Follow-Through Selling

With futures indicated to open lower following yesterday's pummeling, let's take a look at behavior following similar sell-offs that bled over to the next morning.

Pre-market trading has the reputation of being emotional, with large gaps being driven by knee-jerk reactions to hyperbolic media coverage of the prior day's carnage. That's the theory, anyway, and evidence backs it up. Almost always when we've highlighted big gaps following large moves, up and down, it works out. But the times it fails, it usually fails big.

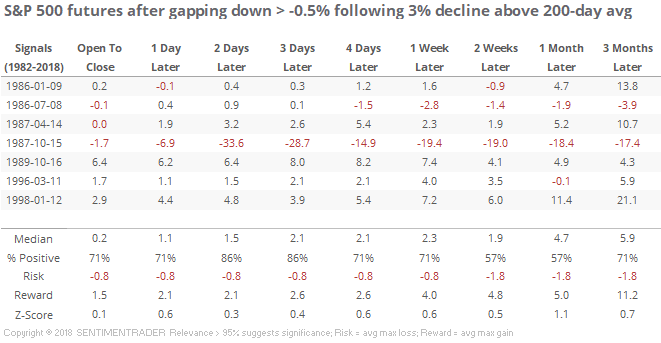

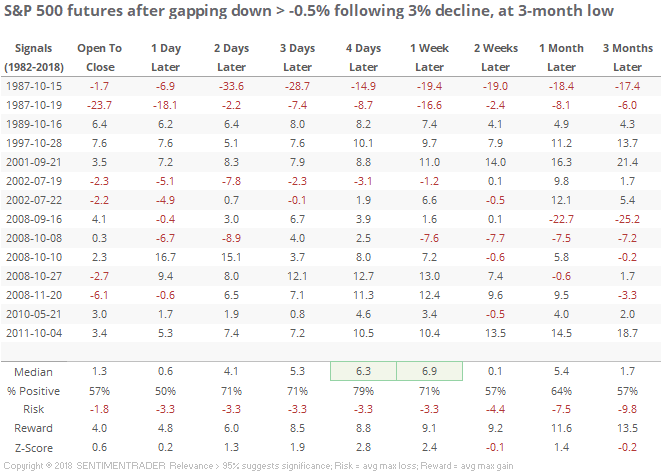

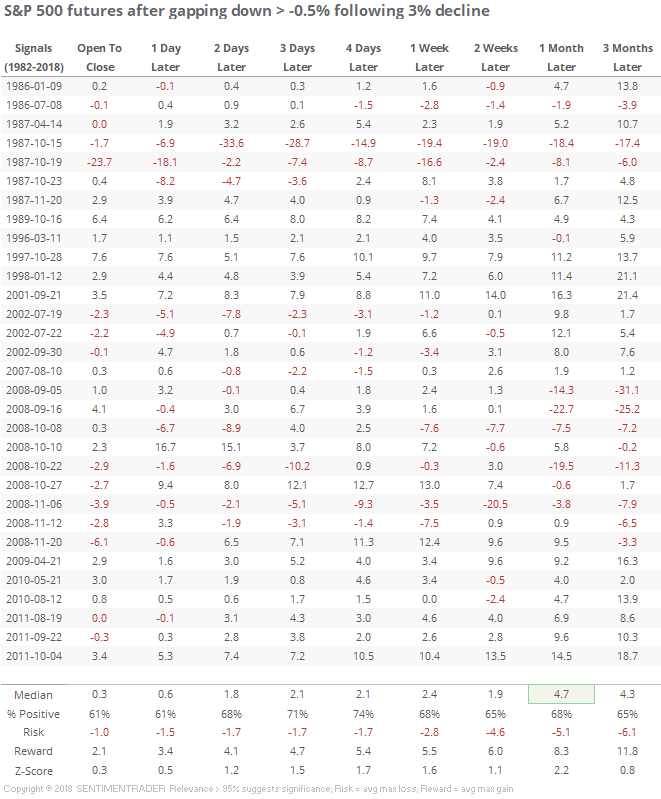

Here's an example. Following is every time the S&P 500 futures fell at least 3% then were on track to gap down the next morning at least -0.5%, which is where the futures are currently indicated. These are only times when the S&P still managed to close above its 200-day average the prior day.

All but one of the signals rallied from the open of the gap down day (this morning in our current case) through the close of the next 2-3 days. But look at that exception - it was the days leading up to Black Monday in 1987.

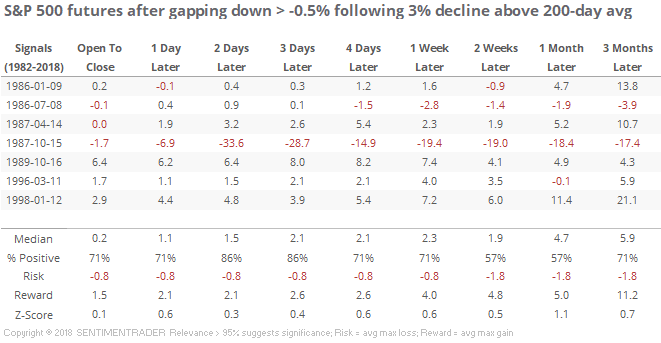

Requiring the S&P to be above its 200-day is pretty restrictive, so how about just that its average was rising?

That added a few more signals, with the same implication - really good probability of rebounding over the next several sessions, but that '87 instance of course sticks out. The risk there was catastrophic failure for anyone holding a futures contract, but other than that one instance, the risk/reward of buying into the gap down and holding for several days was excellent.

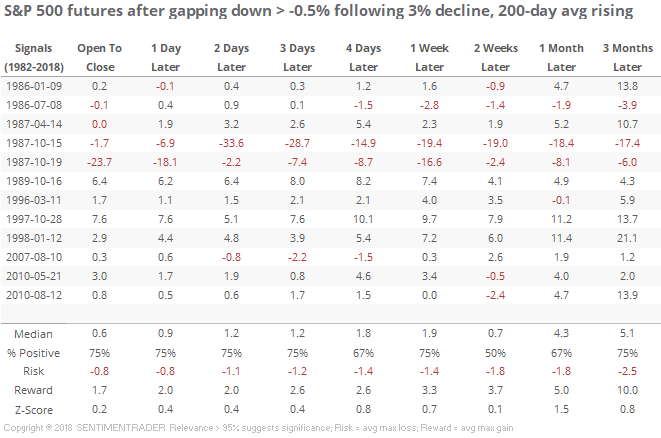

If we forget about trend and look for times when that 3% or larger collapse also caused the futures to trade at a multi-month low, then we get the following returns of buying into the next day's gap down.

Again, quite positive over the ensuing sessions, but more risk. Here, the positive implications were a tiny bit delayed, with the best results over the next 4-5 sessions, which shows extremely positive returns (again, 1987 though).

Let's just get rid of any context whatsoever and look at all big gaps down following a large decline.

Once again, even without context, the results were good over the next several sessions, with an especially positive risk/reward.

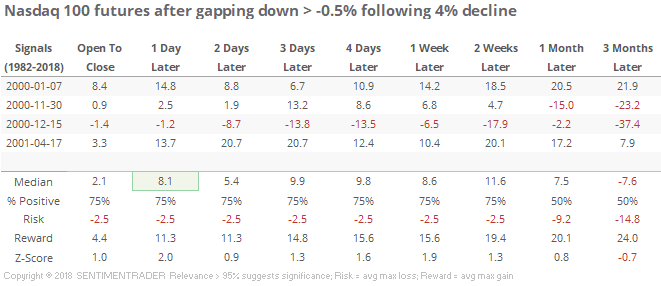

For the Nasdaq 100 futures, it was even uglier. A 4% decline on Wednesday, followed by (so far) a gap down this morning. That has not happened often.

All but one of them rebounded, but a sample size of four is hard to rely on. And that exception was painful.

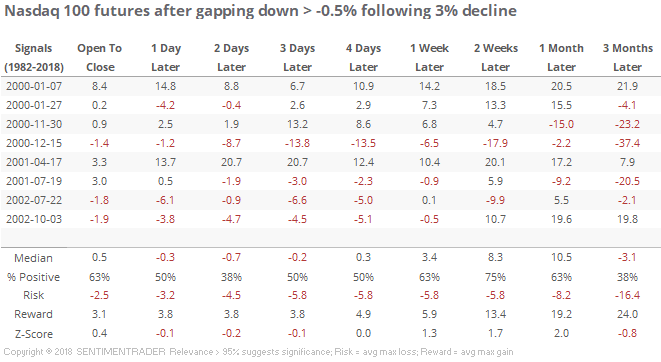

If we look at 3% declines then a gap down, it gives several signals in 2001-02 that were not good.

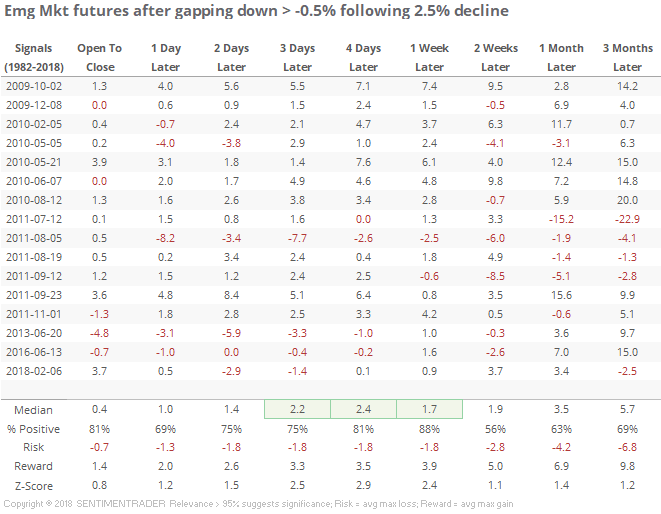

For emerging market futures, it was a little brighter. The futures contract for the MSCI Emerging Markets Index is relatively new with only about a decade of trading history. But when it gapped down following a decline of 2.5% or more the prior day, it did tend to bounce back.

The futures had only two losses over the next week. That bodes well for a fund like EEM, assuming we continue to see selling into this morning's open.

Overall, the probability favors a multi-day bounce, assuming we see continued pressure into the open of regular trading hours. If the gap shrinks as buyers step in before trading opens, then the positive implications shrink as well. Ironically, the worse it looks, the better it tends to be. As always, the major caveat is that if it fails, it will likely fail big.