For the 1st time in 2 years, bears reign

Key points:

- The I.I. survey of newsletter writers showed more bears than bulls

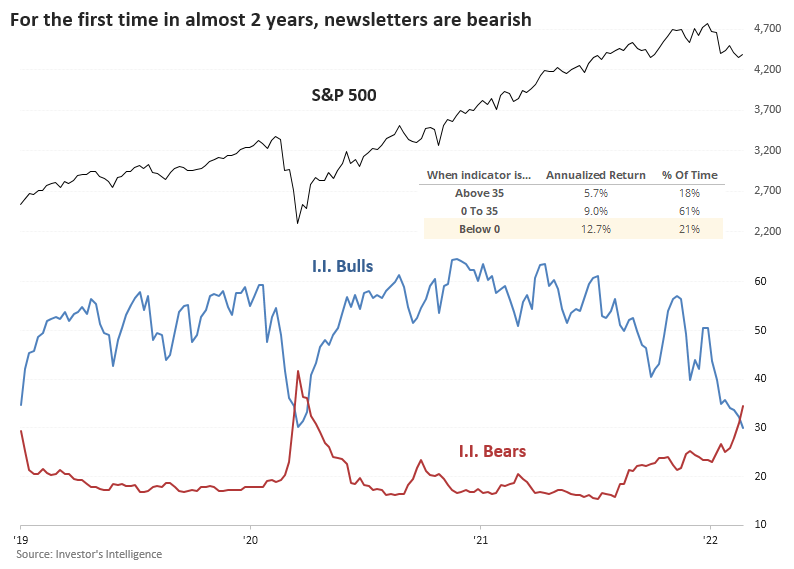

- This ended a streak of nearly 2 years of optimism, the 6th-longest streak in 53 years

- The ends of other long streaks mostly preceded gains for stock indexes and sectors

Survey of newsletters shows more bears than bulls, 1st time in almost 2 years

Investors aren't panicking, but they sure aren't very bullish, either. On an average day over the past week, nearly 30% of our core indicators have recorded a pessimistic extreme. That's the most since April 2020, but at most significant lows over the past decade, nearly 50% of indicators hit a pessimistic extreme.

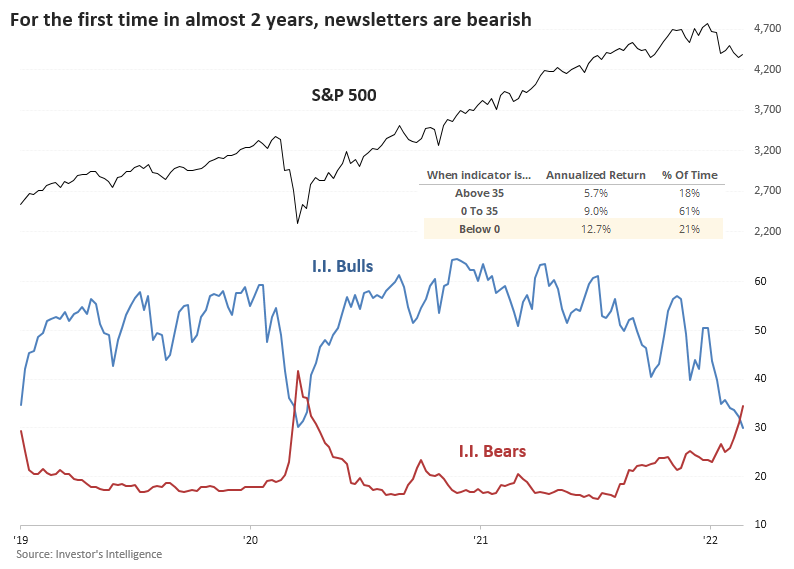

Still, more and more indicators are falling out of neutral, including real-money gauges and surveys. One of the granddaddy surveys from Investor's Intelligence showed that more newsletters expect stocks to decline than rally in the months ahead. This is the first week with fewer bulls than bears in nearly 2 years.

This ends the 6th-longest streak of bullish sentiment since the survey's inception.

Best to fade the majority of newsletters

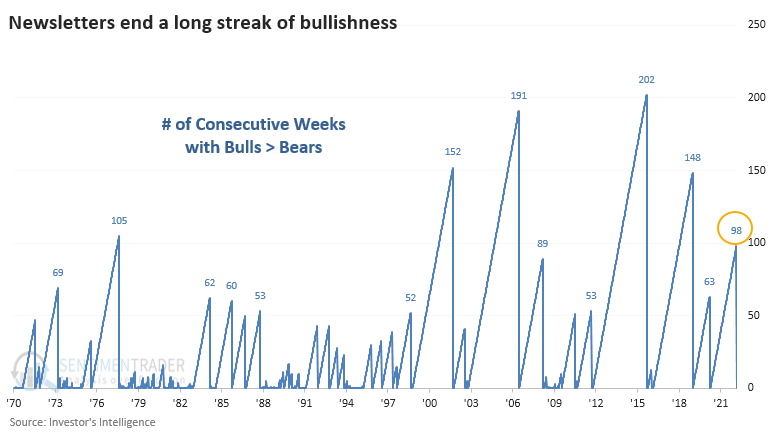

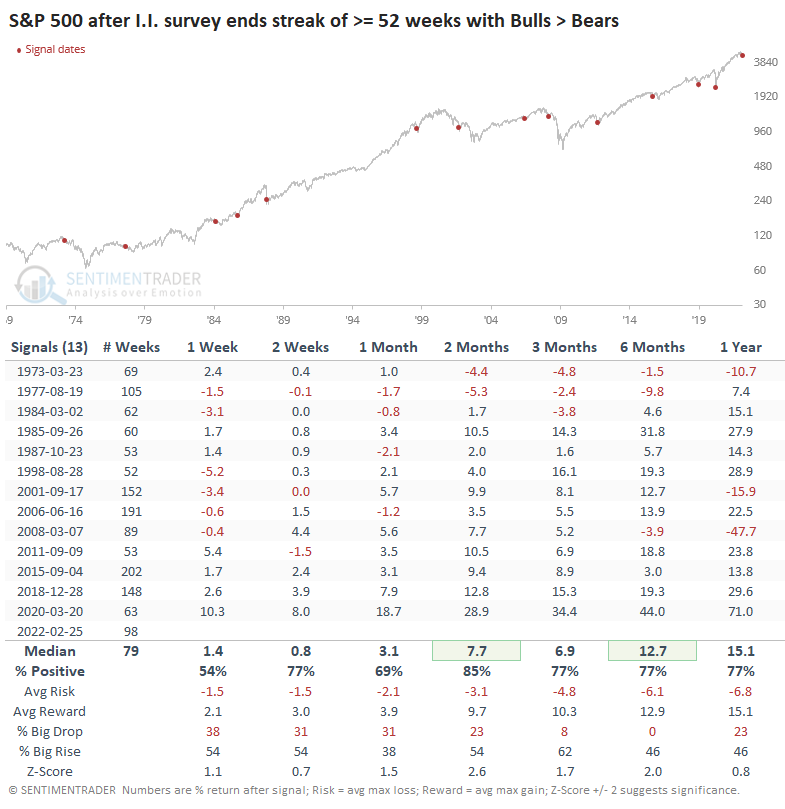

The ends of other long streaks of optimism tended to be a good sign for the S&P 500. While we prefer to see optimism rising instead of falling, by the time that pessimists accounted for the majority of newsletters, most stock declines were behind us. Over the next 2 months, the S&P rallied after 11 out of 13 precedents. The only two losses were in the 1970s, and the gains tended to persist, though they most certainly did not in 2008.

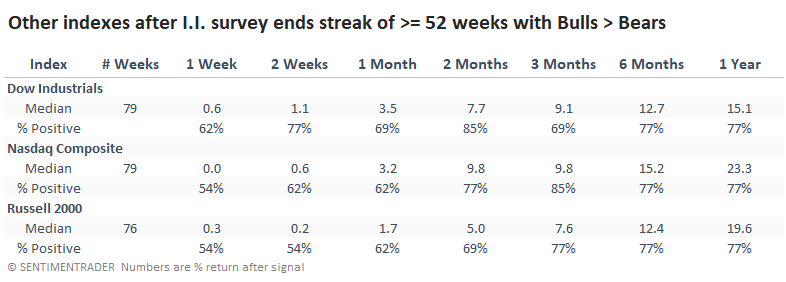

It was also a mostly good sign for the other major indexes. The Dow Industrials did the best in the short term, while the Nasdaq took the lead after that.

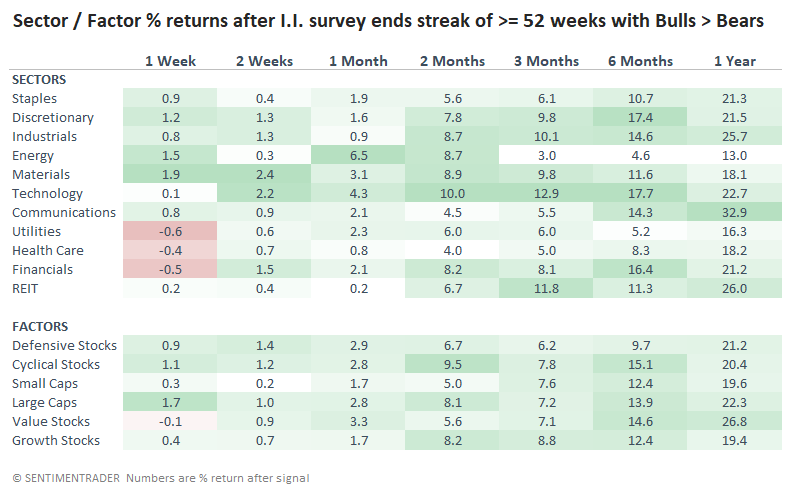

Among sectors and factors, Technology stocks showed the most consistently impressive average returns, with Industrials and Discretionary doing well, too. Cyclical stocks showed better short-term returns while Value stocks did best over the long term. Over the next 6 months, Value stocks gained after 12 out of 13 signals.

What the research tells us...

The Investor's Intelligence survey isn't yet showing that newsletters are extremely pessimistic. But the fact that they're pessimistic at all is noteworthy since it ends a long period of optimism. After other long streaks of bullish opinion, stocks had a strong tendency to rally in the months ahead. We'd prefer to see rising optimism, but the fact that stocks showed consistently strong returns after these streaks is a point in bulls' favor.