For the 1st time in months, oil rigs come back online

The oil and gas industry has been devastated in the past year, triggering layoffs and dividend cuts, something energy executives hold off as a last resort.

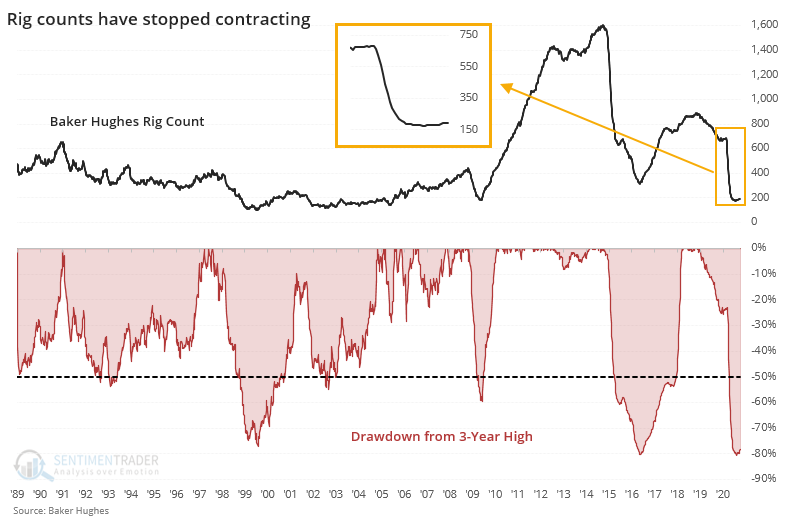

They were quicker in paring other expenses. The number of oil and gas rigs peaked almost 2 years ago and has been in freefall ever since.

The Baker Hughes Rig Count fell from a peak of 888 in November 2018 to only 172 by mid-August of this year, a plunge of more than 80%. But even though the news flow for this sector has been atrocious, a few rigs have come back online. For the first time since March, the count has started to increase.

Per Bloomberg (emphasis added):

"A rotary rig rotates the drill pipe from surface to drill a new well (or sidetracking an existing one) to explore for, develop and produce oil or natural gas. The Baker Hughes Rotary Rig count includes only those rigs that are significant consumers of oilfield services and supplies and does not include cable tool rigs, very small truck mounted rigs or rigs that can operate without a permit. Non-rotary rigs may be included in the count based on how they are employed. For example, coiled tubing and workover rigs employed in drilling new wells are included in the count. To be counted as active a rig must be on location and be drilling or 'turning to the right'. A rig is considered active from the moment the well is 'spudded' until it reaches target depth or 'TD'. Rigs that are in transit from one location to another, rigging up or being used in non-drilling

activities such as workovers, completions or production testing, are NOT counted as active. Miscellaneous rig counts represent geothermal rigs."

When the Rig Count rises at least 10% from its low after falling more than 50% from a multi-year peak, it has been a good long-term sign for the energy sector.

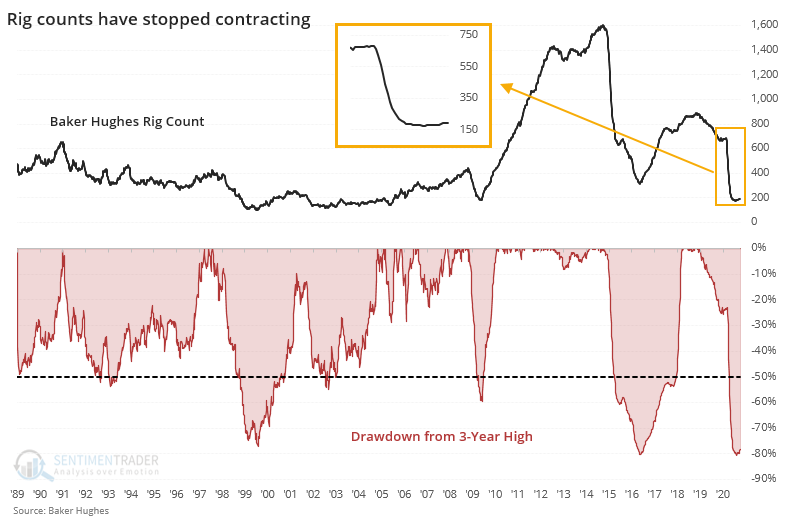

Rig counts tend to be a slow-moving series since these firms can't simply turn wells on and off with a switch. When they started adding capacity after a plunge, then companies in the S&P Energy Sector index had a strong tendency to rally over the next 9-24 months. The risk/reward and probability of a large gain/loss was most impressive over the next 2 years.

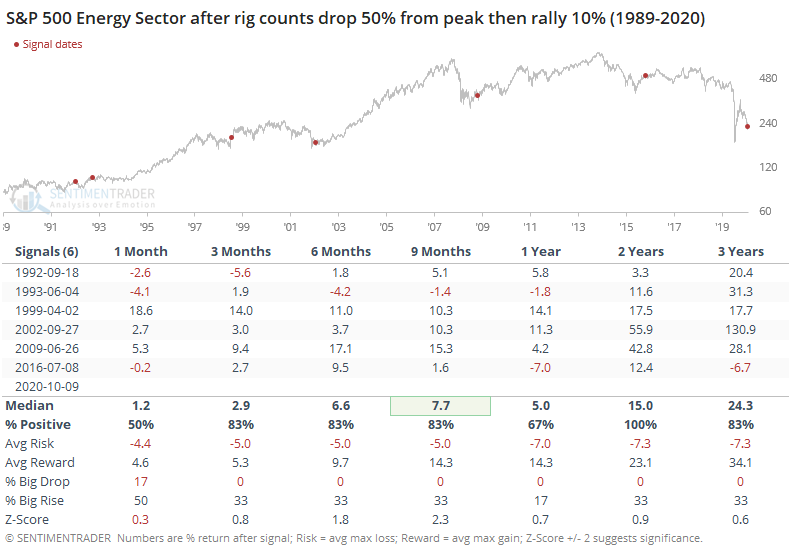

The same was true for oil and gas companies. They tend to swing more in boom/bust cycles than the broader energy sector, and so the returns were more extreme.

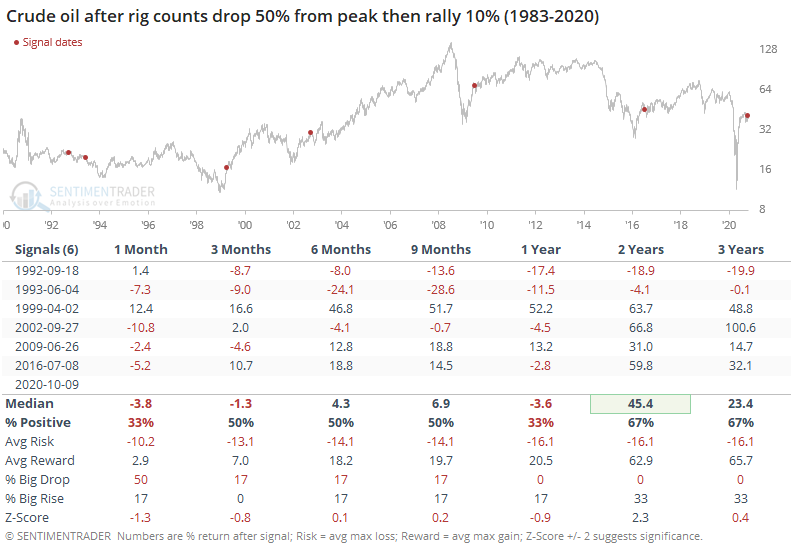

While this has been a good long-term sign for energy companies, for oil itself, it was a different story. As noted by Oilprice.com,

"Baker Hughes reported on Friday that the number of oil rigs in the United States rose by 4 to 193-a gain that may push prices down further."

Indeed, it's been tough for crude to hold gains in the short- to medium-term after rig counts start to tick up from a low. Every one of the signals showed a loss either 1 or 2 months later, and even a year later there were only 2 gains out of the 6 signals.

Positive signs in this sector are hard to come by, on a fundamental, macro, or technical basis. That's typically when the only potential positive comes from a sentiment standpoint, and signs are building that that's where we are in this cycle. When it gets to this point, usually the stocks will rally when investors realize things are getting "less bad" and rig counts may be one factor in shifting that sentiment.