For the 1st time in months, yields near their long-term average

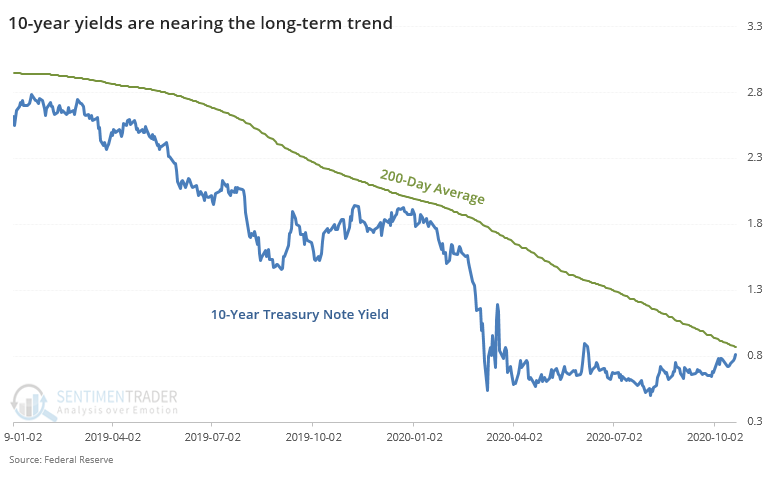

As investors weigh the potential for a new administration, another round of stimulus, and (hopefully) good news on the pandemic, yields on longer-term Treasuries have quietly risen.

Now, for the first time in more than 200 days, the yield on 10-year Treasury notes is nearing its 200-day moving average.

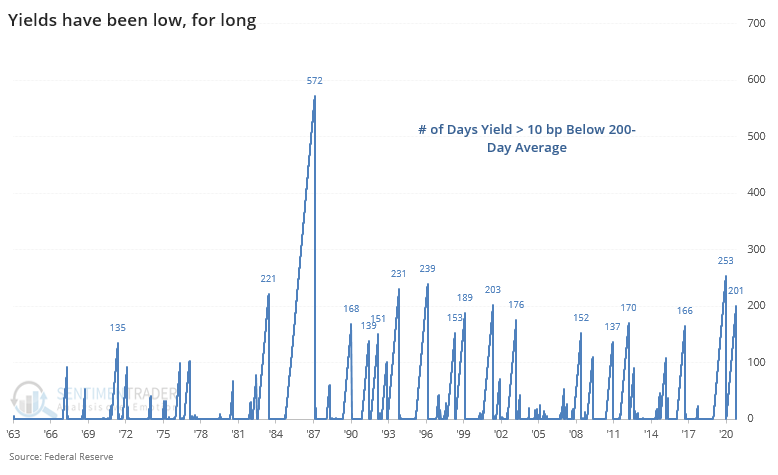

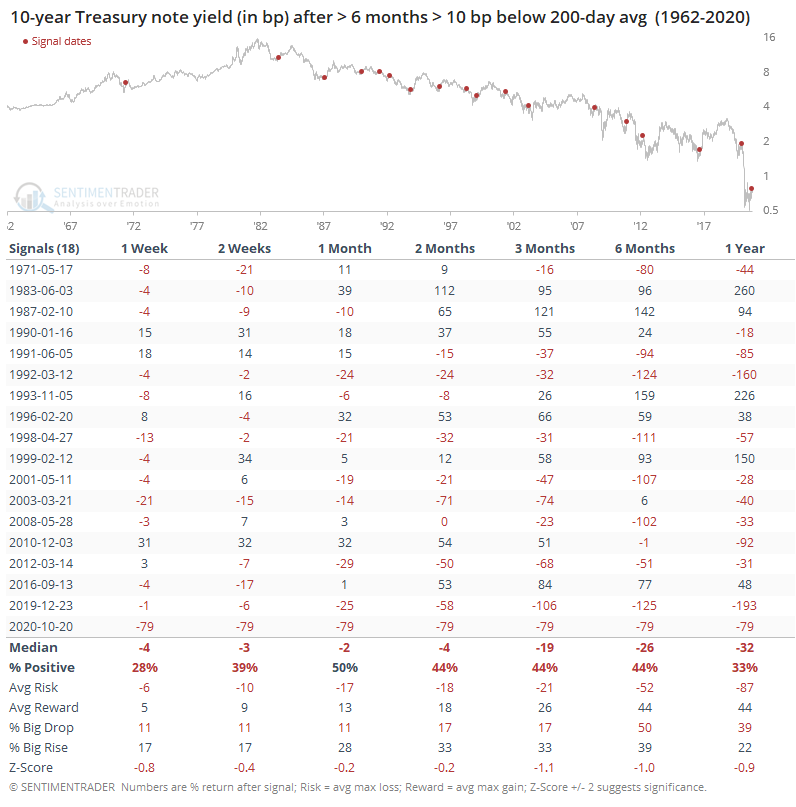

It's been more than 9 months since the yield was within 10 basis points of its average. That's one of the longest streaks in nearly 60 years.

When a streak of more than 6 months of being at least 10 basis points under its 200-day average finally ended, it usually didn't precede a further rise in yields.

There was no time frame in which the 10-year yield rose more than half the time. Of course, the study period is dominated by the long bear market (in yields) so it would take a lot for a signal to show a high likelihood of rising yields across almost any time frame.

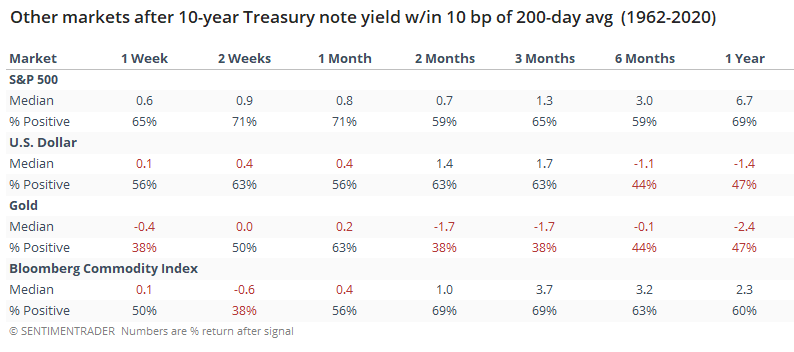

The ends of these streaks proved to be modestly positive for stocks and commodities but were inconsistent for the dollar and gold.