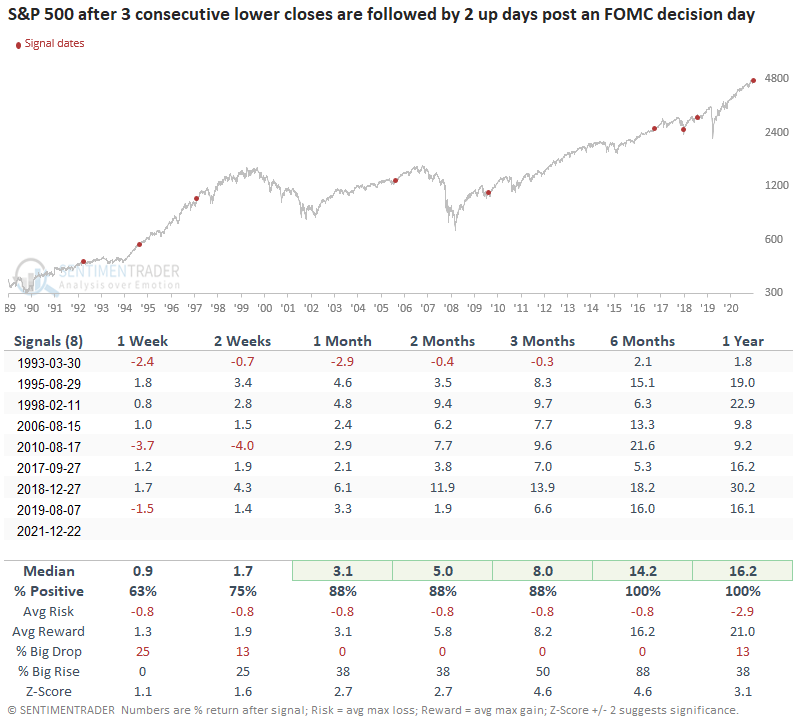

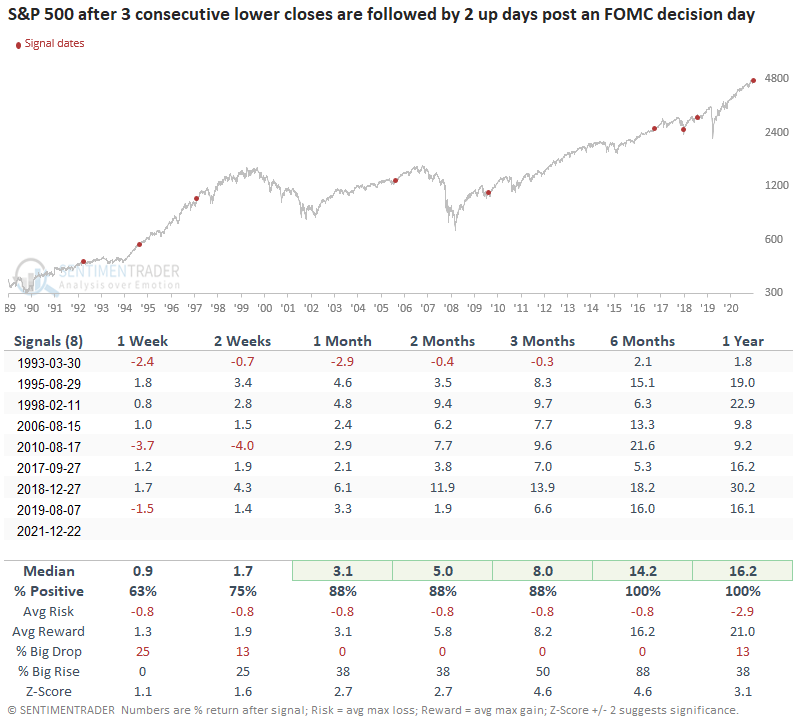

FOMC stumble and reversal suggests higher stock prices

Key points:

- The market closed lower for 3 consecutive days post the FOMC decision day

- Since the FOMC stumble, stocks have rallied on successive days

- The S&P 500 shows a strong tendency to rally after similar patterns

When markets rally on bad news, it's often bullish

The hawkish fed pivot caught the market by surprise, and stocks declined for 3 consecutive days post the FOMC meeting. However, stocks have subsequently rallied on successive days after they stumbled. Let's assess the outlook for the S&P 500 when the index closes down for 3 consecutive days post an FOMC decision day and then rallies on successive days.

This signal triggered 8 other times over the past 29 years. After the others, future returns and win rates were solid across all time frames. The 1-12 month periods show excellent risk-reward profiles. And, 6-12 months later, the S&P 500 shows a 100% win rate.

What the research tells us...

Stocks stumbled and subsequently rallied post the FOMC decision day. Similar setups to what we're seeing now have preceded solid returns and win rates for the S&P 500 across multiple time frames, especially on a medium and long-term basis.