Foreign buyers come back in a historic way

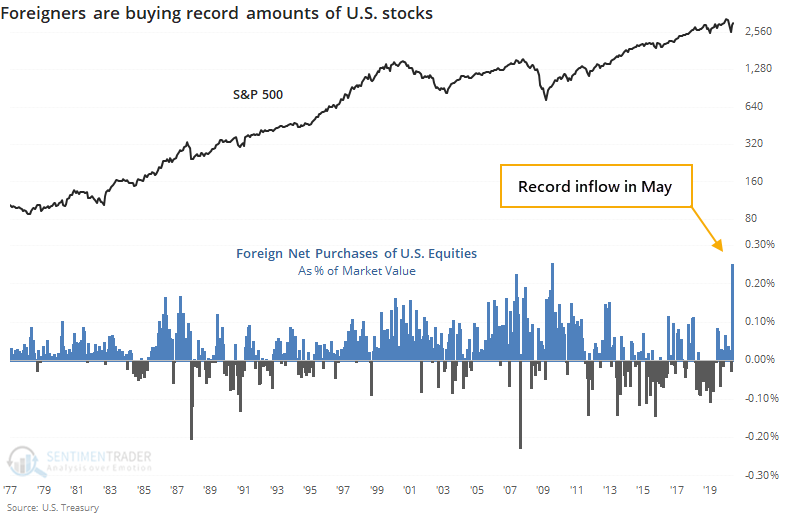

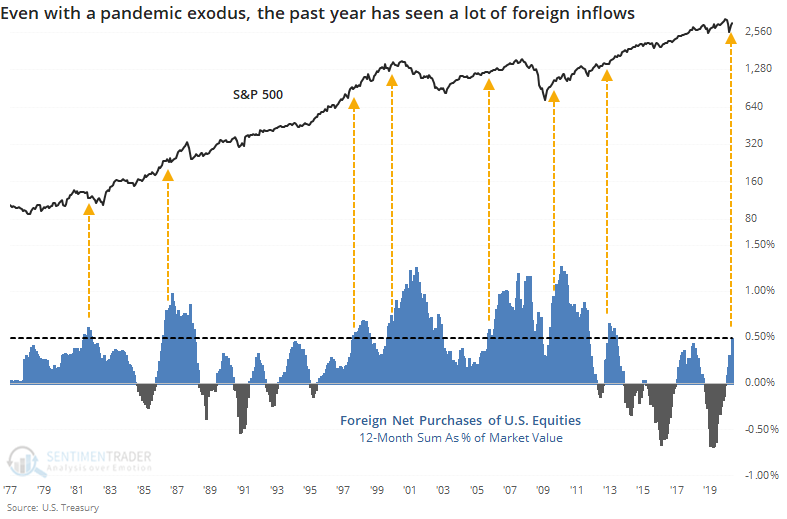

According to the U.S. Treasury, foreign buyers have stepped into U.S. stocks in a big way. A record way, even. They bought more than $79 billion worth of stocks in May alone, more than 0.25% of the market cap of U.S. stocks.

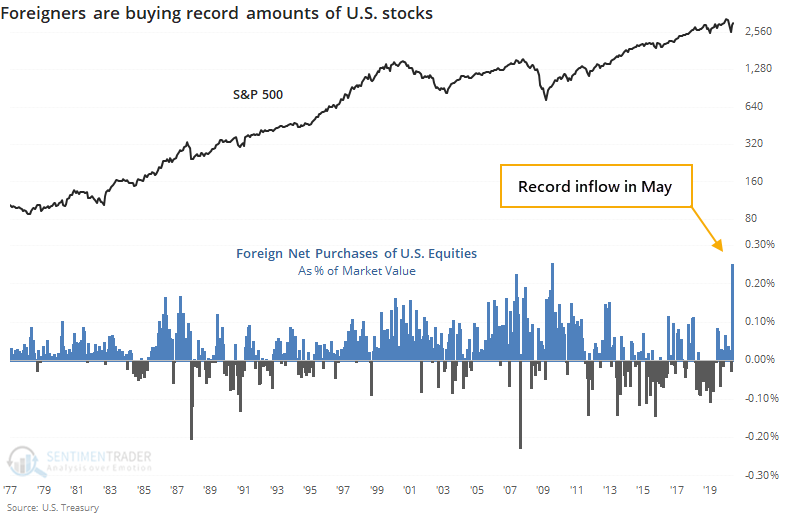

The next-largest inflow was soon after the bottom in 2009, but otherwise, their pattern was to buy after a rally and not a decline. So, other big inflows were a modest contrary indicator.

Because there were clusters of these big inflows leading up to the financial crisis, overall longer-term results were well below random. We're in a weird junction now because stocks are near their highs, but also just coming out of a major decline, so it's hard to know which precedents are more apropos.

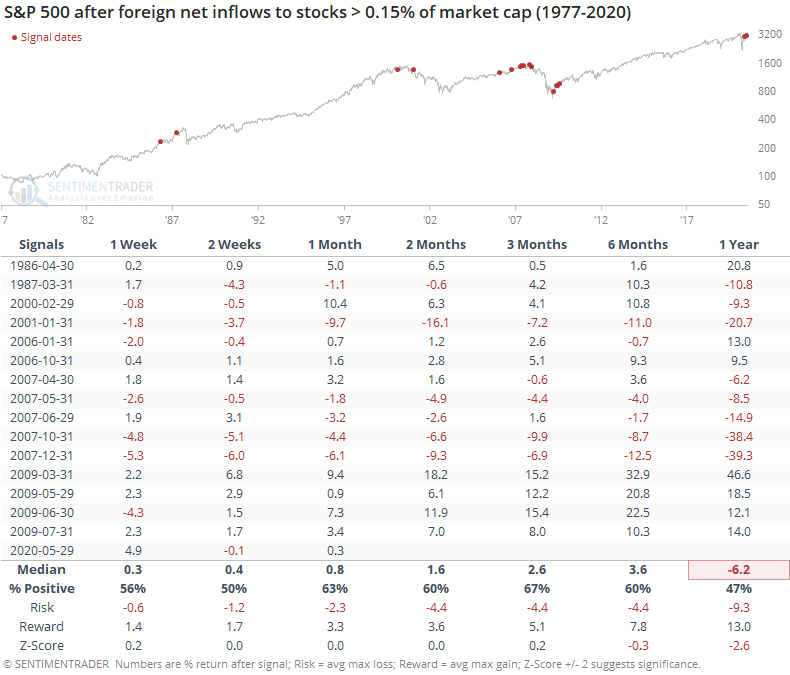

May's surge in inflows pushed foreigners' 12-month total to more than $157 billion. That's the most since 2013. From a long-term perspective, this wasn't necessarily a reason to expect stocks to suffer.

When we've looked at this data in various ways in the past, it has confirmed that it's a modest contrary indicator on most time frames. So this surge in buying pressure could be considered a slight negative over the medium- to long-term, but not enough to be a major worry.