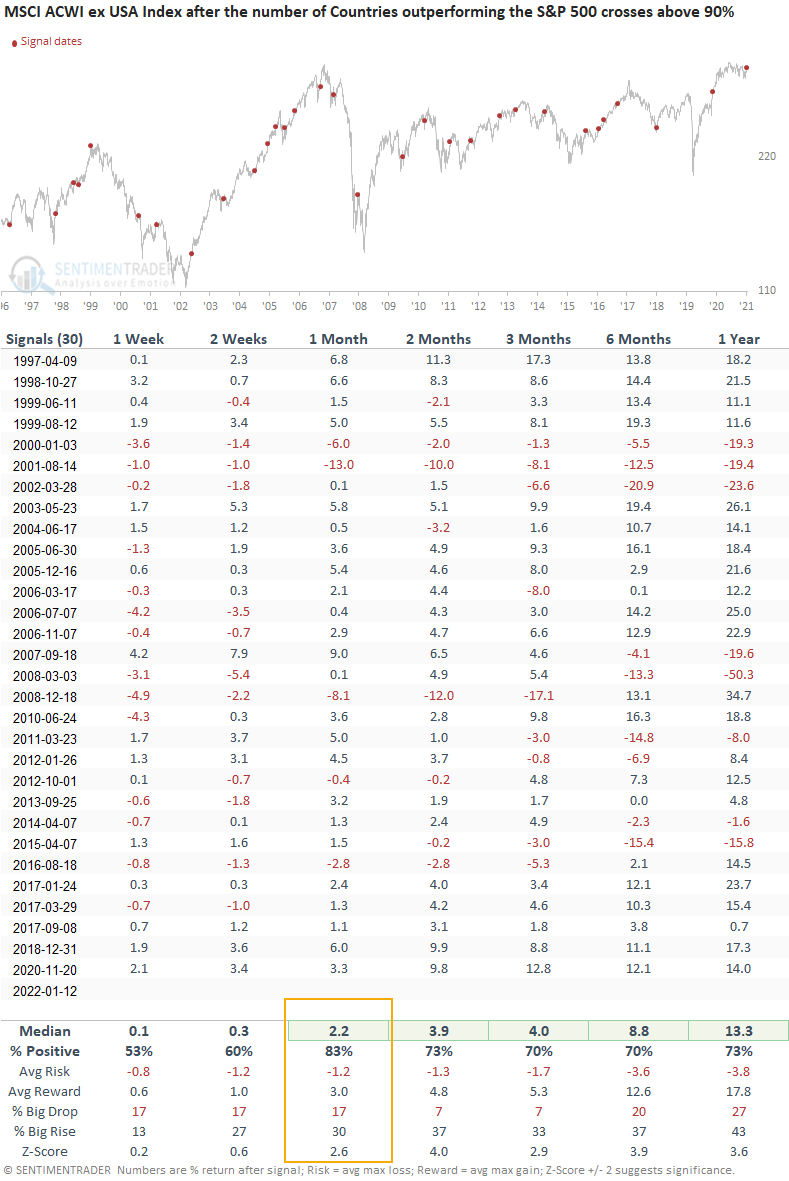

Let's conduct a study to assess the outlook for the MSCI ACWI ex USA Index (a value trade) when 90% or more global country ETFs outperform the S&P 500. I use a 21-day rolling return to calculate the percentage of foreign markets exceeding the S&P 500 and a reset condition that requires the percentage to cross back below 15% before a new signal can occur again.

The MSCI ACWI ex USA Index rallied 83% of the time after other signals

This signal has triggered 30 other times over the past 25 years. After the others, future returns, win rates, and z-scores look solid across medium and long-term time frames, especially the 1-month window.

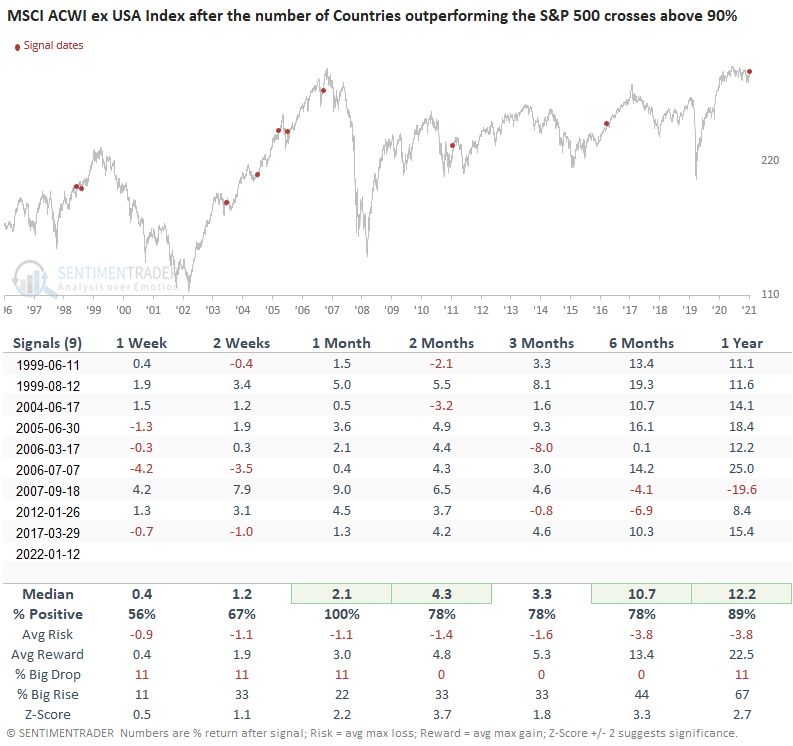

Signals that occurred with a swift reversal

Let's add some context. I will add a condition that requires the percentage of foreign markets outperforming the S&P 500 to reverse from less than 15% to greater than 90% in 20 days or fewer, a situation similar to the current signal.

This signal has triggered 9 other times over the past 23 years. After the others, future returns, win rates, and z-scores look solid across medium and long-term time frames. Once again, the 1-month time frame stands out with excellent metrics.

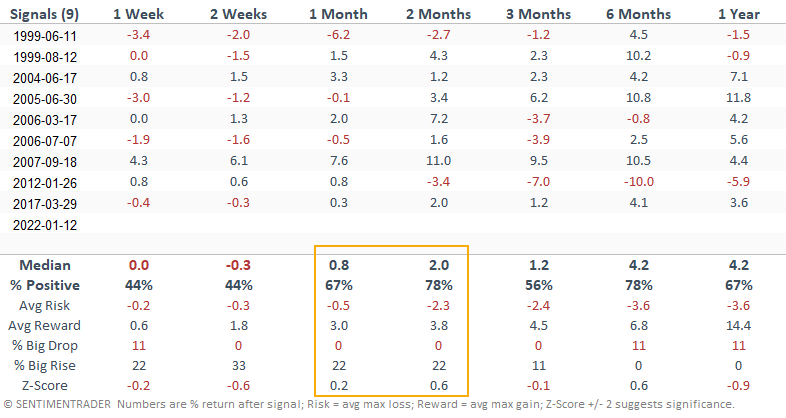

Relative comparison for the swift reversal signals

Relative comparison for the swift reversal signals

Comparing the MSCI ACWI ex USA Index to the S&P 500 shows a tendency for the global benchmark to outperform the S&P 500 in the 1-2 month time frames.

What the research tells us...

What the research tells us...

When a large percentage of foreign markets outperform the S&P 500 over a trailing 21-day period, the outlook for a broad-based global index with a value tilt looks promising. Similar setups to what we're seeing now have preceded rising prices for the MSCI ACWI ex USA Index, especially in the 1-month time frame.