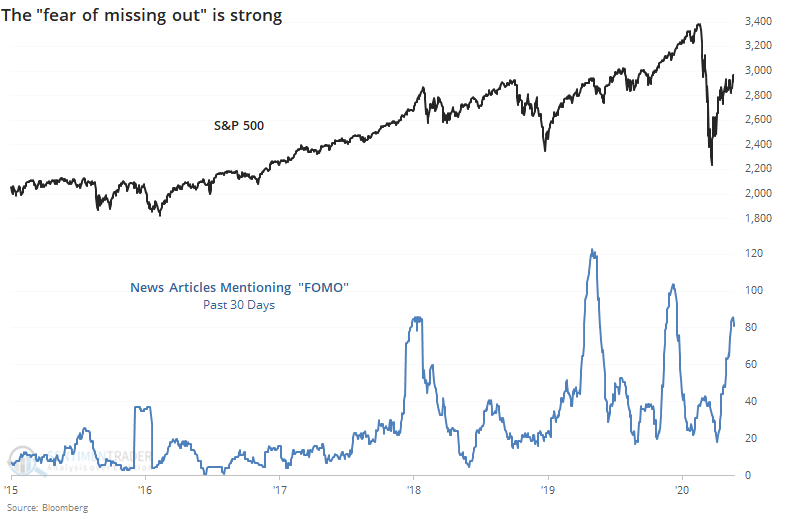

FOMO takes hold as the S&P can't mount its long-term average

As stocks seemingly shrug off one bit of bad news after another, the idea that people are missing out on something is gaining steam. Articles mentioning FOMO (Fear Of Missing Out) have jumped over the past 30 days.

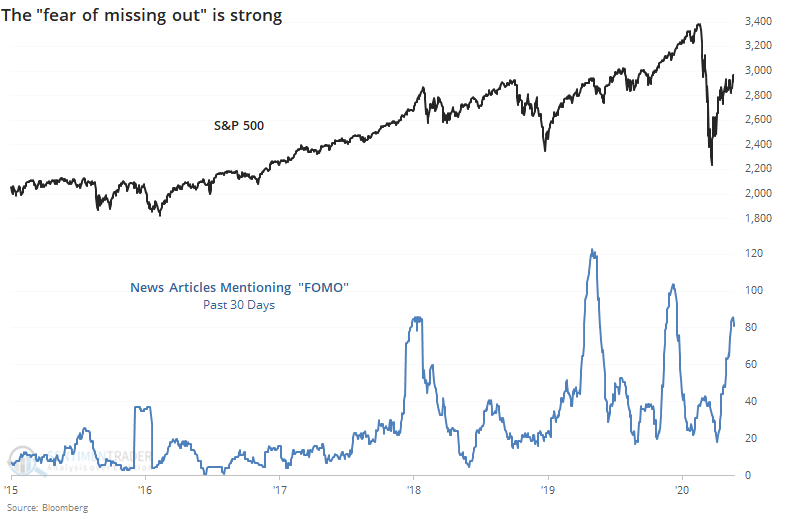

This is curious since arguably the most important index in the world still hasn't been able to mount what is arguably its most widely-watched determinant of it trend.

Three weeks ago, the S&P 500 approached its 200-day average for the first time in over a month, and it still hasn't been able to close above it.

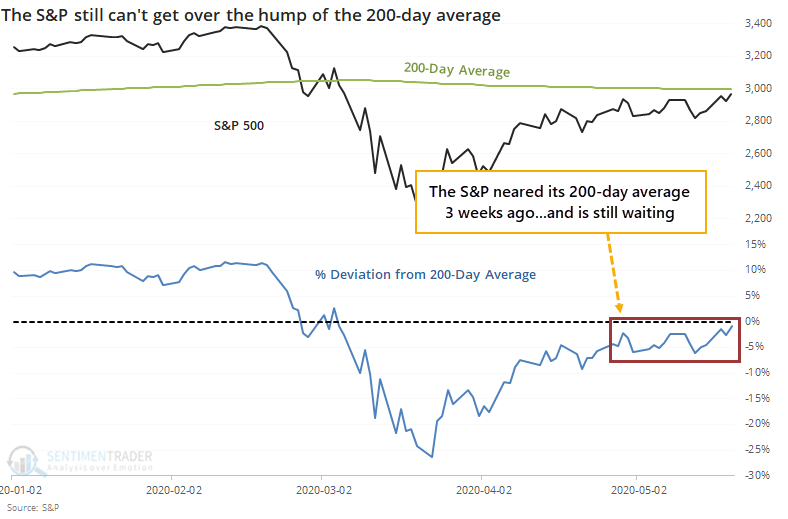

When the index nears its 200-day but can't get over it for the next 3 weeks, it has indicated weak conditions that have tended to persist.

During bear markets, a return to neutral, however that's defined, is usually about where they run into trouble. Once they reach that point, new bull markets typically see buying interest persist to such a degree that the blow right through any barriers. Weak markets don't see that, and prices start to roll over. This is a good test for our current market.