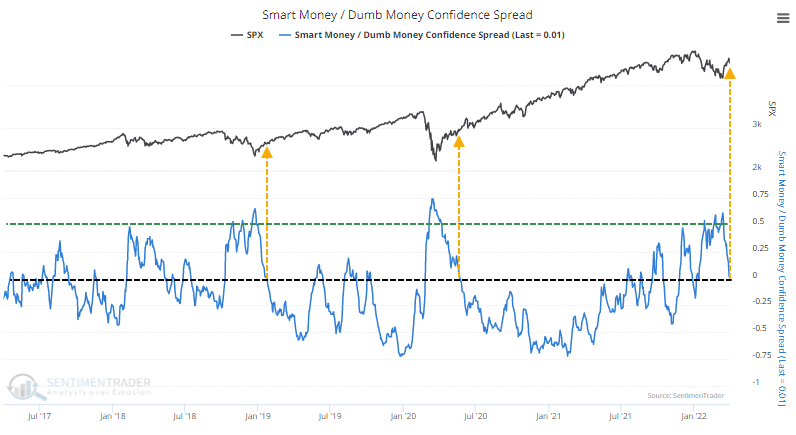

For the 1st time in months, Dumb Money is dominating

A big change in sentiment

For the first time in months, Dumb Money is more confident than Smart Money that stocks will rally.

Starting in late February, Dumb Money Confidence was well below Smart Money Confidence, and the spread between them exceeded 50%. Essentially, that suggests that investors who tend to be most net long near market troughs were 50% more confident that stocks would rally over the next several months. The Backtest Engine shows that this does, indeed, happen about 82% of the time.

Over the past 5 years, the spread has gone back to neutral after a reading of 50% or great only twice.

Returns following similar setups were decent, but nothing exceptional. There were several outright failures or times when stocks corrected hard before recovering again.

There were 4 signals that had substantial risk relative to reward. When we looked at those, we gleaned some insights about what to look for now.

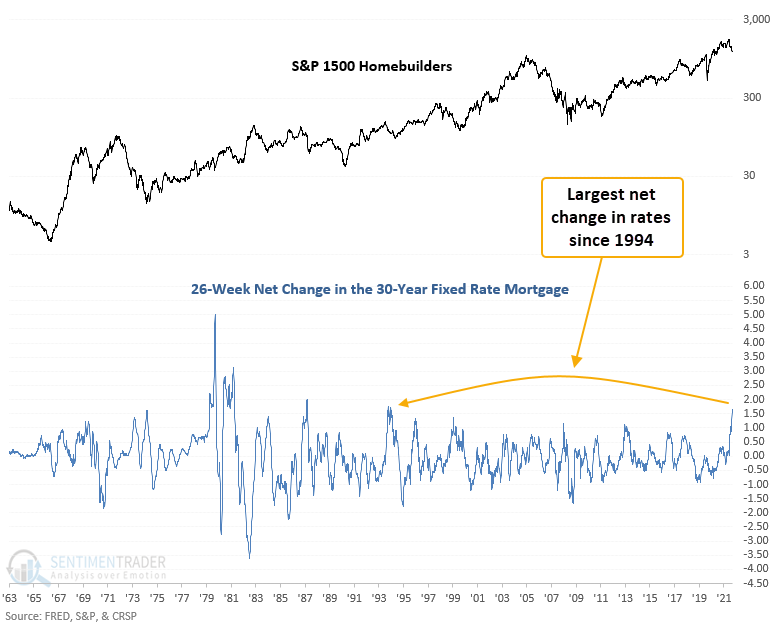

Homebuilders and interest rates

The S&P 1500 homebuilders are currently trading down more than 27% from a 2-year high. At the same time, the S&P 500 index is trading down less than 5% from its own high. Dean looked at this divergence to see what it might mean for stocks, and homebuilders in particular.

Homebuilders are among the most interest-rate sensitive equity industries. The 30-year fixed-rate mortgage has risen by 166 basis points over the trailing 26-week time frame, representing one of the most significant increases in the last 60 years.

This signal has been triggered 39 other times over the past 57 years. After the others, S&P 500 future returns, win rates, and risk/reward profiles were uninspiring across medium and long-term time frames.